Mahindra Manulife

Arbitrage Fund

(An open ended scheme investing in arbitrage opportunities)

One Pager as on September 30, 2023

| Relatively lower risk as arbitrage strategy focuses on protecting downside risk by capturing market spreads |

| Better tax efficiency on returns compared to short term debt funds |

| One of the least volatile hybrid schemes that is suitable for investment across market cycles |

- Will take tactical hedging calls while maintaining liquidity.

- Will be agnostic to sector and market cap.

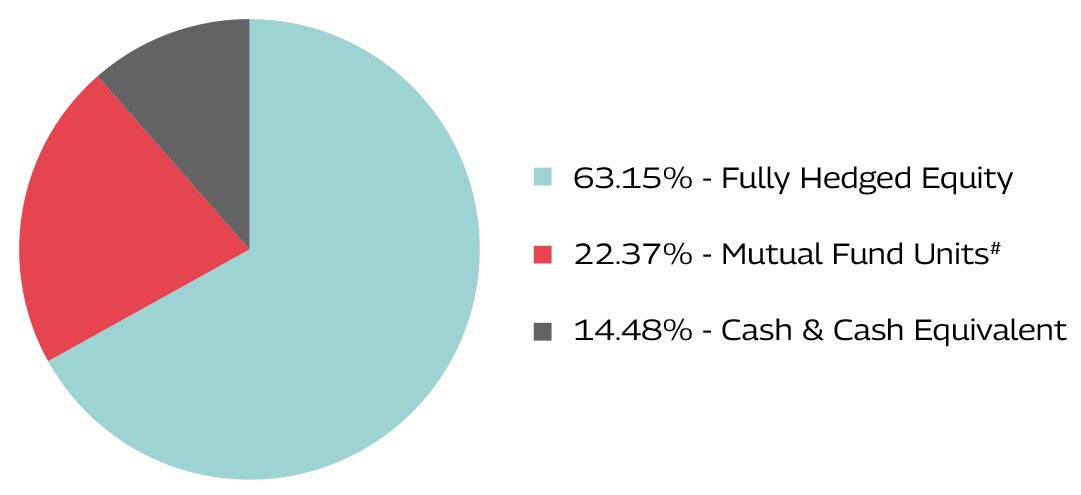

Data as on September 30, 2023

#Mutual Fund units as provided above is towards margin for derivatives positions.

| Sector | MMAF | Nifty 100 Index TRI |

| Financial Services | 21.27% | 35.95% |

| Telecommunication | 7.47% | 2.71% |

| Power | 7.02% | 2.41% |

| Services | 6.69% | 0.77% |

| Oil Gas & Consumable Fuels | 6.67% | 11.24% |

^For the equity portion

Data as on September 30, 2023

| Security | % to Net Assets |

| HDFC Life Insurance Company Limited | 7.72% |

| Indus Towers Limited | 7.47% |

| ICICI Bank Limited | 7.05% |

| Tata Power Company Limited | 7.02% |

| Adani Ports and Special Economic Zone Limited | 6.69% |

| Hindustan Petroleum Corporation Limited | 6.67% |

| Tata Steel Limited | 5.62% |

| Maruti Suzuki India Limited | 5.14% |

| Kotak Mahindra Bank Limited | 4.28% |

| Hindustan Unilever Limited | 3.26% |

| Total | 60.93% |

| Annualised Portfolio YTM*1^ | 6.80%2 |

| Macaulay Duration^ | 3.00 days2 |

| Modified Duration^ | 0.012 |

| Residual Maturity^ | 3.00 days2 |

| Portfolio Turnover Ratio (Last 1 year) | 8.51 |

| As on (Date) | Sep 30, 2023 |

| Standard Deviation | 0.59% |

| Beta | 0.57 |

| Sharpe Ratio | -5.62 |

| Jenson’s Alpha | 0.0613 |

* In case of semi annual YTM, it will be annualised

#Risk-free rate assumed to be 6.95% (MIBOR as on 29-09-23) - Source: www.mmda.org

^ For debt component

1Yield to maturity should not be construed as minimum return oered by the Scheme.

2Calculated on amount invested in debt securities (including accrued interest), deployment of funds in TREPS and Reverse Repo and net receivable / payable.

Data as on September 30, 2023

The investment objective of the Scheme is to generate income by predominantly investing in arbitrage opportunities in the cash and derivatives segment of the equity market and the arbitrage opportunities available within the derivative segment and by investing the balance in debt and money market instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved.

