MAHINDRA MANULIFE

DYNAMIC BOND YOJANA

An open ended dynamic debt scheme investing across duration.

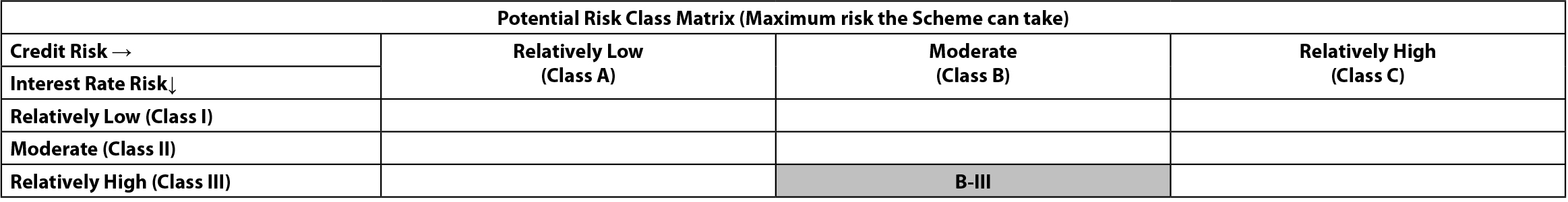

A relatively high interest rate risk and moderate credit risk.

(Scheme Code : MMDBY)

| One Pager | October, 2022 |

• The Modified Duration of the portfolio (MD) increased to around 3.38 years

• The Portfolio largely derives it duration from Gilts as we believe that the AAA credit spreads may expand as we move ahead

| Instruments | Indicative Allocation (% of assets) | Risk Profile | |

| Minimum | Maximum | Low/Moderate/ High | |

| Debt* & Money Market instruments | 0% | 100% | Moderate |

| Units issued by REITs & InvITs | 0% | 10% | Moderately High |

* Includes securitized debt and debt instruments having structured obligations/credit enhancements (such as corporate / promoter guarantee, conditional and contingent liabilities, covenants, pledge and / or Non Disposal Undertaking of shares etc) upto 35% of the net assets of the Scheme.

Benchmark: CRISIL Dynamic Bond Fund BIII IndexEntry Load: N.A.

Exit Load: Nil

KEY MARKET INDICATORS

| Parameters | 31-Oct-2022 | 30-Sep-22 | 31-Oct-21 |

| RBI Repo Rate % | 5.90 | 5.90 | 4.00 |

| 5Y AAA PSU % | 7.40 | 7.34 | 5.99 |

| 1 year CD % | 7.50 | 7.05 | 4.31 |

| 10Y Gsec % | 7.45 | 7.40 | 6.39 |

| CPI (%) | 7.41 | 7.00 | 4.48 |

| IIP (YoY) % | -0.83 | 2.36 | 4.17 |

| US 10Y % | 4.05 | 3.83 | 1.55 |

| Dollar Rupee | 82.79 | 81.35 | 74.88 |

FUND MANAGER : MR. RAHUL PAL

Total Experience : 21 years

Experience in managing this fund: 4 years 3 months (managing since August 20, 2018)

As minutes of the MPC meeting held on September 30th were put out for in the public domain, we saw two external members opining for a wait and watch policy to see the lag effects on the economy of the monetary policy measures.

The US rates continued its upward trend and the yield curve from the 3 months treasury to the 10 years treasury flattened marking potential recessionary economic growth in the near future. The home prices in the US have started stagnating /marginally falling and this trend would be actively monitored. The US Fed meets in the first week of November and would be an interesting watch.

Data as on 31 October, 2022 | Data source: Bloomberg

Note: The data/statistics given above are to explain general market trends in the securities market, it should not be construed as any research report/research recommendation.

