MAHINDRA MANULIFE

BALANCED ADVANTAGE YOJANA

(An open ended dynamic asset allocation fund)

(Scheme Code : MMBAY)

One Pager as on November 30, 2022

| Optimal asset allocation at regular intervals. |

| Aims to capture the optimum mix between Equity and Debt across market cycles. |

| With flexibility to invest upto 100% in equity & debt, the Scheme may be suitable for volatile market conditions. |

| Endeavours to provide tax efficiency* |

*Though the scheme is a dynamic asset allocation scheme, the endeavour will be to invest a minimum of 65% of its net assets in equity and equity related instruments which may help in attracting equity taxation as per prevailing tax laws.

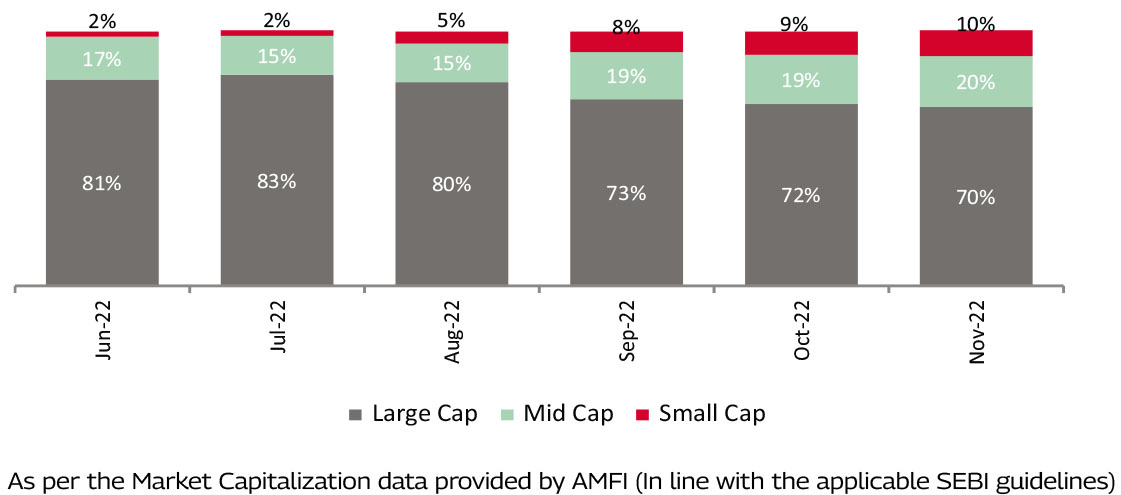

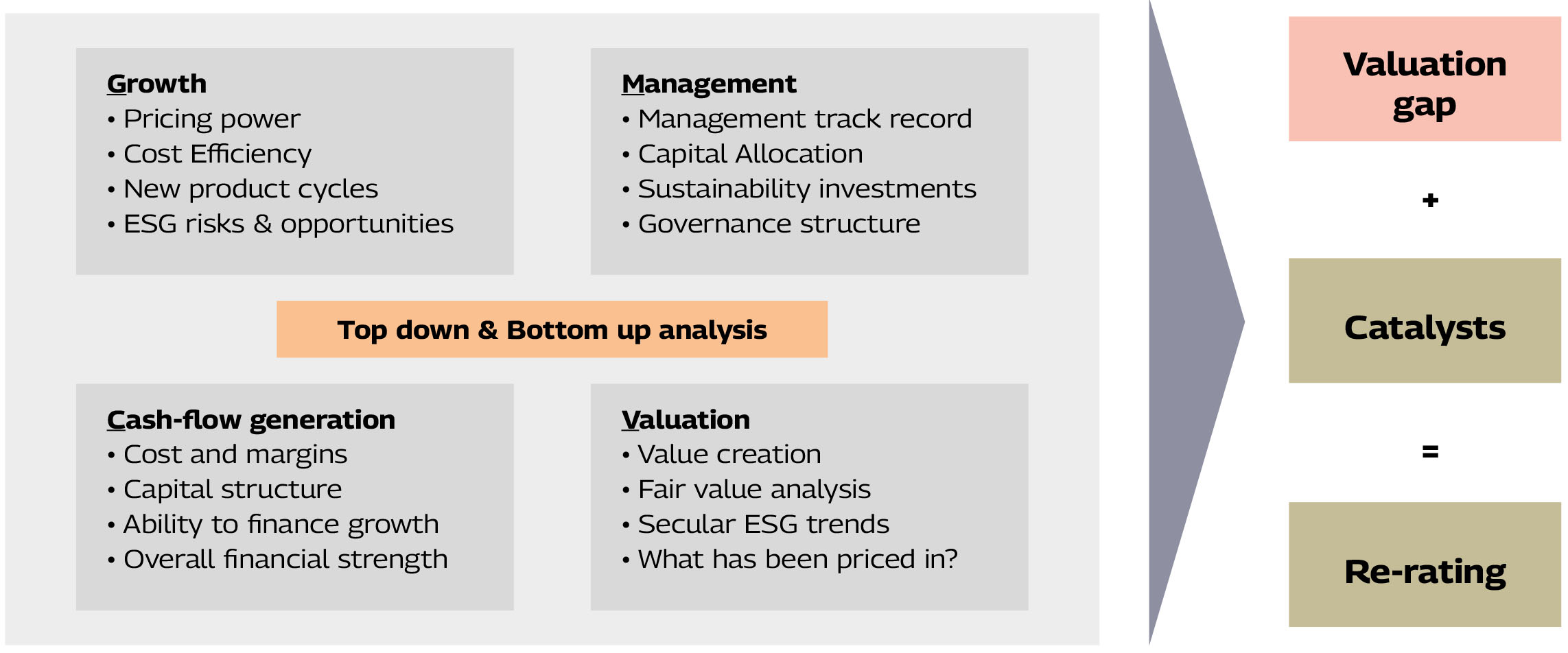

- Portfolio composition would have preference for growth style of investing with large

cap bias.

- Bottom-up approach would be adopted to identify companies that have ability to

scale up, gain market share and/or are present in sunrise/high growth sectors.

- Portfolio composition would have preference for growth style of investing with large cap bias.

- Bottom-up approach would be adopted to identify companies that have ability to scale up, gain market share and/or are present in sunrise/high growth sectors.

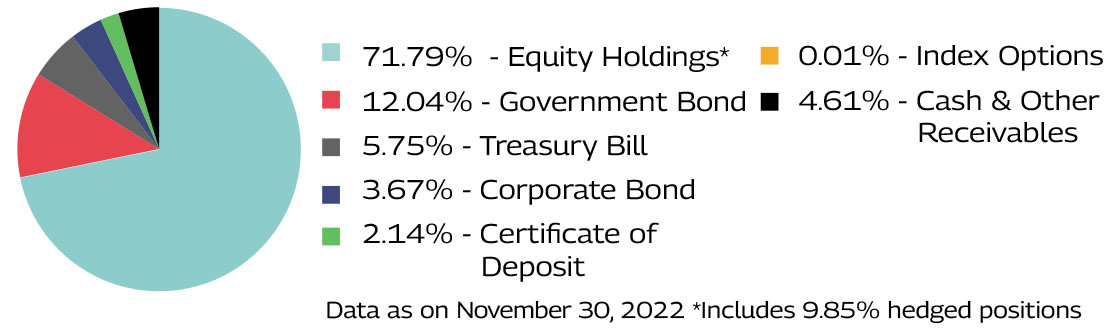

- The Modified duration of the portfolio is around 1.99 years for the debt portion.

- The duration is built through exposure in 10-year/5-year Gilt.

| Sector | MMBAY | Nifty 50 Hybrid Composite Debt 50: 50 Index TRI |

| Financial Services | 20.63% | 37.16% |

| Information Technology | 11.36% | 14.38% |