Fund Manager:

Mr. Abhinav Khandelwal (Equity)

Total Experience : 14 years

Experience in managing this fund: 1 year and 6 months (Managing since April 1, 2022)

Mr. Manish Lodha (Equity)

Total Experience : 23 years,

Experience in managing this fund: 2 years and 9 months (Managing since December 21, 2020)

Mr. Rahul Pal (Debt)

Total Experience : 22 years,

Experience in managing this fund: 3 years and 1 month (Managing since August 24, 2020)

Date of allotment: August 24, 2020

Benchmark: Nifty 50 Arbitrage Index TRI

Option: IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D)D-Default

Minimum Amount for Subscription / Purchase: Rs. 1,000/- and in multiples of Re. 1/- thereafter.

Minimum Amount for Switch in: Rs. 1,000/- and in multiples of Re. 0.01/- thereafter.

Minimum Amount for Redemption / Switch-outs:Rs. 1,000/- or 100 units or account balance, whichever is lower

Minimum Weekly & Monthly SIP Amount: Rs 500 and in multiples of Re. 1/- thereafter

Monthly AAUM as on September 30, 2023 (Rs. in Cr.): 22.98

Quartely AAUM as on September 30, 2023 (Rs. in Cr.): 22.86

Monthly AUM as on September 30, 2023 (Rs. In Cr.): 22.69

Entry Load: Not applicable

Exit Load: • An exit load of 0.25% is payable if Units are redeemed / switched-out on or before completion of 30 days from thedate of allotment of Units;

• Nil - If Units are redeemed / switched-out after completion of 30 days from the date of allotment of Units.

Redemption /Switch-Out of Units would be done on First in First out Basis (FIFO).

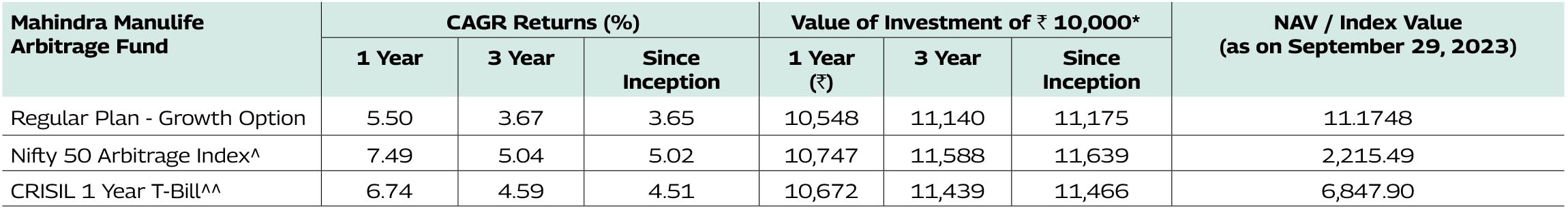

^Benchmark ^^Additional Benchmark. Inception/Allotment date: 24-Aug-20.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. Mr. Abhinav Khandelwal is managing this scheme since April 1, 2022. Mr. Manish Lodha is managing this fund since December 21, 2020.

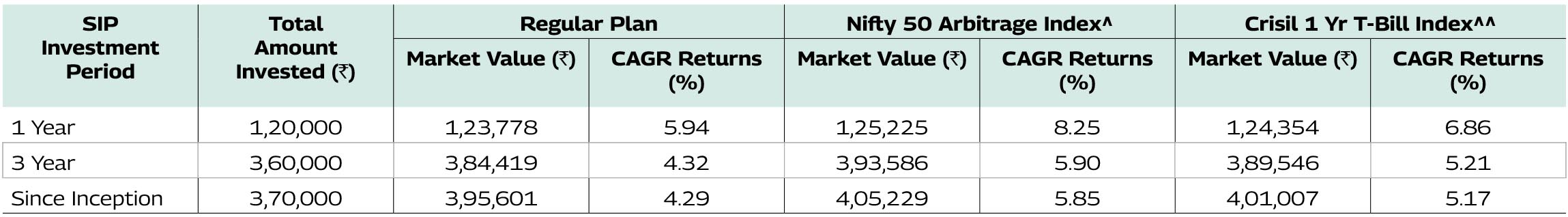

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 24-Aug-20.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Returns greater than 1 year period are compounded annualized. For SIP returns, monthly investment of equal amounts invested on the 1st business day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return).