| CURRENT MONTH October 31, 2022 |

|

| AUM (Rs. In Crore) | 68.69 |

| Monthly AAUM (Rs. In Crore) | 72.59 |

| Avg. Maturity (Years) | 4.32 |

| Modified Duration | 3.38 |

| Macaulay Duration (Years) | 3.51 |

| YTM (%) | 7.23 |

| PREVIOUS MONTH September 30, 2022 |

|

| AUM (Rs. In Crore) | 75.56 |

| Monthly AAUM (Rs. In Crore) | 72.64 |

| Avg. Maturity (Years) | 4.05 |

| Modified Duration | 3.19 |

| Macaulay Duration (Years) | 3.31 |

| YTM (%) | 7.07 |

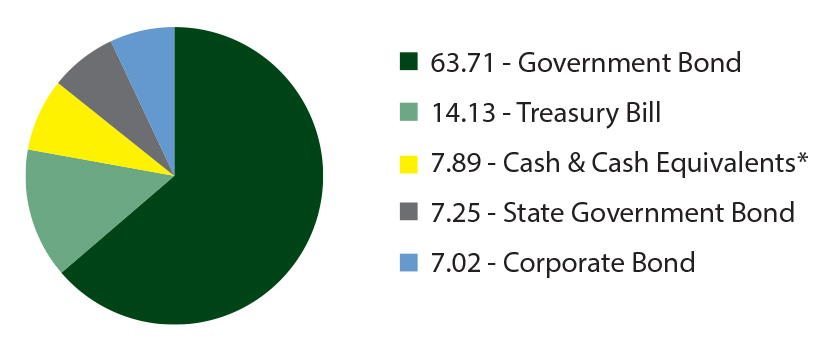

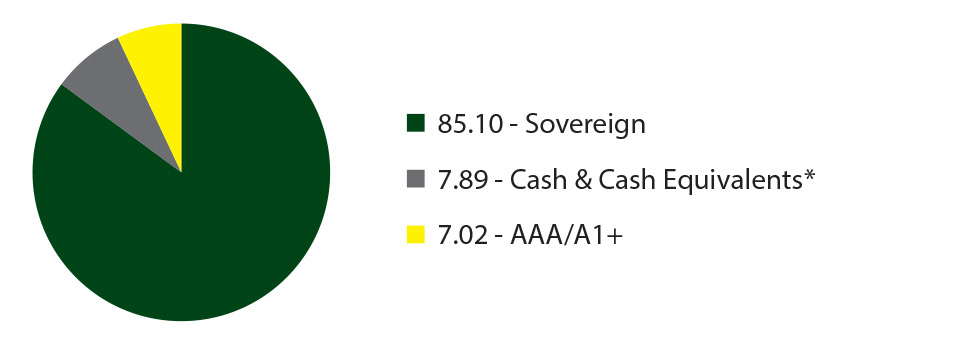

*Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS

*Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS

| CURRENT MONTH October 31, 2022 | |

| Security | % to N.A. |

| 5.74% GOI (MD 15/11/2026) (SOV) | 20.64% |

| 7.38% GOI (MD 20/06/2027) (SOV) | 18.18% |

| 7.26% GOI (MD 22/08/2032) (SOV) | 17.95% |

| 7.39% Maharashtra SDL (MD 09/11/2026) (SOV) | 7.25% |

| Housing Development Finance Corporation Limited (CRISIL AAA rated CB) | 7.02% |

| 5.22% GOI (MD 15/06/2025) (SOV) | 6.94% |

| 364 Days Tbill (MD 24/08/2023) (SOV) | 6.89% |

| 364 Days Tbill (MD 31/08/2023) (SOV) | 6.88% |

| 91 Days Tbill (MD 12/01/2023) (SOV) | 0.36% |

| 91 Days Tbill (MD 20/10/2022) (SOV) | 0.33% |

| TOTAL | 92% |

| PREVIOUS MONTH September 30, 2022 | |

| Security | % to N.A. |

| 5.74% GOI (MD 15/11/2026) (SOV) | 18.79% |

| 7.38% GOI (MD 20/06/2027) (SOV) | 16.59% |

| 7.26% GOI (MD 22/08/2032) (SOV) | 16.40% |

| 364 Days Tbill (MD 24/08/2023) (SOV) | 12.49% |

| 7.39% Maharashtra SDL (MD 09/11/2026) (SOV) | 6.61% |

| Housing Development Finance Corporation Limited (CRISIL AAA rated CB) | 6.39% |

| 5.22% GOI (MD 15/06/2025) (SOV) | 6.31% |

| 364 Days Tbill (MD 31/08/2023) (SOV) | 6.24% |

| 364 Days Tbill (MD 13/10/2022) (SOV) | 5.29% |

| 91 Days Tbill (MD 20/10/2022) (SOV) | 0.33% |

| TOTAL | 95% |

| FRESH ADDITIONS | COMPLETE EXITS |

| Security | Security |

| 91 Days Tbill (MD 12/01/2023) (SOV) | 364 Days Tbill (MD 13/10/2022) (SOV) |

| 91 Days Tbill (MD 20/10/2022) (SOV) |

Note: The companies/stock(s) referred above are only for the purpose of disclosure of significant portfolio changes during the month and should not be construed as recommendation to buy/ sell/ hold. The fund manager may or may not choose to hold these companies/stocks, from time to time. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

