Mahindra Manulife

Multi Asset Allocation Fund

(An open ended scheme investing in Equity, Debt, Gold/Silver Exchange Traded Funds (ETFs) and Exchange Traded Commodity Derivatives)

One Pager as on September 30, 2024

| Different asset classes performs at different points in time |

| Reduce dependency on a single asset class |

| Helps to mitigate volatility of portfolio returns |

| Asset Allocation shall be rebalanced regularly by fund managers based on evolving market dynamics |

| Diversified Portfolio that aims to combine stability of fixed income, growth potential of equity and tactical exposure to gold/silver |

| EQUITY : Diversified portfolio of stocks for long term capital appreciation. |

| DEBT : Dynamic duration management with a portfolio of high-quality securities with reasonable accruals. |

| Gold/Silver** : Tactical exposure to Gold and Silver |

**Units of Gold/Silver ETFs & other Gold and Silver instruments (including Exchange traded commodity derivative (ETCDs) as permitted by SEBI from time to time.

| Sector | MMMAA |

| Financial Services | 7.58% |

| Oil Gas & Consumable Fuels | 4.44% |

| Fast Moving Consumer Goods | 4.21% |

| Information Technology | 3.97% |

| Capital Goods | 3.05% |

#For the equity portion

Data as on September 30, 2024

| ICICI Prudential Gold ETF | 7.59% |

| Nippon India Silver ETF | 7.14% |

| National Bank For Agriculture and Rural Development (CB) | 7.07% |

| 7.18% GOI (MD 24/07/2037) (SOV) | 6.16% |

| Small Industries Dev Bank of India (CB) | 5.03% |

| Total | 32.99% |

CP - Commercial Paper, CD - Certificate of Deposit, CB - Corporate Bond, SOV- Sovereign

| Security | % to Net Assets |

| Nippon India Silver ETF | 8.73% |

| ICICI Prudential Gold ETF | 7.58% |

| National Bank For Agriculture and Rural Development (CB) | 6.76% |

| Muthoot Finance Limited (CB) | 4.80% |

| 7.1% GOI (MD 08/04/2034) (SOV) | 4.11% |

| 7.3% GOI (MD 19/06/2053) (SOV) | 3.62% |

| 7.23% GOI (MD 15/04/2039) (SOV) | 2.98% |

| 7.18% GOI (MD 24/07/2037) (SOV) | 2.96% |

| Brookfield India Real Estate Trust (REIT) | 2.70% |

| Kotak Mahindra Investments Limited (CB) | 1.93% |

| Total | 46.17% |

| Annualised Portfolio YTM*1^ | 7.38%2 |

| Macaulay Duration^ | 4.54 years2 |

| Modified Duration^ | 4.332 |

| Residual Maturity^ | 7.32 years2 |

| As on (Date) | September 30, 2024 |

*In case of semi annual YTM, it will be annualised

^For debt component

1Yield to maturity should not be construed as minimum return offered by the Scheme. 2Calculated on

amount invested in debt securities (including accrued interest), deployment of funds in TREPS and Reverse

Repo and net receivable / payable.

Calculated for the period since inception till September 30, 2024. | Data Source: ICRA Analytics, Bloomberg

| Data as on September 30, 2024 | N.A.: Net Assets

The investment objective of the Scheme is to seek to generate long-term capital appreciation and income by investing in equity and equity related securities, debt & money market instruments, Gold/Silver ETFs and Exchange Traded Commodity Derivatives (ETCDs) as permitted by SEBI from time to time. However, there can be no assurance that the investment objective of the Scheme will be achieved.

Fund Manager:

Mr. Renjith Sivaram (Equity)

Total Experience: 13 years | Experience in managing this fund: 6 months (managing since March 13, 2024)

Mr. Rahul Pal (Debt)

Total Experience: 22 years | Experience in managing this fund: 6 months (managing since March 13, 2024)

Mr. Pranav Patel$

Total Experience: 9 years | Experience in managing this fund: 6 months (managing since March 13, 2024)

$Dedicated Fund Manager for Overseas Investments

Date of allotment: March 13, 2024

Benchmark: 45% NIFTY 500 TRI + 40% CRISIL Composite Bond Index + 10% Domestic Price of Physical Gold + 5% Domestic Price of Silver

