Mahindra Manulife

Manufacturing Fund

(An open-ended equity scheme following manufacturing theme)

One Pager as on November 30, 2024

| GOVERNMENT POLICIES: Policies like Make in India, Atmanirbhar Bharat, Production Linked Incentives etc. could drive manufacturing in India |

| GLOBAL TAILWINDS: Diversification of production away from China to avoid supply chain shocks and overdependence could boost manufacturing in India |

| IMPROVED INFRASTRUCTURE: Push for improved physical and industrial infrastructure, increased power capacity could be an important enabler for manufacturing |

| EXPORT PROMOTION: Focusing on companies that are manufacturing finished goods for export. |

| IMPORT SUBSTITUTION: Substitution of imported finished goods and raw materials with domestically manufactured products and materials. |

| DOMESTIC CONSUMPTION: Focus on Production of goods for used by domestic businesses and retail consumers. |

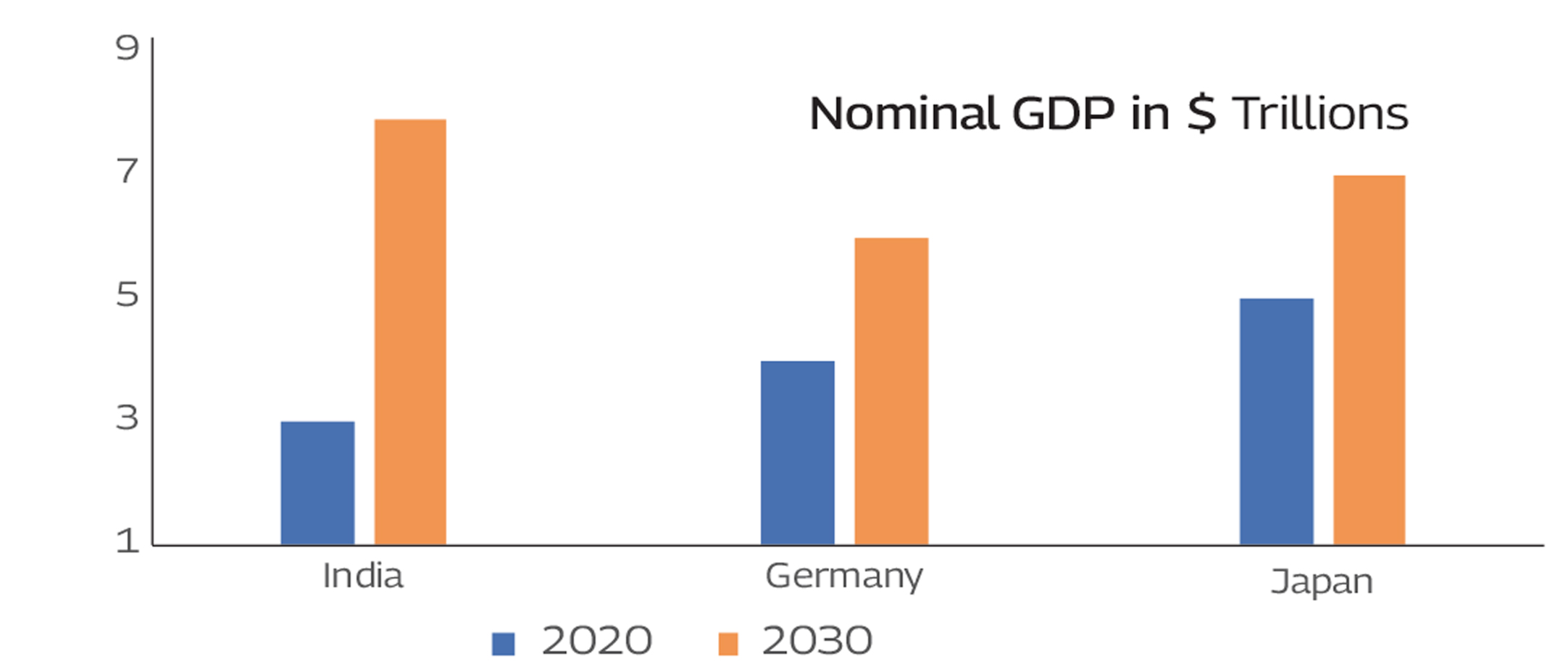

Based on adjacent data India’s GDP is expected to surpass that of Japan and

Germany by 2030. A key driver of this growth could be a significant expansion in manufacturing output.

