Mahindra Manulife

Small Cap Fund

(Small Cap Fund - An open ended equity scheme predominantly investing in small cap stocks)

One Pager as on October 31, 2024

| Potential growth tailwinds in Indian Economy. |

| Opportunity to capitalize on Indian Entrepreneurship. |

| Opportunity to capture market / economic cycles. |

| Potential to create wealth and generate alpha over long-term. |

| Small caps are generally under-researched and under-owned and hence provides an opportunity for stock-picking at reasonable valuations. |

| Small Caps could be beneficiaries of structural reforms announced from time to time. |

| Small caps also provide exposure to companies which are potential market leaders in the industries they operate in (a few examples include textile, paper, sugar, luggage) and have potential to become midcaps of tomorrow as they achieve scale. |

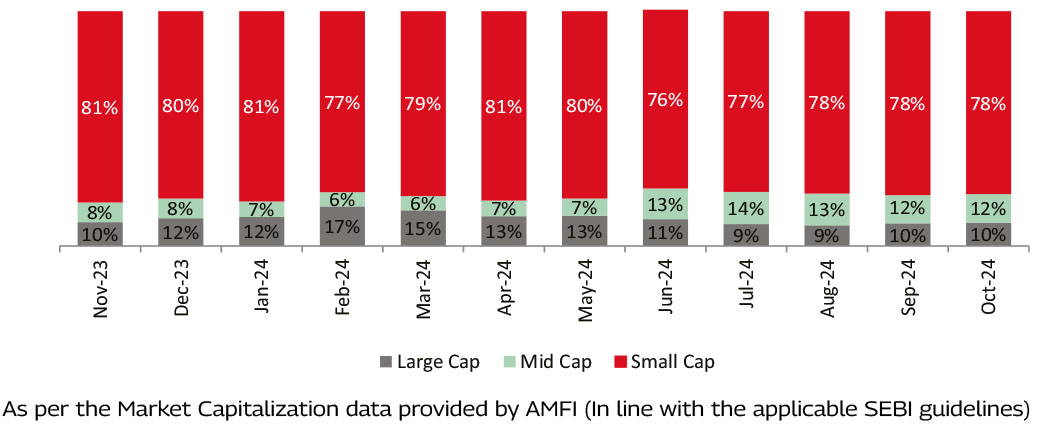

- Portfolio construction on bottom up stock selection basis.

- Key Overweight sectors/Industries include Forest Materials, Power and

Construction Materials vs the Schemes’ Benchmark.

- Key Underweight sectors /Industries include Consumer Durables,

Chemicals and Healthcare vs the Schemes’ Benchmark.

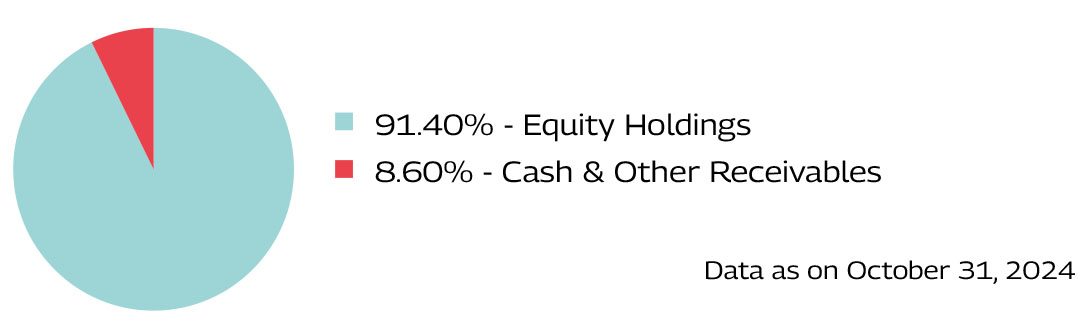

- Carrying Higher cash levels around 8.6% in the portfolio as tight monetary

policy in India may continue a bit longer than expected, following higher

global policy rates and upside risks to domestic inflation.

