MAHINDRA MANULIFE

ULTRA SHORT TERM FUND

(An open ended ultra-short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 to 6 months

(please refer to page no. 31 of SID).

A relatively low interest rate risk and moderate credit risk)

| One Pager | November, 2022 |

- Look to deploy dominant part of the portfolio in AAA rated assets

- Target a portfolio duration of 3 -6 months

- Aim to minimize concentration risk by controlling sector and group exposures

- Hold sizeable part of the portfolio in short tenor securities and other liquid instruments

- Laddered approach to liquidity

- The average maturity of the portfolio is around 118 days

- We will remain in this maturity segment as we move ahead through the next month

- The YTM of the portfolio is around 6.92%

| Asset Class | Proportion | Risk Profile |

| Low/Moderate/High | ||

| Debt* & Money Market instruments | 0-100% | Low to Moderate |

| Units issued by REITs & InvITs | 0-10% | Moderately High |

* Includes securitized debt up to 30% of the net assets of the Scheme and structured

obligations (such as corporate / promoter guarantee, conditional and contingent liabilities,

covenants, pledge and / or Non Disposal Undertaking of shares etc) upto 25% of the net

assets of the Scheme.

Note: For detailed asset allocation pattern, please refer SID/KIM of the Scheme available on

our website www.mahindramanulife.com or visit the nearest ISC.

Entry Load: N.A.

Exit Load: Nil

KEY MARKET INDICATORS

| Parameters | 30-Nov-2022 | 31-Oct-2022 | 30-Nov-21 |

| RBI Repo Rate % | 5.90 | 5.90 | 4.00 |

| 5Y AAA PSU % | 7.46 | 7.65 | 5.97 |

| 1 year CD % | 7.43 | 7.64 | 4.39 |

| 10Y Gsec % | 7.28 | 7.45 | 6.33 |

| CPI (%) | 6.77 | 7.41 | 4.48 |

| IIP (YoY) % | 3.09 | -0.83 | 3.06 |

| US 10Y % | 3.61 | 4.05 | 1.44 |

| Dollar Rupee | 81.43 | 82.79 | 75.17 |

FUND MANAGER : MR. RAHUL PAL

Total Experience : 21 years

Experience in managing this fund:3 years (Managing since October 17, 2019)

FUND MANAGER : MR. AMIT GARG

Total Experience : 17 years

Experience in managing this fund: 2 years and 5 months (Managing since June 8, 2020)

India retail inflation printed at 6.77% along the expected lines. The core inflation continues to remain sticky around 6.30%. With commodities cooling off, we believe inflation can ease and edge closer to the RBI target band.

The Monetary Policy Committee (MPC) of the RBI meets between December 5-7. We expect the MPC to hike rates between 25-35 basis points. What may be of interest is whether the MPC takes cognizance of the softening in the commodities prices and crude prices and make policy moves data dependent. We think the domestic rate cycle is close to its peak. While RBI may have a bit more rate hike cycle up its sleeve, the markets have largely priced in such rate hikes. With RBI projecting an inflation of 5% in the second quarter of fiscal 2024, the time is now apt for looking into fixed income products across all duration segments. With commodity prices, barring crude, softening through the past 3 months; we think a sustained commodity slowdown may provide a respite to the retail inflation.

Data as on 30 November, 2022 | Data source: Bloomberg

Note: The data/statistics given above are to explain general market trends in the securities market, it should not be construed as any research report/research recommendation.