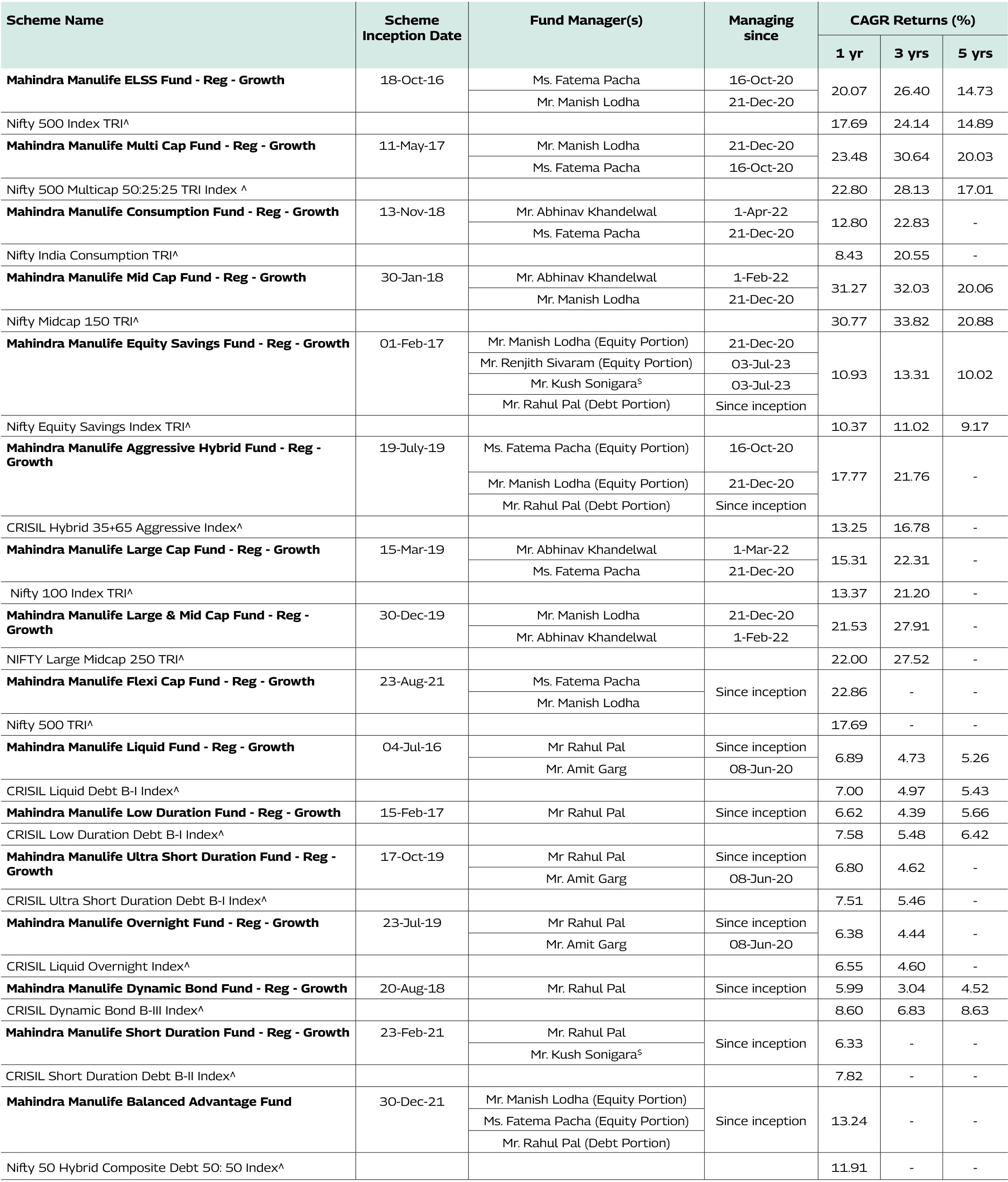

^Benchmark CAGR – Compounded Annual Growth Rate. $Dedicated Fund Manager for Overseas Investments.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. The performance details provided above are of Growth Option under Regular Plan Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Mr. Rahul Pal manages 10 schemes, Mr. Abhinav Khandelwal manages 6 schemes and Mr. Manish Lodha manages 10 schemes each of Mahindra Manulife Mutual Fund. The performance data for the schemes which have not completed one year has not been provided.

Mahindra Manulife Arbitrage Fund

This product is suitable for investors who are seeking*:

• Income over short term;

• Income through arbitrage opportunities between cash and derivative market and arbitrage opportunities within the derivative segment.

Nifty 50 Arbitrage Index TRI

Benchmark Riskometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Get in Touch: Unit No. 204, 2nd Floor, Amiti Building,

Piramal Agastya Corporate Park, LBS Road,

Kamani Junction, Kurla (W), Mumbai – 400 070.

Phone: +91-22-66327900, Fax: +91-22-66327932

Toll Free No.: 1800 419 6244

Website: www.mahindramanulife.com

*Please consult your tax advisor before investing.