| Security | % to Net Assets |

| Aditya Birla Real Estate Limited | 3.24% |

| Anant Raj Limited | 3.04% |

| Piramal Pharma Limited | 2.42% |

| Firstsource Solutions Limited | 2.41% |

| PCBL Limited | 2.40% |

| Cholamandalam Financial Holdings Limited | 2.30% |

| GAIL (India) Limited | 2.30% |

| CESC Limited | 2.28% |

| Apar Industries Limited | 2.22% |

| Reliance Industries Limited | 2.14% |

| Total | 24.75% |

| Sector | MMSCF | BSE 250 Small Cap TRI |

| Capital Goods | 16.48% | 16.12% |

| Financial Services | 10.50% | 18.47% |

| Healthcare | 6.99% | 11.67% |

| Fast Moving Consumer Goods | 5.23% | 4.37% |

| Automobile And Auto Components | 4.85% | 5.13% |

*Mahindra Manulife Small Cap Fund

Data as on October 31, 2024

| Turnover Ratio (Last 1 year) | 0.66 |

| Fresh Additions | Complete Exits |

| Security | Security |

| Aditya Birla Real Estate Limited | Aarti Industries Limited |

| Deepak Fertilizers and Petrochemicals Corporation Limited | BEML Limited |

| - | Century Textiles & Industries Limited |

| - | Sula Vineyards Ltd |

Note: The companies/stock(s) referred above are only for the purpose of disclosure of significant

portfolio changes during the month and should not be construed as recommendation to buy/sell/

hold. The fund manager may or may not choose to hold these companies/stocks, from time to

time. Investors are requested to consult their financial, tax and other advisors before taking any

investment decision(s). Data as on October 31, 2024

The investment objective of the Scheme is to generate long term capital appreciation by investing in a diversified portfolio of equity & equity related securities of small cap companies. However, there can be no assurance that the investment objective of the Scheme will be achieved.

Fund Manager:

Mr. Krishna Sanghavi££

Total Experience : 27 years

Experience in managing this fund: Not available (Managing since October 24, 2024)

Mr. Manish Lodha

Total Experience : 23 years,

Experience in managing this fund:1 Year and 10 months (Managing since December 12, 2022)

Date of allotment: December 12, 2022

Benchmark: BSE 250 Small Cap TRI

Option: IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default

Minimum Application Amount: Rs. 1,000 and in multiples of Re. 1/- thereafter

Minimum Additional Purchase Amount: Rs. 1,000 and in multiples of Re. 1/- thereafter

Minimum Weekly & Monthly SIP Amount: Rs 500 and in multiples of Rs 1/- thereafter

Minimum Weekly & Monthly SIP Installments: 6

Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Rs 1/- thereafter

Minimum Quarterly SIP installments: 4

Monthly AAUM as on October 31, 2024 (Rs. in Cr.): 5,305.14

Monthly AUM as on October 31, 2024 (Rs. In Cr.): 5,220.09

Entry Load: Not applicable

Exit Load: • An Exit Load of 1% is payable if Units are redeemed / switched-out upto 3 months from the date of allotment;

• Nil if Units are redeemed / switched-out after 3 months from the date of allotment.

££Pursuant to change in Fund Management Responsibilities, the scheme shall be managed by Mr. Krishna Sanghavi effective October 24, 2024.

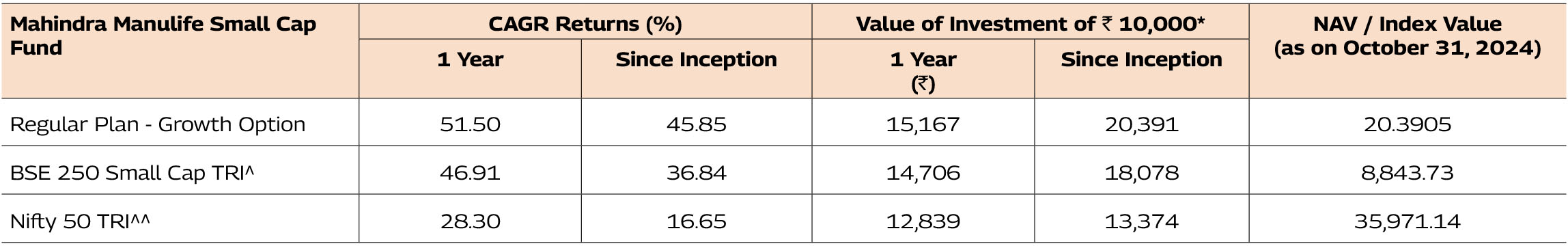

^Benchmark ^^Additional Benchmark. Inception/Allotment date: 12-Dec-22.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since

inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan

under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. Note: Pursuant to change in Fund Management Responsibilities, the scheme shall

be managed by Mr. Krishna Sanghavi and Mr. Manish Loadha efffective from October 24, 2024.

