Mahindra Manulife

Balanced Advantage Fund

(An open ended dynamic asset allocation fund)

One Pager as on March 31, 2023

| Optimal asset allocation at regular intervals. |

| Aims to capture the optimum mix between Equity and Debt across market cycles. |

| With flexibility to invest upto 100% in equity & debt, the Scheme may be suitable for volatile market conditions. |

| Endeavours to provide tax efficiency* |

*Though the scheme is a dynamic asset allocation scheme, the endeavour will be to invest a minimum of 65% of its net assets in equity and equity related instruments which may help in attracting equity taxation as per prevailing tax laws.

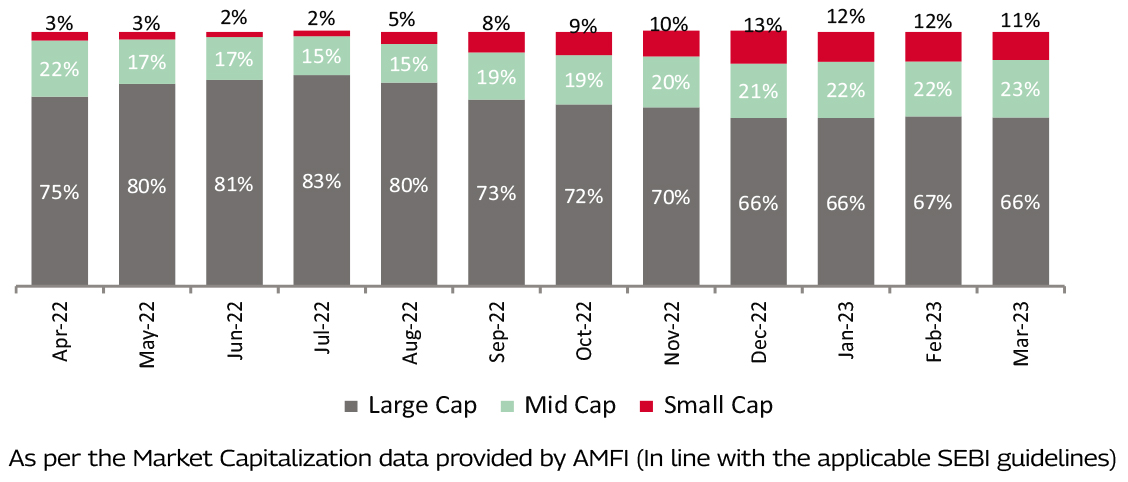

- Portfolio composition would have preference for growth style of investing with large

cap bias.

- Bottom-up approach would be adopted to identify companies that have ability to

scale up, gain market share and/or are present in sunrise/high growth sectors.

- Key Overweight sector/Industries includes Capital Goods, IT, Construction Materials and Telecom.

- Key Underweights sectors /Industries includes Banks, FMCG and Automobile and Auto Components.

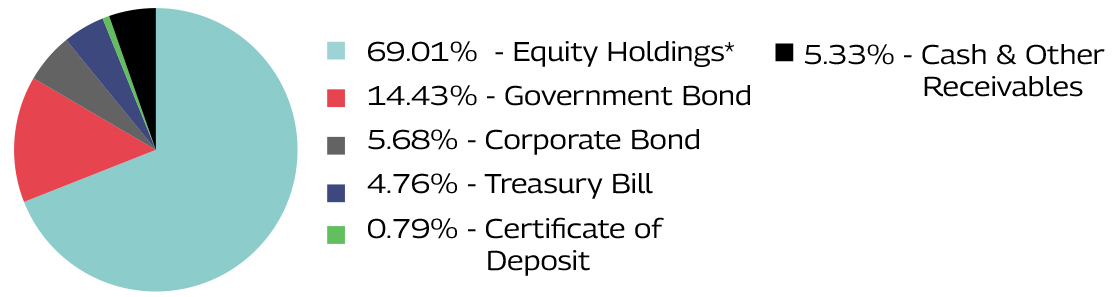

- Portfolio is 60% invested in Equities

Data as on March 31, 2023 *Includes 9.16% hedged positions

| Sector | MMBAF | Nifty 50 Hybrid Composite Debt 50: 50 Index TRI |

| Financial Services | 19.67% | 37.72% |

| Information Technology | 12.85% | 14.11% |

| Capital Goods | 6.80% | - |

| Oil Gas & Consumable Fuels | 6.69% | 12.14% |

| Construction Materials | 4.63% | 1.94% |

Data as on March 31, 2023

| Security | % to Net Assets |

| Infosys Limited | 6.70% |

| HDFC Bank Limited | 6.51% |

| Reliance Industries Limited | 6.03% |

| Tech Mahindra Limited | 3.83% |

| ICICI Bank Limited | 2.39% |

| Ambuja Cements Limited | 2.19% |

| IndusInd Bank Limited | 1.99% |

| LTIMindtree Limited | 1.86% |

| Sun Pharmaceutical Industries Limited | 1.86% |

| State Bank of India | 1.84% |

| Total | 35.20% |

| Fresh Additions | Complete Exits |

| Security | Security |

| Apollo Pipes Limited | DLF Limited |

| Ingersoll Rand (India) Limited | Harsha Engineers International Limited |

| Zee Entertainment Enterprises Limited | Jindal Stainless (Hisar) Limited |

Note: The companies/stock(s) referred above are only for the purpose of disclosure of significant portfolio changes during the month and should not be construed as recommendation to buy/sell/ hold. The fund manager may or may not choose to hold these companies/stocks, from time to time. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). Data as on February 28, 2023

| Annualised Portfolio YTM*1^ | 7.32%2 |

| Macaulay Duration^ | 2.79 years2 |

| Modified Duration^ | 2.692 |

| Residual Maturity^ | 3.55 years2 |

| Portfolio Turnover Ratio (Last 1 year) | 2.60 |

| As on (Date) | March 31, 2023 |

*In case of semi annual YTM, it will be annualised

^For debt component

1Yield to maturity should not be construed as minimum return offered by the Scheme;