| Capital Goods | 9.20% | - |

| Construction Materials | 7.26% | 1.78% |

| Healthcare | 4.81% | 3.87% |

Data as on November 30, 2022

| Security | % to Net Assets |

| Infosys Limited* | 6.71% |

| State Bank of India | 4.71% |

| Ambuja Cements Limited* | 4.69% |

| ICICI Bank Limited | 4.43% |

| IndusInd Bank Limited | 2.58% |

| Sun Pharmaceutical Industries Limited | 2.45% |

| Reliance Industries Limited* | 2.39% |

| Bharat Forge Limited | 2.39% |

| Larsen & Toubro Infotech Limited | 2.10% |

| Canara Bank | 2.03% |

| Top 10 Holdings | 34.49% |

| Fresh Additions | Complete Exits |

| Security | Security |

| Cummins India Limited | HDFC Life Insurance Company Limited |

| JK Lakshmi Cement Limited | Housing Development Finance Corporation Limited |

| Kaynes Technology India Limited | LIC Housing Finance Limited |

| Larsen & Toubro Infotech Limited | |

| Steel Authority of India Limited |

Note: The companies/stock(s) referred above are only for the purpose of disclosure of significant portfolio changes during the month and should not be construed as recommendation to buy/sell/ hold. The fund manager may or may not choose to hold these companies/stocks, from time to time. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). Data as on October 31 2022

| Average Maturity^ | 2.80 years* |

| Modified Duration^ | 2.17* |

| Yield to Maturity1^ | 6.76%* |

| Macaulay Duration^ | 2.25 years* |

^For debt component

*Calculated on amount invested in debt securities (including accrued interest), deployment of funds in TREPS and Reverse Repo and net receivable / payable. Data as on November 30, 2022