The adjacent graph is based on expectations and the actual results could vary

materially. This is not indicating returns from any investments. There is no assurance as

regards to performance of any company, sector or investment

Source: S&P Global Intelligence

| Security | % to Net Assets |

| ITC Limited | 3.51% |

| Mahindra & Mahindra Limited | 3.51% |

| Deepak Fertilizers and Petrochemicals Corporation Limited | 3.10% |

| Kirloskar Brothers Limited | 2.87% |

| Reliance Industries Limited | 2.68% |

| Divi's Laboratories Limited | 2.61% |

| Hindustan Unilever Limited | 2.51% |

| Oil & Natural Gas Corporation Limited | 2.38% |

| Samvardhana Motherson International Limited | 2.34% |

| Hindalco Industries Limited | 2.25% |

| Total | 27.76% |

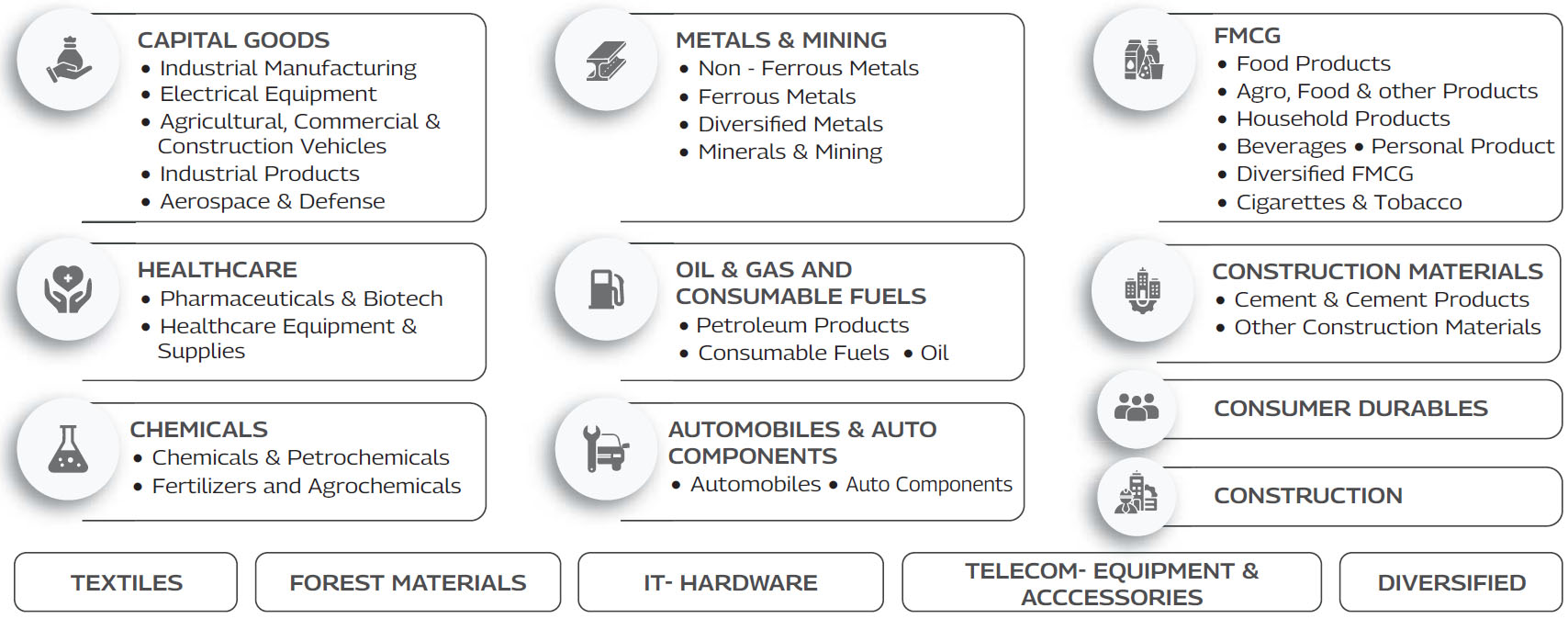

- Are engaged in manufacturing activity.

- May benefit from government incentives to encourage manufacturing opportunities.

- Are positioned to benefit from export promotion of domestic industries and import substitution through domestic manufacturing.

- May produce goods and materials for export.

- Are establishing new manufacturing capacity or investing in new plants and production technology.

- Are part of sectors which offer allied services associated with the entire manufacturing lifecycle.

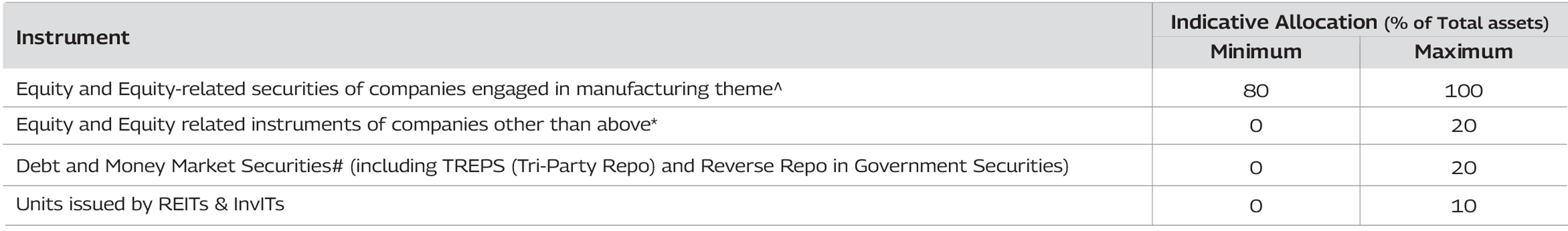

- 80-100% of the Portfolio will be invested in companies engaged in

the manufacturing theme.

- Flexible to invest across market capitalisation

- Portfolio shall comprise of diversified stock universe mapped to the

basic Industry list published by Asia Index Private Limited for BSE

