Mahindra Manulife

Business Cycle Fund

(An open ended equity scheme following business cycles based investing theme)

One Pager as on September 30, 2023

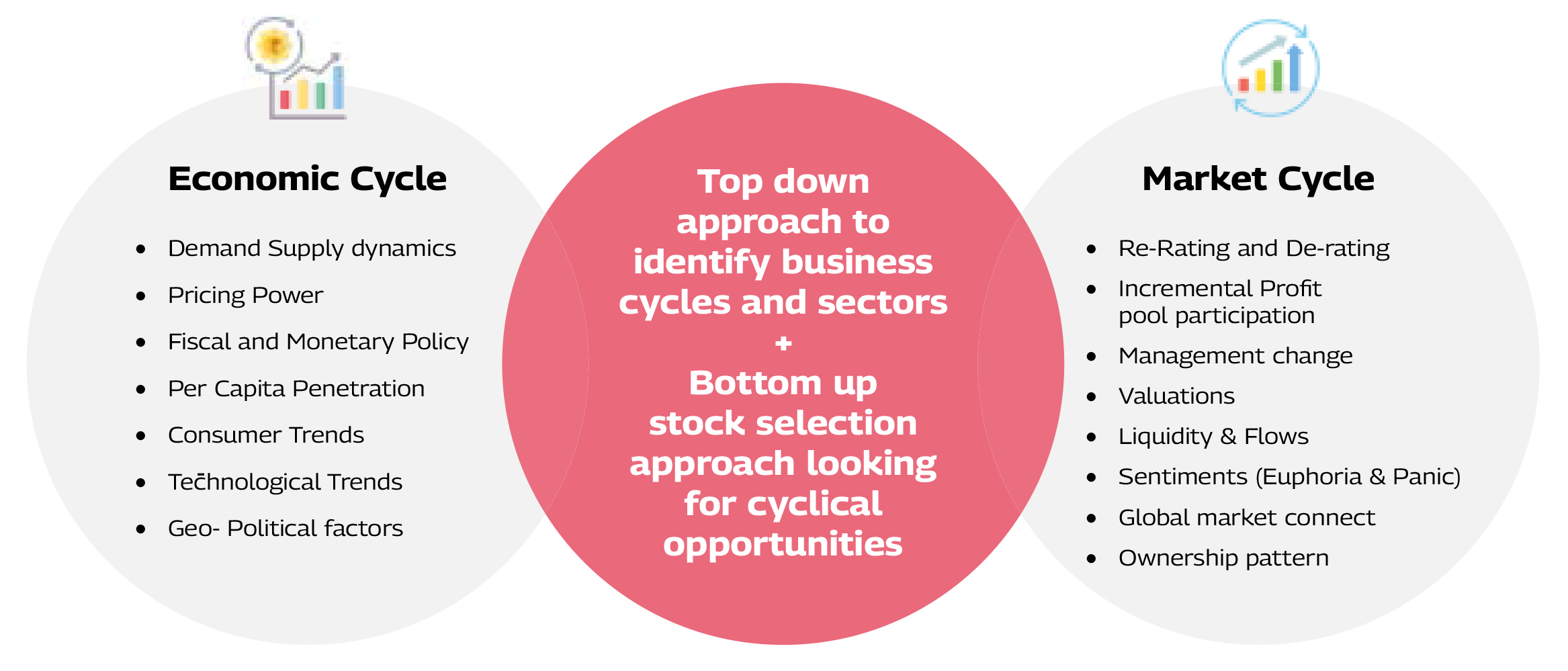

| Business Cycle fund aims to identify and invest in select sectors based on the market and economic dynamics. |

| Skilled fund managers can strategically rotate the portfolio`s sectoral allocation to capture outperformance during specific phases of the business cycle. |

| The Funds are designed to be flexible and adaptive to changing economic & market conditions. |

| Investing in a business cycle fund allows investors to participate in the growth potential of different sectors and industries as the economy progresses through different phases of the cycle. |

| Blend of top-down Business Cycle/Sector identification and bottom-up stock selection approach. |

| Portfolio Allocation: Quality companies preferred during the favourable business cycle. |

| Concentrated sectoral position based on the stages of Business Cycle. |

| Investments across market capitalization. |

| Instruments | Indicative Allocation

(%of net assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity and Equity related instruments of companies selected based on the business cycle theme^* | 80% | 100% | Very High |

| Equity and Equity related instruments of companies other than above | 0% | 20% | Very High |

| Debt and Money Market Securities# (including TREPS (Tri-Party Repo) and Reverse Repo in Government Securities) | 0% | 20% | Low to Moderate |

| Units issued by REITs & InvITs | 0% | 10% | Moderately High |

^including derivative instruments to the extent of 50% of the equity component of the Scheme.

Investment in derivatives shall be for hedging, portfolio balancing and such other purposes as maybe

permitted from time to time under the Regulations and subject to guidelines issued by SEBI/RBI from time

to time. The Scheme may utilize the entire available equity derivatives exposure limit as provided above, for

hedging purpose. However, the equity derivatives exposure towards non-hedging purpose shall not exceed

20% of the net assets of the Scheme subject to maximum derivatives exposure as defined above (i.e. 50%

of the equity component of the Scheme). The margin money deployed on derivative positions would be

included in the Debt and Money Market Securities category.