| CURRENT MONTH NOVEMBER 30, 2022 |

|

| AUM (Rs. In Crore) | 189.33 |

| Monthly AAUM (Rs. In Crore) | 187.63 |

| Avg. Maturity (Days) | 117.58 |

| Modified Duration | 0.30 |

| Macaulay Duration (Days) | 115.62 |

| YTM (%) | 6.92% |

| PREVIOUS MONTH OCTOBER 31, 2022 |

|

| AUM (Rs. In Crore) | 176.71 |

| Monthly AAUM (Rs. In Crore) | 176.35 |

| Avg. Maturity (Days) | 139.41 |

| Modified Duration | 0.36 |

| Macaulay Duration (Days) | 137.28 |

| YTM (%) | 7.14 |

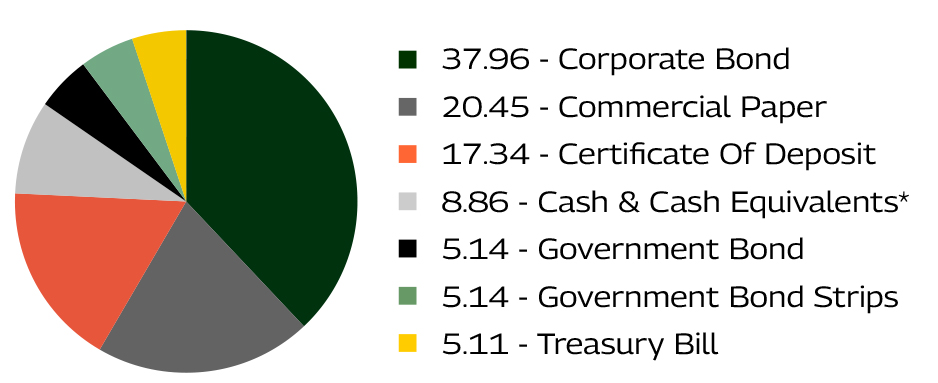

*Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS

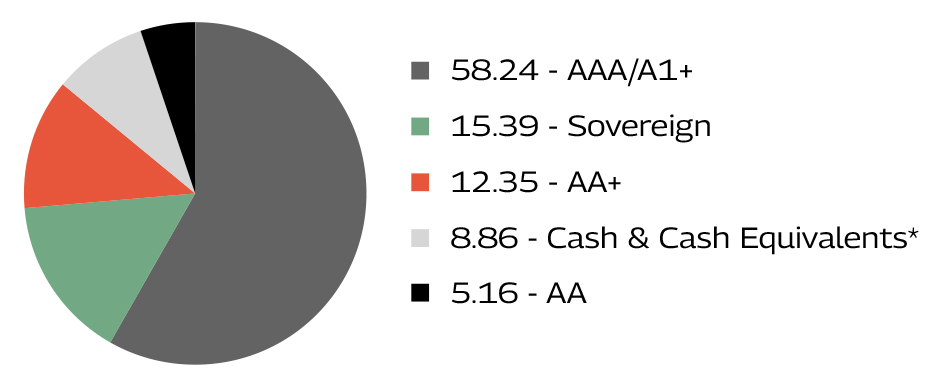

*Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS

| CURRENT MONTH NOVEMBER 30, 2022 | |

| Security | % to N.A. |

| Tata Power Company Limited (FITCH AA rated CB) | 5.16% |

| Godrej Properties Limited (ICRA A1+ rated CP) | 5.15% |

| Reliance Jio Infocomm Limited (CRISIL A1+ rated CP) | 5.14% |

| Government of India (SOV) | 5.14% |

| JM Financial Services Limited (CRISIL A1+ rated CP) | 5.14% |

| Indian Railway Finance Corporation Limited (CRISIL AAA rated CB) | 5.14% |

| TATA Realty & Infrastructure Limited (ICRA AA+ rated CB) | 5.13% |

| Canara Bank (CRISIL A1+ rated CD) | 5.11% |

| Housing & Urban Development Corporation Limited (ICRA AAA rated CB) | 5.09% |

| National Bank For Agriculture and Rural Development (CRISIL AAA / ICRA AAA rated CB) | 5.08% |

