Mahindra Manulife

Multi Asset Allocation Fund

(An open ended scheme investing in Equity, Debt, Gold/Silver Exchange Traded Funds (ETFs) and Exchange Traded Commodity Derivatives)

One Pager as on March 31, 2024

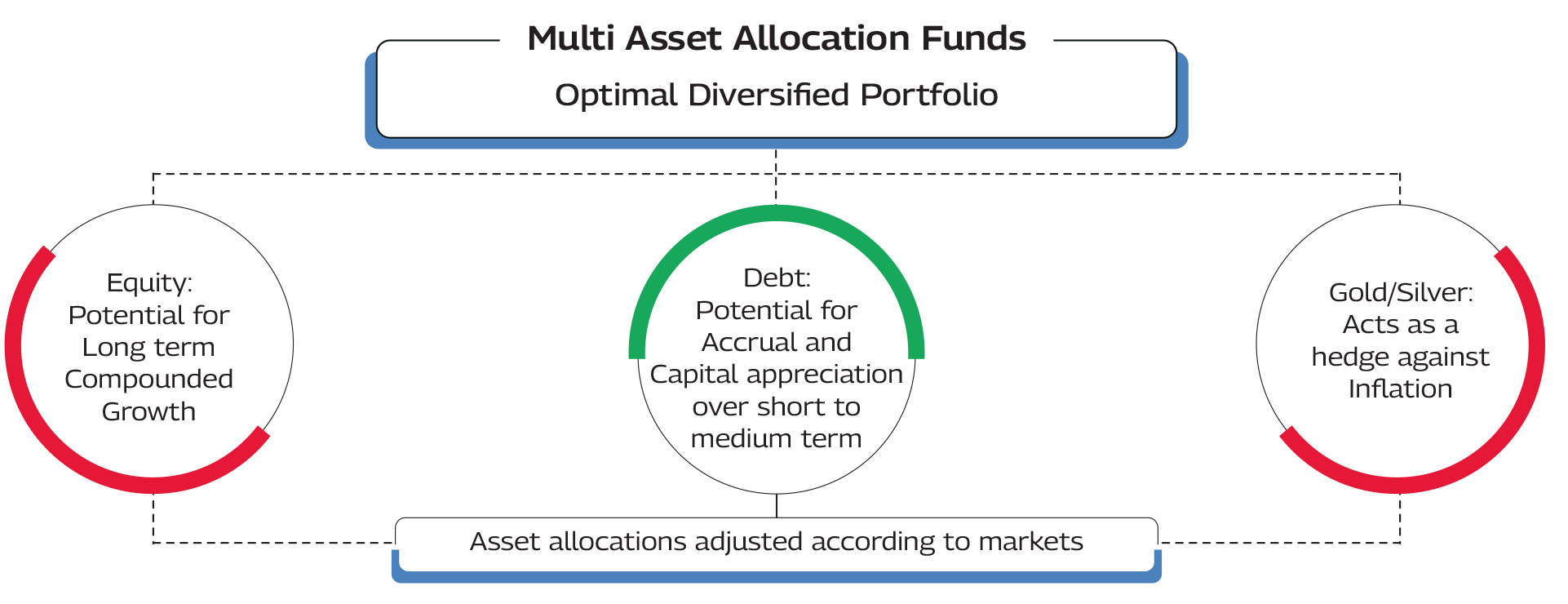

| Different asset classes performs at different points in time |

| Reduce dependency on a single asset class |

| Helps to mitigate volatility of portfolio returns |

| Asset Allocation shall be rebalanced regularly by fund managers based on evolving market dynamics |

| Diversified Portfolio that aims to combine stability of fixed income, growth potential of equity and tactical exposure to gold/silver |

| Provides investors with an opportunity for long term capital gains taxation with the benefit of indexation$ |

**Units of Gold/Silver ETFs & other Gold and Silver instruments (including Exchange traded commodity derivative (ETCDs) as permitted by SEBI from time to time.

| Performance above 6% | Performance above 8% | Performance above 10% | Performance above 12% | |