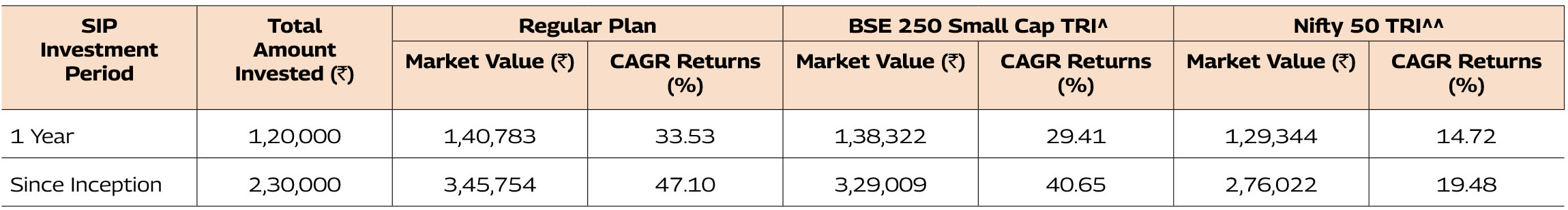

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 12-Dec-22.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Returns greater than 1 year period are compounded annualized. For SIP returns, monthly investment of equal

amounts invested on the 1st business day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment

internal rate of return).