| TOTAL | 51% |

| PREVIOUS MONTH OCTOBER 31, 2022 | |

| Security | % to N.A. |

| Bajaj Housing Finance Limited (CRISIL AAA rated CB) | 5.66% |

| Indian Railway Finance Corporation Limited (CRISIL AAA rated CB) | 5.64% |

| TATA Realty & Infrastructure Limited (ICRA AA+ rated CB) | 5.63% |

| Godrej Properties Limited (ICRA A1+ rated CP) | 5.63% |

| Government of India (SOV) | 5.62% |

| Reliance Jio Infocomm Limited (CRISIL A1+ rated CP) | 5.62% |

| JM Financial Services Limited (CRISIL A1+ rated CP) | 5.61% |

| Canara Bank (CRISIL A1+ rated CD) | 5.59% |

| Housing & Urban Development Corporation Limited (ICRA AAA rated CB) | 5.59% |

| National Bank For Agriculture and Rural Development (CRISIL AAA / ICRA AAA rated CB) | 5.57% |

| TOTAL | 56% |

| FRESH ADDITIONS | COMPLETE EXITS |

| Security | Security | Bank of Baroda (CD) | Bajaj Housing Finance Limited (CB) | Motilal Oswal Financial Services Limited (CP) | Northern Arc Capital Limited (CP) | Tata Power Company Limited (CB) |

Note: The companies/stock(s) referred above are only for the purpose of disclosure of significant portfolio changes during the month and should not be construed as recommendation to buy/ sell/ hold. The fund manager may or may not choose to hold these companies/stocks, from time to time. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

| SYSTEMATIC INVESTMENT PLAN |

| WITH THIS YOU CAN • Build corpus in the long term • Take advantage of rupee cost averaging • Experience the power of compounding even on small investments |

| CHOICE OF FREQUENCIES • Weekly • Monthly • Quarterly |

| CHOICE OF DATES Any date of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 6 instalments of ₹ 500 each under weekly frequency • 6 instalments of ₹ 500 each under monthly frequency • 4 instalments of ₹ 1500 each under quarterly frequency |

| SYSTEMATIC TRANSFER PLAN |

| WITH THIS YOU CAN • Take measured exposure into a new asset class • Rebalance your portfolio |

| CHOICE OF FREQUENCIES • Daily • Weekly • Monthly • Quarterly |

| CHOICE OF DATES Any date^ of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 6 instalments of ₹500 each under daily, weekly and monthly frequency • 4 instalments of ₹1500 each under quarterly frequency |

| SYSTEMATIC WITHDRAWAL PLAN |

| WITH THIS YOU CAN • Meet regular expenses |

| CHOICE OF FREQUENCIES • Monthly • Quarterly |

| CHOICE OF DATES Any date of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 2 instalments of ₹ 500 each under monthly / quarterly frequency |

^STP can be registered for any date under the monthly and quarterly frequencies and for any business day under the weekly frequency.