India Manufacturing Index which includes sectors like Capital goods,

Metals & Mining, Consumer Durables, Construction etc.

For further details, please refer Scheme Information Document of the Scheme

The Scheme shall seek to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in manufacturing theme. However, there is no assurance that the objective of the Scheme will be achieved.

Benchmark: BSE India Manufacturing TRI

Fund Manager (Equity): Mr. Renjith Sivaram

Total Experience: 14 years

Experience in managing this fund: 5 months

(managing since June 24, 2024)

Fund Manager (Equity): Mr. Manish Lodha

Total Experience: 23 years

Experience in managing this fund: 5 months

(managing since June 24, 2024)

Fund Manager: Mr. Pranav Patel$

Total Experience: 14 years

Experience in managing this fund: 5 months

(managing since June 24, 2024)

$(Dedicated Fund Manager for Overseas Investments)

Plans: Regular & Direct

Options:Growth✧ IDCW ɱ

IDCW Sub-options:IDCW Reinvestment✧ & IDCW Payout

Minimum Application Amount(Lumpsum): ₹ 1,000 and in multiples of ₹ 1/- thereafter

Minimum Amount for Switch in: ₹ 1,000 and in multiples of ₹ 0.01/- thereafter

Minimum Application Amount (SIP) for weekly and monthly frequencies:6 installments of ₹ 500 /- each and in multiples of ₹ 1/- thereafter

Minimum Application Amount (SIP) for quarterly frequency:4 installments of ₹ 1,500 /- each and in multiples of ₹ 1/- thereafter

Entry Load: Not Applicable

Exit Load: - An Exit Load of 0.5% is payable if Units are redeemed / switched-out upto 3 months from the date of allotment;

- Nil if Units are redeemed / switched-out after 3 months from the date of allotment.