| Composite Portfolio | 95% | 83% | 61% | 44% |

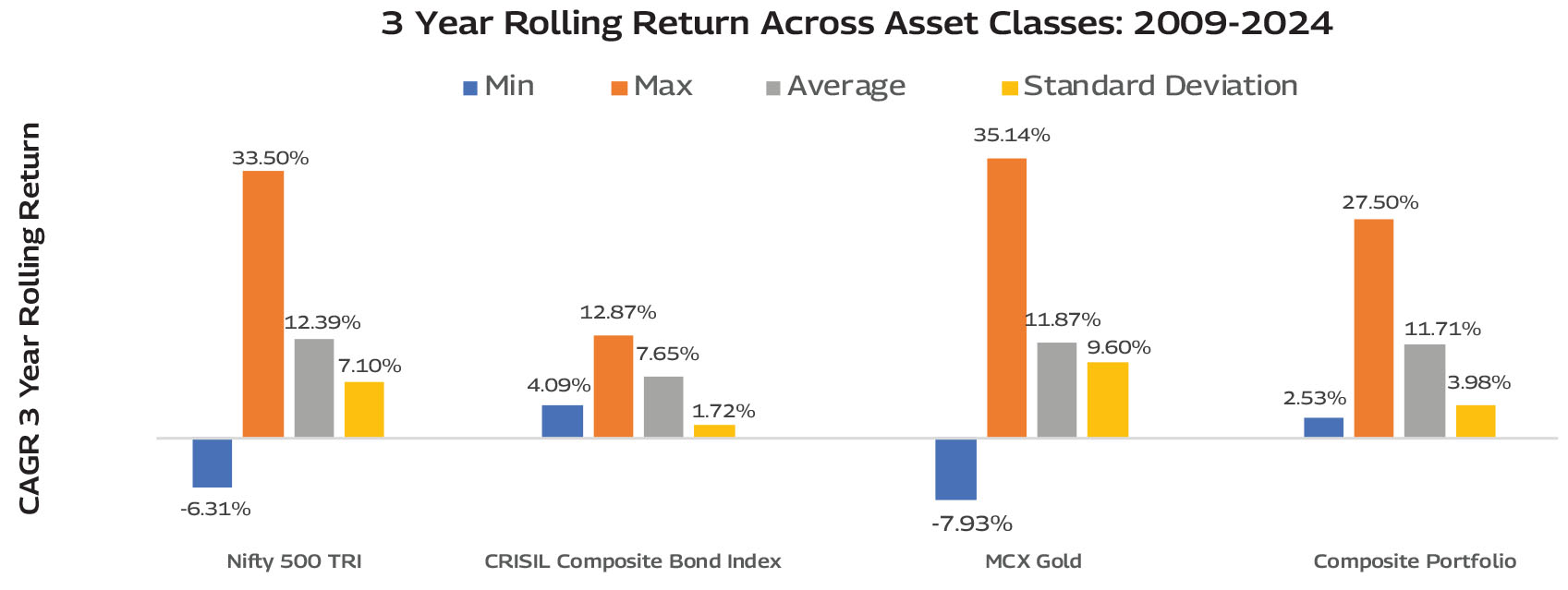

Historical data shows that a diversified portfolio of equity, debt and gold asset classes offers a balanced combination of returns that helps mitigate losses. The Composite portfolio exhibits

a notably lower level of volatility as measured by standard deviation compared to Equity and Gold.

Note : Data period: 31st Mar 2006 - 28th Mar 2024. Returns are CAGR calculated on a 3-year rolling basis for every day for the period 31-Mar-2009-28-Mar-2024. The data provided above is for illustrative

purpose only and should not be construed as a promise on minimum returns and safeguard of capital. Mahindra Manulife Investment Management Private Limited/Mahindra Manulife Mutual Fund is not

guaranteeing or forecasting any returns. Past performance may or may not be sustained in future. *Internally defined threshold for illustrative purpose only to explain the concept of diversification of

asset classes using the composite portfolio. The Composite portfolio is used for illustrative purposes to explain diversification of asset classes.

Source: Bloomberg/MCX/MFI Explorer;

| Instruments | Indicative Allocation (% of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity and Equity related instruments ^* | 35 | 80 | High |

| Debt and Money Market Securities# (including TREPS (Tri-Party Repo) and Reverse Repo in Government Securities) | 10 | 55 | Low to Moderate |

| Units of Gold/Silver ETFs & other Gold and Silver related instruments (including Exchange Traded Commodity Derivatives (ETCDs) as permitted by SEBI from time to time% | 10 | 30 | Moderately High |

| Units issued by REITs & InvITs | 0 | 10 | Moderately High |

%including through ETCDs and/or any other mode of investment in commodities (apart from Gold and Silver), as permitted by SEBI from time to time.

^ including derivative instruments to the extent of 50% of the equity component of the Scheme.

Investment in derivatives shall be for hedging, portfolio balancing and such other purposes as maybe permitted from time to time under the Regulations and subject to guidelines issued by SEBI/RBI from time to time. The Scheme may utilize the entire

available equity derivatives exposure limit as provided above, for hedging purpose. However, the equity derivatives exposure towards non-hedging purpose shall not exceed 20% of the net assets of the Scheme, subject to maximum derivatives exposure

as defined above (i.e. 50% of the equity component of the Scheme). The margin money deployed on derivative positions would be included in the Debt and Money Market Securities category.