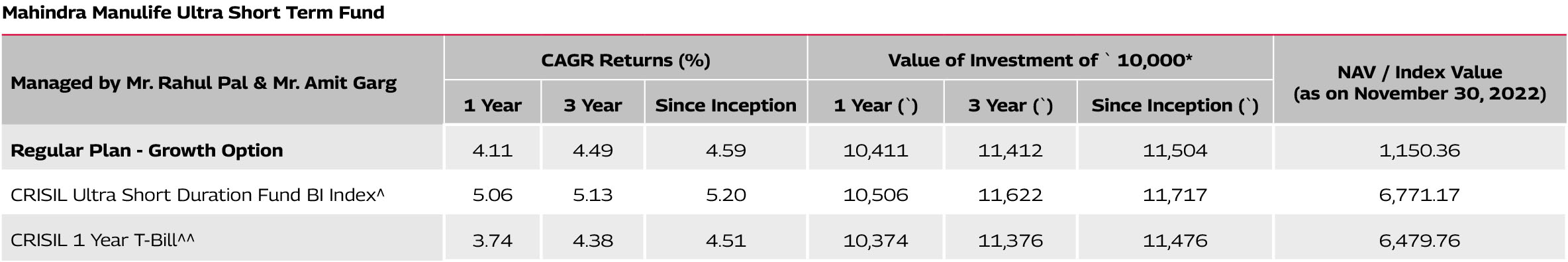

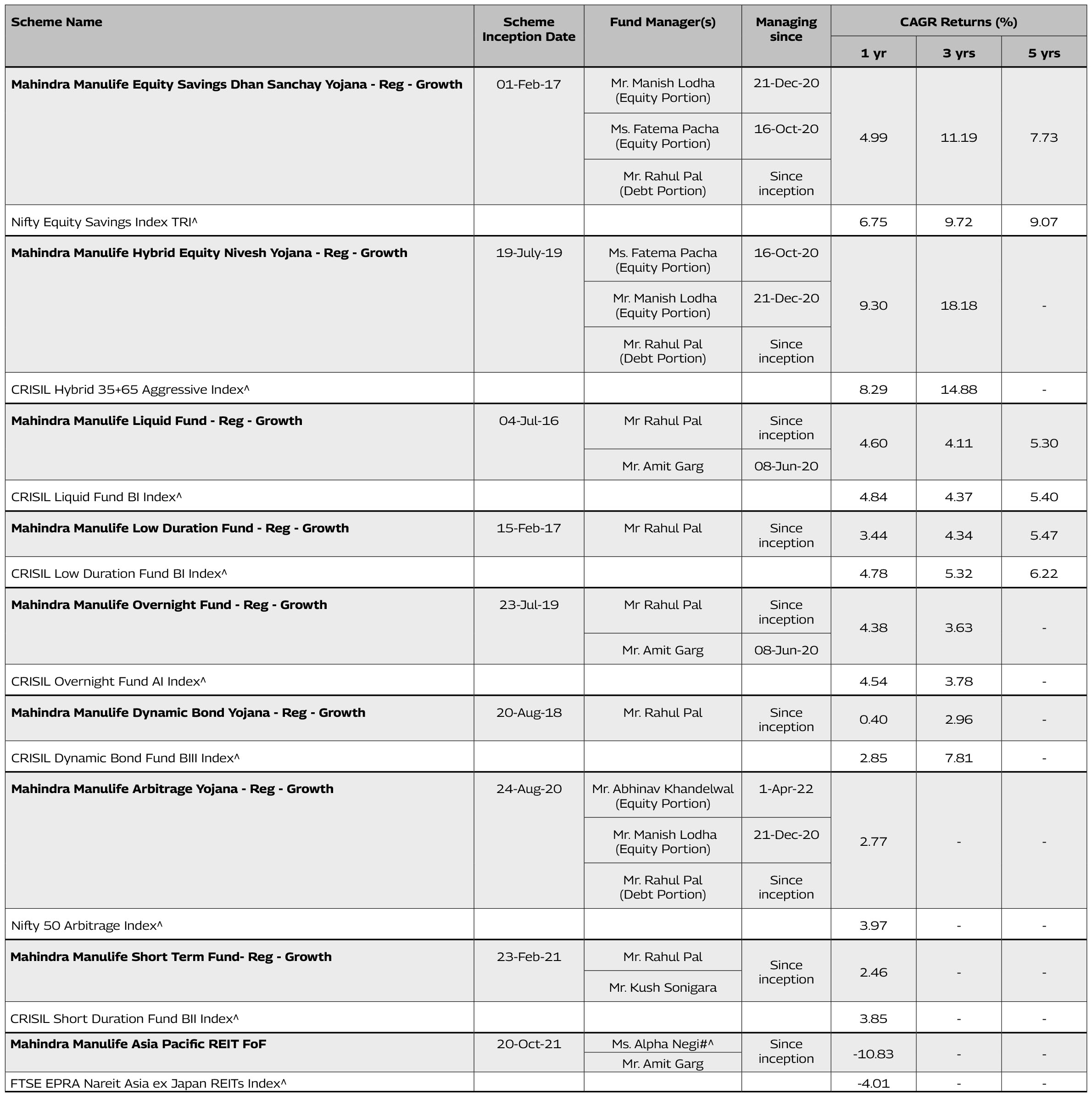

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 17-Oct-19.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 1,000 invested at inception. The performance details provided above are of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. Mr Amit Garg is managing this scheme since June 8, 2020. Performance details of other schemes managed by the Fund Manager(s) is available at the end of the document.

