Mahindra Manulife

Large Cap Fund

(Large Cap Fund - An open ended equity scheme predominantly investing in large cap stocks)

One Pager as on September 30, 2024

| Agile quality portfolio from India's Big 100 Companies* |

| Exposure to the more stable half of the market |

| High conviction bottom up stock picking with a focus on alpha generation |

| *In terms of Full Market Capitalisation. | |

- A concentrated portfolio of market leaders and established businesses.

- A portfolio with measured exposure in other market caps for possible alpha generation.

- Key Overweight sectors/Industries include Oil & Gas, FMCG and Construction

vs the Schemes’ Benchmark

- Key Underweight sectors /Industries include Metals & Mining, Finance and

Telecom vs the Scheme’s Benchmark.

| Sector | MMLCF* | Nifty 100 TRI |

| Financial Services | 29.89% | 31.18% |

| Oil Gas & Consumable Fuels | 12.42% | 10.21% |

| Information Technology | 11.03% | 10.75% |

| Fast Moving Consumer Goods | 10.45% | 8.42% |

| Automobile And Auto Components | 6.61% | 7.67% |

*Mahindra Manulife Large Cap Fund

Data as on September 30, 2024

| Security | % to Net Assets |

| HDFC Bank Limited | 9.04% |

| Reliance Industries Limited | 7.41% |

| ICICI Bank Limited | 6.74% |

| Infosys Limited | 5.71% |

| Larsen & Toubro Limited | 4.73% |

| Tata Consultancy Services Limited | 3.94% |

| State Bank of India | 3.78% |

| ITC Limited | 3.47% |

| Axis Bank Limited | 3.45% |

| Havells India Limited | 2.94% |

| Total | 51.21% |

| Fresh Additions | Complete Exits |

| Security | Security |

| Devyani International Limited | Indus Towers Limited |

| JK Cement Limited | - |

| Zomato Limited | - |

Note:

The companies/stock(s) referred above are only for the purpose of disclosure of significant

portfolio changes during the month and should not be construed as recommendation to buy/sell/

hold. The fund manager may or may not choose to hold these companies/stocks, from time to

time. Investors are requested to consult their financial, tax and other advisors before taking any

investment decision(s). Data as on September 30, 2024

| Turnover Ratio (Last 1 year) | 0.84 |

| Standard Deviation | 12.15% |

| Beta | 0.91 |

| Sharpe Ratio# | 0.66 |

| Jenson's Alpha | -0.0192 |

#Risk-free rate assumed to be 6.76% (MIBOR as on 30-09-24) - Source: www.mmda.org

Note: As per AMFI guidelines for factsheet, the ratios are calculated based on month rolling

returns for last 3 years. Data as on September 30, 2024

The investment objective of the Scheme is to provide long term capital appreciation & provide long-term growth opportunities by investing in a portfolio constituted of equity & equity related securities and derivatives predominantly in large cap companies. However, there can be no assurance that the investment objective of the Scheme will be achieved.

Fund Manager:

Ms. Fatema Pacha

Total Experience : 18 years,

Experience in managing this fund: 3 years and 9 months (Managing since December 21, 2020)

Mr. Abhinav Khandelwal

Total Experience : 14 years

Experience in managing this fund: 2 Years and 7 months (Managing since March 1, 2022)

Date of allotment: March 15, 2019

Benchmark: Nifty 100 TRI

Option: IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D)

D-Default

Minimum Application Amount: Rs. 1,000 and in multiples of Re. 1/- thereafter

Minimum Additional Purchase Amount: Rs. 1,000 and in multiples of Re. 1/- thereafter

Minimum Weekly & Monthly SIP Amount: Rs 500 and in multiples of Re.1/- thereafter

Minimum Weekly & Monthly SIP Installments: 6

Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Re. 1/- thereafter

Minimum Quarterly SIP installments: 4

Minimum Amount for Switch in: Rs. 1,000/- and in multiples of Re. 0.01/- thereafter.

Minimum Amount for Redemption / Switch-outs: Rs. 1,000/- or 100 units or account balance, whichever is lower in respect of each Option.

Monthly AAUM as on September 30, 2024 (Rs. in Cr.): 586.09

Quarterly AAUM as on September 30, 2024 (Rs. in Cr.): 559.51

Monthly AUM as on September 30, 2024 (Rs. In Cr.): 596.25

Entry Load: Not applicable

Exit Load: • An Exit Load of 1% is payable if Units are redeemed / switched-out upto 3 months from the date of allotment;

• Nil if Units are redeemed / switched-out after 3 months from the date of allotment.

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 15-Mar-2019.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of

Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Ms. Fatema Pacha is managing this scheme since December 21, 2020.

Mr. Abhinav Khandelwal is managing this scheme since March 1, 2022. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period.

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 15-Mar-2019.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments.

Returns greater than 1 year period are compounded annualized. For SIP returns, monthly investment of equal amounts invested on the 1st business

day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return).

^Benchmark CAGR – Compounded Annual Growth Rate.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments.The performance details provided above are of

Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Mr. Abhinav Khandelwal manages 6 schemes and

Ms. Fatema Pacha manages 8 schemes of Mahindra Manulife Mutual Fund. The performance data for the schemes which have not completed one year has not been provided.

Performance as on September 30, 2024.

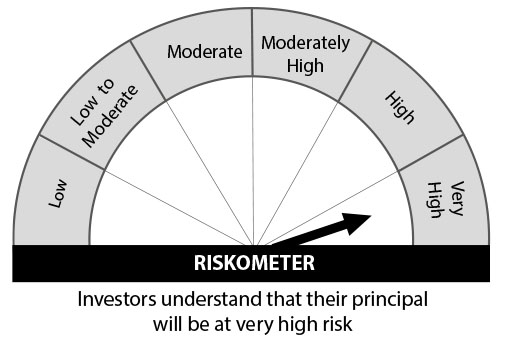

Mahindra Manulife Large Cap Fund

This product is suitable for investors who are seeking*:

• Long term capital appreciation;

• Investment predominantly in equity and equity related securities including derivatives of large cap companies.

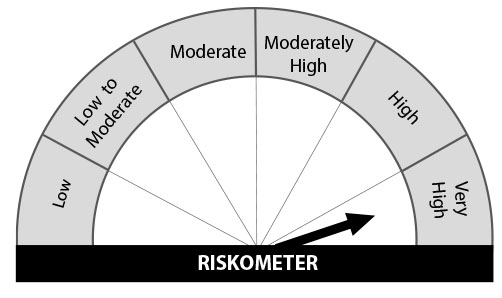

Nifty 100 TRI

Benchmark Riskometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Get in Touch: Unit No. 204, 2nd Floor, Amiti Building, Piramal Agastya Corporate Park, LBS Road, Kamani Junction, Kurla (W), Mumbai – 400 070.

Phone: +91-22-66327900, Fax: +91-22-66327932

Toll Free No.: 1800 419 6244

Website: www.mahindramanulife.com