*The Scheme may invest in Foreign Securities (including units/securities issued by overseas mutual funds

with similar investment objective or strategy / Foreign Securities having business cycle theme) up to 20%

of the net assets of the Scheme in compliance with SEBI Circular(s) / guideline(s) pertaining to overseas

investments by mutual funds/ ETFs, as amended from time to time. The Scheme intends to invest US$

5 million in Overseas securities within six months from the date of the closure of the New Fund Offer

(NFO) of the Scheme. Thereafter, the Scheme shall invest in Foreign Securities as per the limits available

to ‘Ongoing Schemes’ in terms of the clause 12.19 of SEBI Master Circular No. SEBI/HO/IMD/IMD-PoD-1/P/

CIR/2023/74 dated May 19, 2023. Further, it is clarified that the above specified limit would be considered

as soft limit(s) for the purpose of reporting only by mutual funds on monthly basis in the format prescribed

by SEBI.

#Money Market instruments includes commercial papers, commercial bills, treasury bills, Government

securities having an unexpired maturity up to one year, call or notice money, certificate of deposit, usance

bills, and any other like instruments as specified by the Reserve Bank of India from time to time. For

detailed asset allocation, please refer SID/KIM available on our website www.mahindramanulife.com

| Security | % to Net Assets |

| Reliance Industries Limited | 5.46% |

| State Bank of India | 4.32% |

| Grasim Industries Limited | 3.14% |

| NTPC Limited | 2.82% |

| Infosys Limited | 2.79% |

| Indus Towers Limited | 2.48% |

| Axis Bank Limited | 2.46% |

| Piramal Enterprises Limited | 2.26% |

| Canara Bank | 2.03% |

| Bharti Airtel Limited | 2.00% |

| Total | 29.76% |

The Scheme shall seek to generate long term capital appreciation by investing predominantly in equity and equity related securities with a focus on identifying and investing in business cycles through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy. However, there is no assurance that the objective of the Scheme will be realized.

Fund Manager:

Mr. Krishna Sanghavi

Total Experience : 27 years

Experience in managing this fund: (Managing since September 11, 2023)

Mr. Renjith Sivaram

Total Experience : 13 years

Experience in managing this fund: (Managing since September 11, 2023)

Mr. Kush Sonigara$

Total Experience : 12 years

Experience in managing this fund:(Managing since September 11, 2023)

Date of allotment: September 11, 2023

Benchmark: NIFTY 500 TRI (First Tier Benchmark)*

Option: IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default

Minimum Application Amount: Rs. 1000 and in multiples of Rs. 1 thereafter

Minimum Additional Purchase Amount: Rs. 1,000/- and in multiples of Re. 1/- thereafter

Minimum Repurchase Amount: Rs. 1,000/- or 100 units or account balance, whichever is lower

Minimum Weekly & Monthly SIP Amount: Rs 500 and in multiples of Rs 1/- thereafter

Minimum Weekly & Monthly SIP installments: 6

Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Rs 1/- thereafter

Minimum Quarterly SIP installments: 4

Monthly AAUM as on September 30, 2023 (Rs. in Cr.): 298.59

Quarterly AAUM as on September 30, 2023 (Rs. In Cr.): 97.37

Monthly AUM as on September 30, 2023 (Rs. in Cr.): 463.85

Entry Load: Not applicable

Exit Load: • An Exit Load of 1% is payable if Units are redeemed / switched-out upto 3 months from the date of allotment;

• Nil if Units are redeemed / switched-out after 3 months from the date of allotment.

Redemption /Switch-Out of Units would be done on First in First out Basis (FIFO).

Note: *Also referred as NSE 500 TRI, as per the list of benchmark indices (1st tier benchmarks) published by AMFI.

$ Dedicated Fund Manager for Overseas Investments. IDCW: Income Distribution cum Capital Withdrawal

Note: The performance data of the Scheme(s) co-managed by Mr. Krishna Sanghavi & Mr. Renjith Sivaram & Mr. Kush Sonigara (Dedicated Fund Manager for Overseas Investments), Mahindra Manulife Business Cycle Fund, has not been provided as the scheme has not completed 6 month

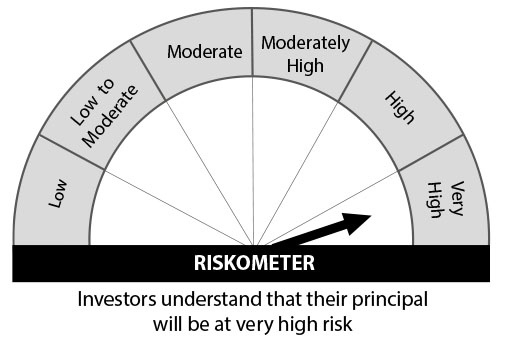

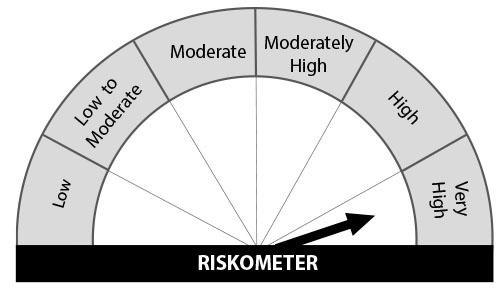

Mahindra Manulife Business Cycle Fund

This product is suitable for investors who are seeking*:

• Long term capital appreciation;

• Investment predominantly in equity

and equity related instruments of

business cycle based theme.

NIFTY 500 TRI

Benchmark Riskometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Get in Touch: Unit No. 204, 2nd Floor, Amiti Building, Piramal Agastya Corporate Park, LBS Road, Kamani Junction, Kurla (W), Mumbai – 400 070.

Phone: +91-22-66327900, Fax: +91-22-66327932

Toll Free No.: 1800 419 6244

Website: www.mahindramanulife.com