^Benchmark CAGR – Compounded Annual Growth Rate.

#pursuant to change in Fund Management Responsibilities, the scheme shall be managed by Ms. Alpha Negi and Mr. Amit Garg effective November 1, 2022.

^Dedicated Fund Manager for Overseas Investments

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. The performance details provided above are of Growth Option under Regular Plan Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Mr. Rahul Pal manages 10 schemes of

Mahindra Manulife Mutual Fund and Mr. Amit Garg manages 4 schemes of Mahindra Manulife Mutual Fund. The performance data for the schemes which have not completed one year has not been provided.

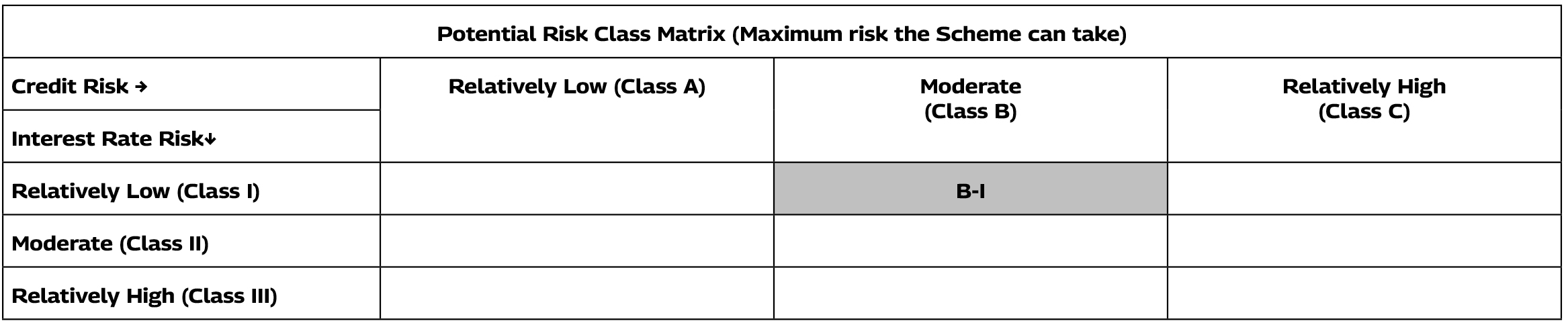

Matrix for debt schemes based on Interest Rate Risk and Credit Risk is as follows:

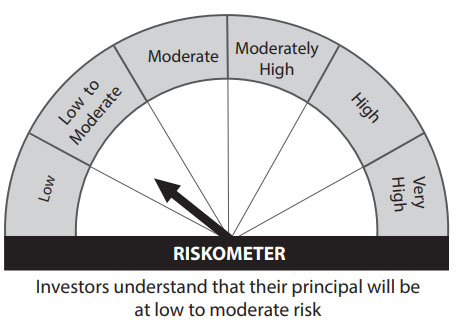

Mahindra Manulife Ultra Short Term Fund

This product is suitable for investors who are seeking*:

• Regular Income over short term.

• Investment in a portfolio of short

term debt and money market

instruments.

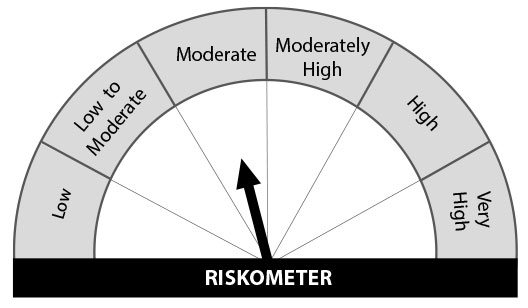

CRISIL Ultra Short Duration Fund BI Index

Benchmark Riskometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Reach us at: Sadhana House, 1st Floor, 570,

P.B. Marg, Worli, Mumbai - 400 018, India.

Phone: +91-22-66327900, Fax: +91-22-66327932

Website: www.mahindramanulife.com