*The Scheme may invest in Foreign Securities (including Overseas ETFs) up to 20% of the net assets of the Scheme in compliance with clause 12.19 of the SEBI Master Circular pertaining to overseas investments by mutual funds, as amended from

time to time. Further, the Scheme intends to invest US$ 10 million in Overseas securities and US$ 5 million in Overseas ETFs within six months from the date of the closure of the New Fund Offer (NFO) of the Scheme. Thereafter, the Scheme shall

invest in Foreign Securities (including Overseas ETFs) as per the limits available to ‘Ongoing Schemes’ in terms of clause 12.19.1.3.c of the SEBI Master Circular. Further, SEBI vide its clause 12.19.1.3.d of the SEBI Master Circular, clarified that the

above specified limit would be considered as soft limit(s) for the purpose of reporting only by mutual funds on monthly basis in the format prescribed by SEBI. #Money Market instruments includes commercial papers, commercial bills, treasury bills,

Government securities having an unexpired maturity up to one year, call or notice money, certificate of deposit, usance bills, and any other like instruments as specified by the Reserve Bank of India from time to time.

For detailed asset allocation, please refer SID/KIM available on our website www.mahindramanulife.com

The investment objective of the Scheme is to seek to generate long-term capital appreciation and income by investing in equity and equity related securities, debt & money market instruments, Gold/Silver ETFs and Exchange Traded Commodity Derivatives (ETCDs) as permitted by SEBI from time to time. However, there can be no assurance that the investment objective of the Scheme will be achieved

Date of allotment: March 13, 2024

Benchmark: 45% NIFTY 500 TRI + 40% CRISIL Composite Bond Index + 10% Domestic Price of Physical Gold + 5% Domestic Price of Silver (First Tier Benchmark)

Plans: Regular & Direct

Option: GrowthΦ; IDCW ϻ

IDCW Sub-options: IDCW ReinvestmentΦ & IDCW Payout

Fund Manager:

Mr. Renjith Sivaram Radhakrishnan (Equity)

Mr. Rahul Pal (Debt)

Mr. Pranav Nishith Patel (Dedicated Fund Manager for Overseas Investments)

Minimum Application Amount (Lumpsum): ₹ 1,000 and in multiples of ₹ 1/- thereafter

Minimum Amount for Switch in: ₹ 1,000/- and in multiples of ₹ 0.01/- thereafter.

Minimum Application Amount (SIP) forweekly and monthly frequencies: 6 installments of ₹ 500 /- each and in multiples of ₹ 1/- thereafter

Minimum Application Amount (SIP) for quarterly frequency 4 installments of ₹ 1,500/- each and in multiples of ₹ 1/- thereafter

Entry Load: Not applicable

Exit Load: - An Exit Load of 0.5% is payable if Units are redeemed / switched-out up to 3 months from the date of allotment;

- Nil if Units are redeemed / switched-out after 3 months from the date of allotment.

Redemption /Switch-Out of Units would be done on First in First out Basis (FIFO).

ϻ IDCW: Income Distribution cum Capital Withdrawal

Φ Default Option

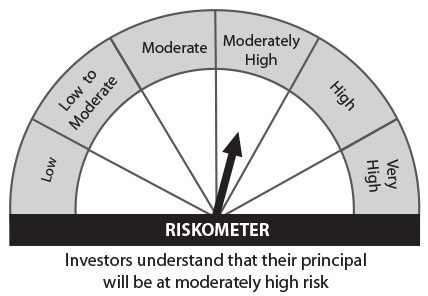

Mahindra Manulife Multi Asset Allocation Fund

This product is suitable for investors who are seeking##

• Capital Appreciation while generating income over long term;

• Investments across equity and equity related instruments,

debt and money market instruments, units of Gold/Silver

Exchange Traded Funds (ETFs) and Exchange Traded

Commodity Derivatives.

##Investor should consult their financial advisers if in doubt about whether the product is suitable for them.

***The product labelling /risk level assigned for the Scheme during the New Fund Offer is based on internal assessment of the Scheme’s characteristics or model portfolio and the same may vary post New Fund Offer when the actual investments are made.

Get in Touch: Unit No. 204, 2nd Floor, Amiti Building,

Piramal Agastya Corporate Park, LBS Road,

Kamani Junction, Kurla (W), Mumbai – 400 070.

Phone: +91-22-66327900, Fax: +91-22-66327932

Toll Free No.: 1800 419 6244

Website: www.mahindramanulife.com

@Units of Gold/Silver ETFs & other Gold and Silver instruments (including Exchange

traded commodity derivative (ETCDs) as permitted by SEBI from time to time).