Option: IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default

Minimum Application Amount : Rs. 1,000/- and in multiples of Rs. 1/- thereafter

Minimum Additional Purchase Amount: Rs. 1,000/- and in multiples of Rs.. 1/- thereafter

Minimum amount for redemption/switch out: Rs. 1,000/- or 100 units or account balance, whichever is lower

Minimum Weekly & Monthly SIP Amount: Rs 500 and in multiples of Rs. 1 thereafter

Minimum Weekly & Monthly SIP Installments: 6

Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Rs. 1 thereafter

Minimum Quarterly SIP installments: 4

Monthly AAUM as on September 30, 2024 (Rs. in Cr.): 508.40

Quaterly AAUM as on September 30, 2024 (Rs. in Cr.): 457.39

Monthly AUM as on September 30, 2024 (Rs. in Cr.): 523.03

Entry Load: Not applicable

Exit Load: • An Exit Load of 0.5% is payable if Units are redeemed / switched-out up to 3 months from the date of allotment;

• Nil if Units are redeemed / switched-out after 3 months from the date of allotment.

Redemption /Switch-Out of Units would be done on First in First out Basis (FIFO).

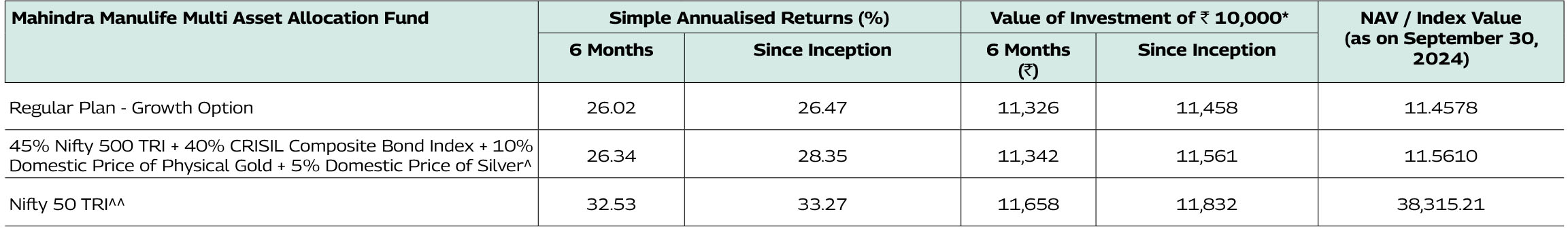

^Benchmark ^^Additional Benchmark. Inception/Allotment date: 13-Mar-24.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the

scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular and Direct Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different

expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. Mr. Renjith Sivaram is managing this scheme since March 13, 2024. Mr. Rahul Pal is managing this fund since March 13, 2024. Mr. Pranav

Patel is managing this fund since March 13, 2024. $Dedicated Fund Manager for Overseas Investments. Simple annualized returns have been provided as per the extant guidelines since the scheme has completed 6 months but not 1 year.