| SYSTEMATIC INVESTMENT PLAN |

| WITH THIS YOU CAN • Build corpus in the long term • Take advantage of rupee cost averaging • Experience the power of compounding even on small investments |

| CHOICE OF FREQUENCIES • Weekly • Monthly • Quarterly |

| CHOICE OF DATES Any date of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 6 instalments of ₹ 500 each under weekly frequency • 6 instalments of ₹ 500 each under monthly frequency • 4 instalments of ₹ 1500 each under quarterly frequency |

| SYSTEMATIC TRANSFER PLAN |

| WITH THIS YOU CAN • Take measured exposure into a new asset class • Rebalance your portfolio |

| CHOICE OF FREQUENCIES • Daily • Weekly • Monthly • Quarterly |

| CHOICE OF DATES Any date^ of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 6 instalments of ₹500 each under daily, weekly and monthly frequency • 4 instalments of ₹1500 each under quarterly frequency |

| SYSTEMATIC WITHDRAWAL PLAN |

| WITH THIS YOU CAN • Meet regular expenses |

| CHOICE OF FREQUENCIES • Monthly • Quarterly • Half-Yearly & Annual |

| CHOICE OF DATES Any date of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 2 instalments of ₹ 500 each under monthly / quarterly / Half-Yearly & Annual frequency |

^STP can be registered for any date under the monthly and quarterly frequencies and for any business day under the weekly frequency.

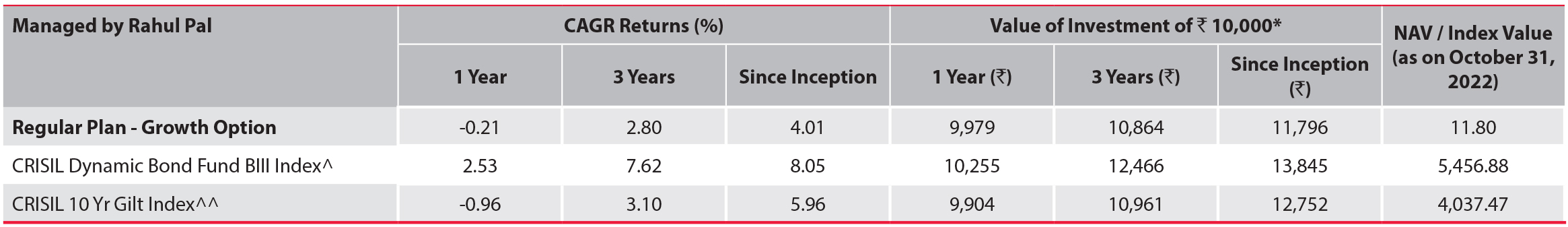

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 20-Aug-18.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. Performance details of other schemes managed by the Fund Manager(s) is available at the end of the document