Redemption /Switch-Out of Units would be done on First in First out Basis (FIFO).

ɱIDCW: Income Distribution cum Capital Withdrawal

✧ Default Option

For more details please refer SID/KIM available on our website www.mahindramanulife.com

^ including equity derivatives to the extent of 50% of the equity component of the Scheme.

Investment in derivatives shall be for hedging, portfolio balancing and such other purposes as maybe permitted from time to time under the Regulations and subject to guidelines issued by SEBI/RBI from time to time. The Scheme may utilize

the entire available equity derivatives exposure limit as provided above, for hedging purpose. However, the equity derivatives exposure towards non-hedging purpose shall not exceed 20% of the net assets of the Scheme, subject to maximum

derivatives exposure as defined above (i.e. 50% of the equity component of the Scheme). The margin money deployed on derivative positions would be included in the Debt and Money Market Securities category.

*The Scheme may invest in Foreign Securities (including units/securities issued by overseas mutual funds) up to 20% of the net assets of the Scheme in compliance with clause 12.19 of the SEBI Master Circular pertaining to overseas investments by mutual funds, as amended from time to time. The Scheme intends to invest US$ 5 million in Overseas securities within six months from the date of the closure of the New Fund Offer (NFO) of the Scheme. Thereafter, the Scheme shall invest in Foreign Securities as per the limits available to ‘Ongoing Schemes’ in terms of clause 12.19.1.3.c of SEBI Master Circular. Further, SEBI vide its clause 12.19.1.3.d of the SEBI Master Circular, clarified that the above specified limit would be considered as soft limit(s) for the purpose of reporting only by mutual funds on monthly basis in the format prescribed by SEBI.

#Money Market instruments includes commercial papers, commercial bills, treasury bills, Government securities having an unexpired maturity up to one year, call or notice money, certificate of deposit, usance bills, and any other like instruments as specified by the Reserve Bank of India from time to time.

For detailed asset allocation, please refer Scheme Information Document available on our website www.mahindramanulife.com

Market Capitalization of Manufacturing Theme3 :

LARGE CAP: Rs. 111.4 Trillion | MIDCAP: Rs. 36.3 Trillion | SMALL CAP: Rs. 41.5 Trillion

Source: 1 BSE Thematic Indices Methodology Document published by Asia Index Private Limited (last updated as on 31 March 2023). 2GDP Ratio as on 31st December 2023. GDP data sourced from Press Information Bulletin.

3For the purpose of this data/calculation MarketCapitalization of companies mapped to sectors/industries defined for BSE India Manufacturing Index in the BSE Thematic Indices Methodology Document published by Asia Index Private Limited has been considered. Market Capitalization numbers for the said data are as per AMFI classification list as on 30th June 2024.

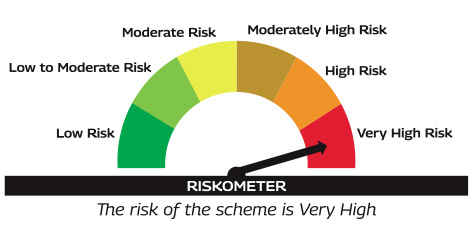

Mahindra Manulife Manufacturing Fund

This product is suitable for investors who are seeking##:

• Long term capital appreciation;

• Investment in equity and equity-related securities of

companies engaged in manufacturing theme.

##Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Get in Touch: Corporate Office: Unit No. 204, 2nd Floor, Amiti Building, Piramal Agastya Corporate Park, LBS Road, Kamani Junction, Kurla (West), Mumbai – 400 070.

☎ 022 6632 7900 / 1800 419 6244 - (Toll Free) Mon-Fri (9AM to 6PM) | ✉ mfinvestors@mahindra.com