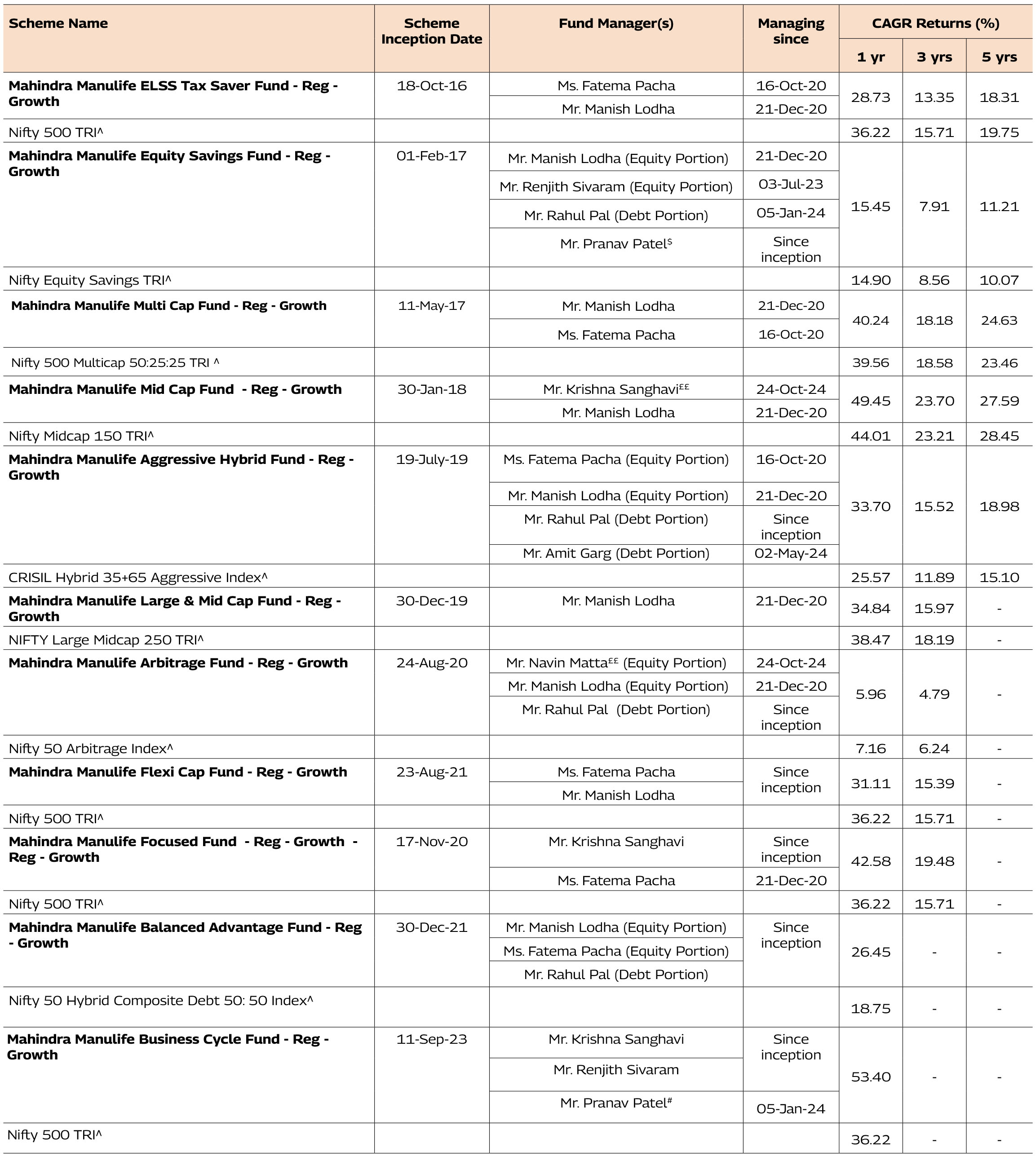

^Benchmark CAGR – Compounded Annual Growth Rate. $Dedicated Fund Manager for Overseas Investments.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments.

The performance details provided above are

of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Mr. Krishna Sanghavi manages 4 schemes

and Mr. Manish Lodha manages 11 schemes each of Mahindra Manulife Mutual Fund. The performance data for the schemes which have not completed one year has not been provided.

Performance as on October 31, 2024

££Pursuant to change in Fund Management Responsibilities, the scheme shall be managed by Mr. Krishna Sanghavi effective October 24, 2024.

££Pursuant to change in Fund Management Responsibilities, the scheme shall be managed by Mr. Navin Matta effective October 24, 2024.

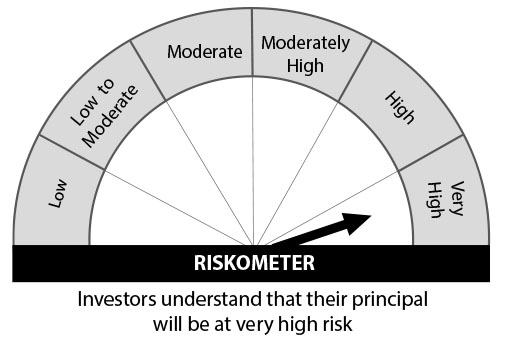

Mahindra Manulife Small Cap Fund

This product is suitable for investors who are seeking*:

• Long term capital appreciation;

• Investment predominantly in equity and equity related securities of small cap companies.

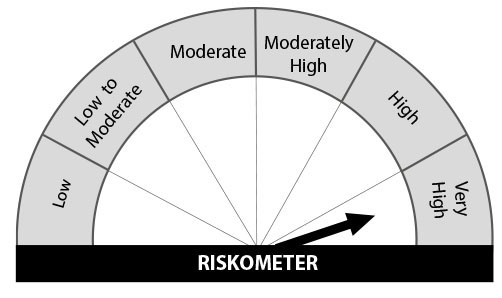

BSE 250 Small Cap TRI

Benchmark Riskometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Get in Touch: Unit No. 204, 2nd Floor, Amiti Building, Piramal Agastya Corporate Park, LBS Road, Kamani Junction, Kurla (W), Mumbai – 400 070.

Phone: +91-22-66327900, Fax: +91-22-66327932

Toll Free No.: 1800 419 6244

Website: www.mahindramanulife.com