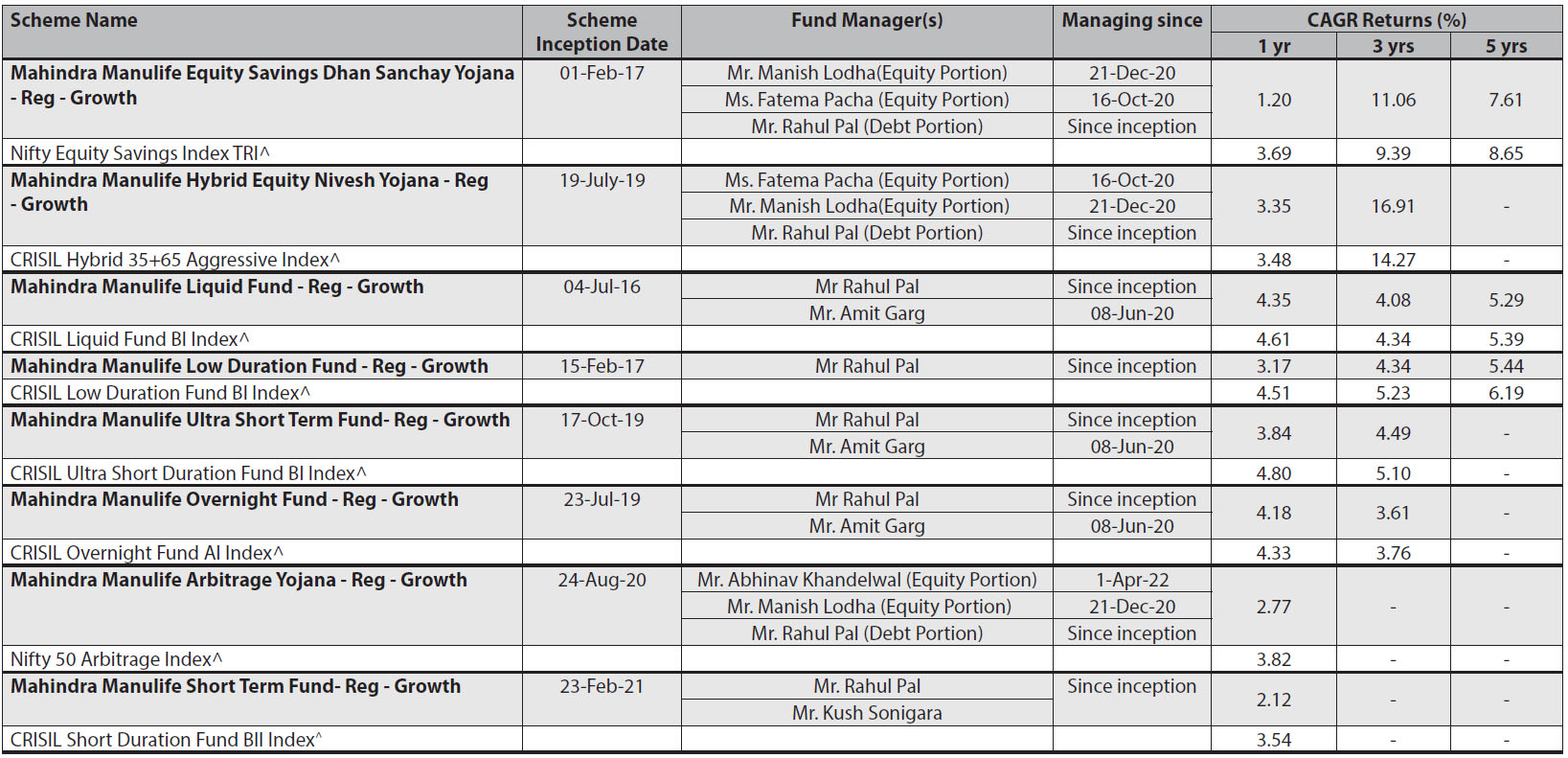

^Benchmark CAGR - Compounded Annual Growth Rate.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. The performance details provided above are of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Mr. Rahul Pal manages 10 schemes of Mahindra Manulife Mutual Fund.

Matrix for debt schemes based on Interest Rate Risk and Credit Risk is as follows:

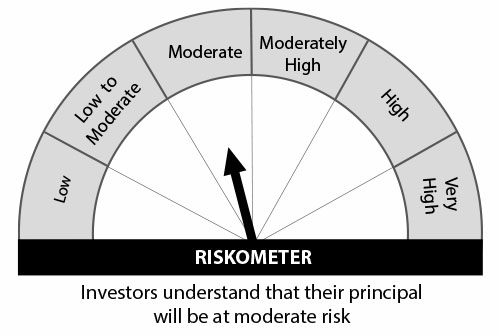

Mahindra Manulife Dynamic Bond Yojana

This product is suitable for investors who are seeking*:

• To generate regular returns and

capital appreciation through active

management of portfolio.

• Investments in debt & money market instruments across duration.

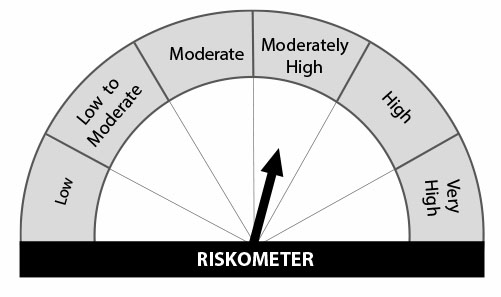

CRISIL Dynamic Bond Fund BIII Index

Benchmark Riskometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Reach us at: Sadhana House, 1st Floor, 570,

P.B. Marg, Worli, Mumbai - 400 018, India.

Phone: +91-22-66327900, Fax: +91-22-66327932

Website: www.mahindramanulife.com