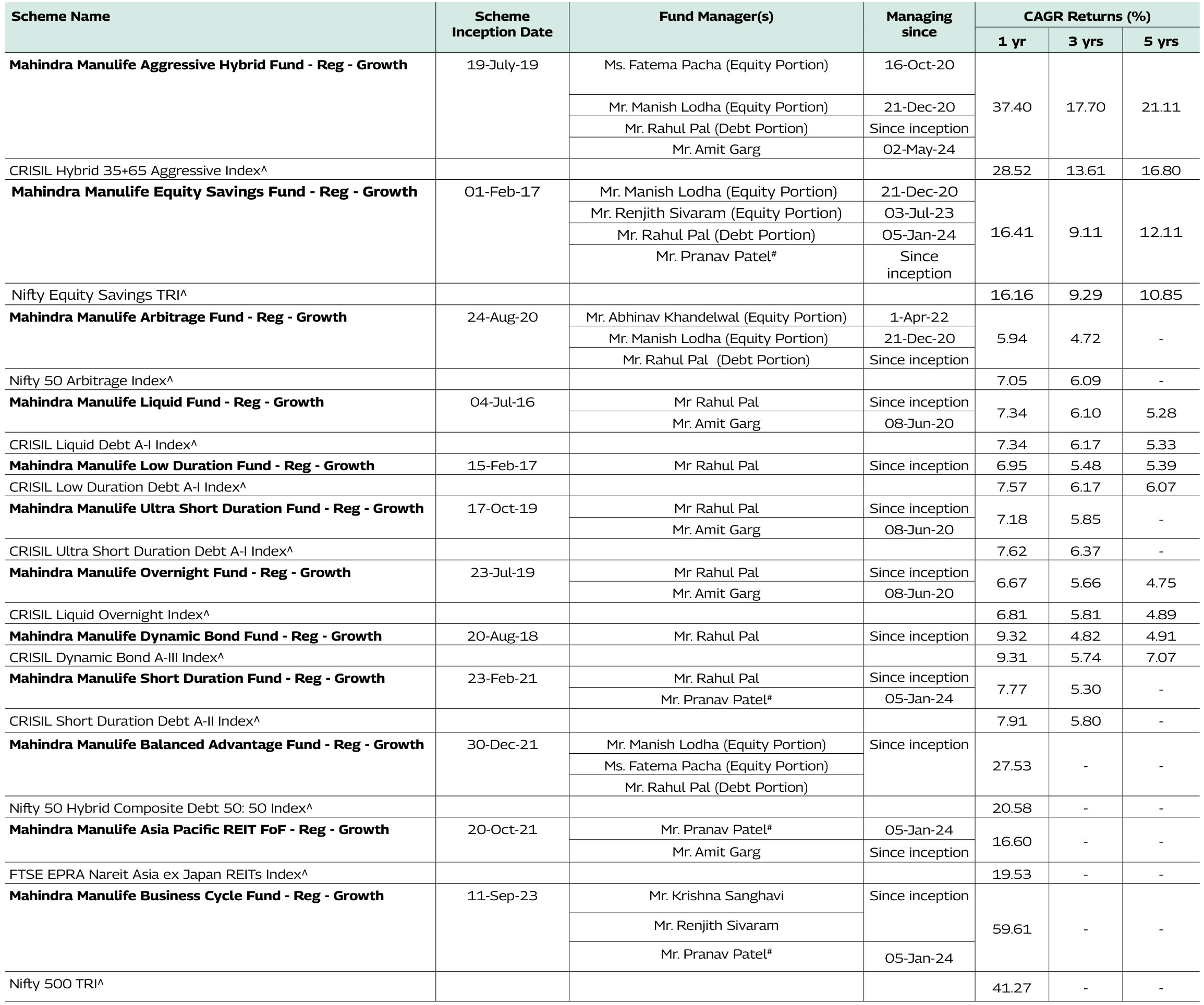

^Benchmark CAGR – Compounded Annual Growth Rate. #Dedicated Fund Manager for Overseas Investments.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments.

The performance details provided above are of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Mr. Renjith Sivaram manages 3 schemes, Mr. Rahul Pal manages 11 schemes and Mr. Pranav Patel manage 5 schemes each of Mahindra Manulife Mutual Fund. The performance data for the schemes which have not completed one year has not been provided. Performance as on September 30, 2024

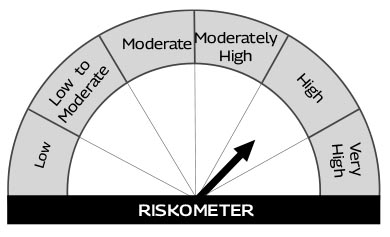

Mahindra Manulife Multi Asset Allocation Fund

This product is suitable for investors who are seeking*

• Capital Appreciation while generating income over long term;

• Investments across equity and equity related instruments,

debt and money market instruments, units of Gold/Silver

Exchange Traded Funds (ETFs) and Exchange Traded

Commodity Derivatives.

45% NIFTY 500 TRI + 40% CRISIL Composite Bond Index + 10% Domestic Price of Physical Gold + 5% Domestic Price of Silver

Benchmark Riskometer

*Investor should consult their financial advisers if in doubt about whether the product is suitable for them.

Get in Touch: Unit No. 204, 2nd Floor, Amiti Building,

Piramal Agastya Corporate Park, LBS Road,

Kamani Junction, Kurla (W), Mumbai – 400 070.

Phone: +91-22-66327900, Fax: +91-22-66327932

Toll Free No.: 1800 419 6244

Website: www.mahindramanulife.com

@Units of Gold/Silver ETFs & other Gold and Silver instruments (including Exchange

traded commodity derivative (ETCDs) as permitted by SEBI from time to time).