1Yield to maturity should not be construed as minimum return offered by the Scheme;

The investment objective of the Scheme is to provide capital appreciation and generate income through a dynamic mix of equity, debt and money market instruments. The Scheme seeks to reduce the volatility by diversifying the assets across equity, debt and money market instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved.

Fund Manager:

Mr. Manish Lodha (Equity)

Total Experience : 22 years

Experience in managing this fund: 11 months (Managing since December 30, 2021)

Ms. Fatema Pacha (Equity)

Total Experience : 17 years,

Experience in managing this fund: 11 months (managing since December 30, 2021)

Mr. Rahul Pal (Debt)

Total Experience : 21 years,

Experience in managing this fund: 11 months (Managing since December 30, 2021)

Date of allotment: December 30, 2021

Benchmark: Nifty 50 Hybrid Composite Debt 50: 50 Index TRI

Option: IDCW and Growth (D)

D-Default

IDCW Sub-options: IDCW Reinvestment (D) & IDCW Payout

Minimum Application Amount: Rs. 1,000 and in multiples of Re. 1/- thereafter

Minimum Redemption/Switch-Out Amount: Rs. 1,000/- or 100 units or account balance, whichever is lower

Minimum Weekly & Monthly SIP Amount: Rs 500 and in multiples of Re. 1/- thereafter

Minimum Weekly & Monthly SIP Installments: 6

Monthly AAUM as on November 30, 2022 (Rs. in Cr.): 682.02

Monthly AUM as on November 30, 2022 (Rs. In Cr.): 678.28

Entry Load: Not applicable

Exit Load: 10% of the units allotted shall be redeemed without any exit load, on or before completion of 3 months from the date of allotment of Units. Any redemption in excess of the above limit shall be subject to the following exit load:

• An Exit Load of 0.5% is payable if Units are redeemed / switched-out on or before completion of 3 months from the date of allotment of Units;

• Nil - If Units are redeemed / switched-out after completion of 3 months from the date of allotment of Units.

Redemption /Switch-Out of Units would be done on First in First out Basis (FIFO).

For illustrative purposes only

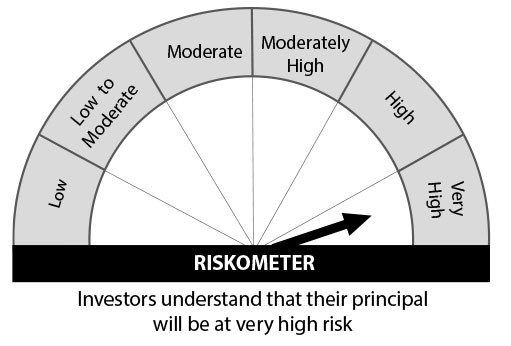

Mahindra Manulife Balanced Advantage Yojana

This product is suitable for investors who are seeking*:

• Capital Appreciation while generating

income over medium to long term;

• Investments in a dynamically

managed portfolio of equity and

equity related instruments and debt

and money market instruments.

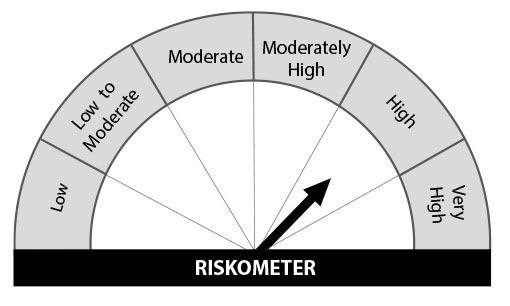

Nifty 50 Hybrid Composite Debt 50: 50 Index TRI

Benchmark Riskometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Reach us at: Sadhana House, 1st Floor, 570,

P.B. Marg, Worli, Mumbai - 400 018, India.

Phone: +91-22-66327900, Fax: +91-22-66327932

Toll Free No.: 1800 419 6244

Website: www.mahindramanulife.com