2Calculated on amount invested in debt securities (including accrued interest), deployment of funds in TREPS and Reverse Repo and net receivable / payable. Data as on March 31, 2023

The investment objective of the Scheme is to provide capital appreciation and generate income through a dynamic mix of equity, debt and money market instruments. The Scheme seeks to reduce the volatility by diversifying the assets across equity, debt and money market instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved.

Fund Manager:

Mr. Manish Lodha (Equity)

Total Experience : 22 years

Experience in managing this fund:1 Year and 3 months (Managing since December 30, 2021)

Ms. Fatema Pacha (Equity)

Total Experience : 17 years,

Experience in managing this fund: 1 Year and 3 months (managing since December 30, 2021)

Mr. Rahul Pal (Debt)

Total Experience : 21 years,

Experience in managing this fund: 1 Year and 3 months (Managing since December 30, 2021)

Date of allotment: December 30, 2021

Benchmark: Nifty 50 Hybrid Composite Debt 50: 50 Index TRI

Option: IDCW and Growth (D)

D-Default

IDCW Sub-options: IDCW Reinvestment (D) & IDCW Payout

Minimum Application Amount: Rs. 1,000 and in multiples of Re. 1/- thereafter

Minimum Redemption/Switch-Out Amount: Rs. 1,000/- or 100 units or account balance, whichever is lower

Minimum Weekly & Monthly SIP Amount: Rs 500 and in multiples of Re. 1/- thereafter

Minimum Weekly & Monthly SIP Installments: 6

Monthly AAUM as on March 31, 2023 (Rs. in Cr.): 612.60

Quartely AAUM as on March 31, 2023 (Rs. in Cr.): 632.20

Monthly AUM as on March 31, 2023 (Rs. In Cr.): 614.17

Entry Load: Not applicable

Exit Load: 10% of the units allotted shall be redeemed without any exit load, on or before completion of 3 months from the date of allotment of Units. Any redemption in excess of the above limit shall be subject to the following exit load:

• An Exit Load of 0.5% is payable if Units are redeemed / switched-out on or before completion of 3 months from the date of allotment of Units;

• Nil - If Units are redeemed / switched-out after completion of 3 months from the date of allotment of Units.

Redemption /Switch-Out of Units would be done on First in First out Basis (FIFO).

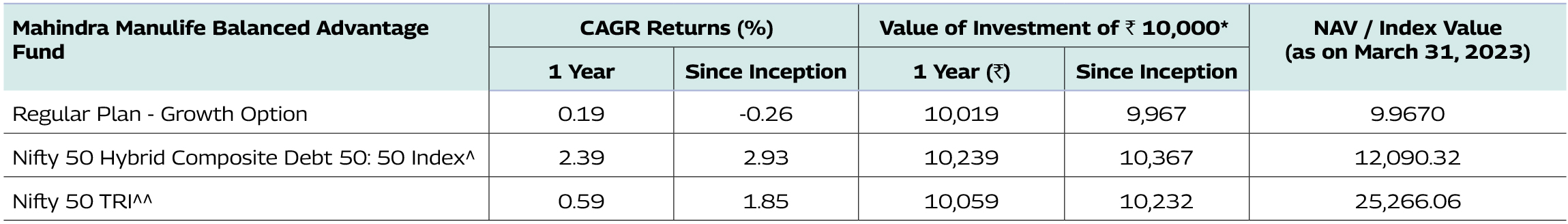

^Benchmark ^^Additional Benchmark. Inception/Allotment date: 30-Dec-21.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments.

Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period.

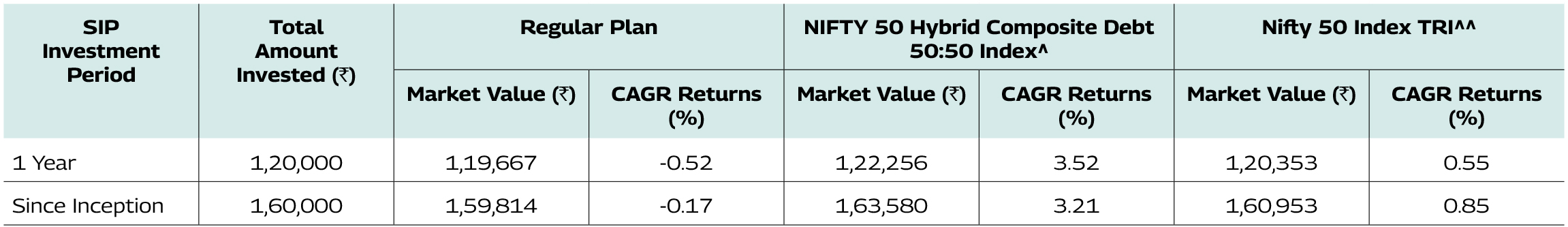

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 30-December-21.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Returns greater than 1 year period are compounded annualized. For SIP returns, monthly investment of equal amounts invested on the 1st business day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return).

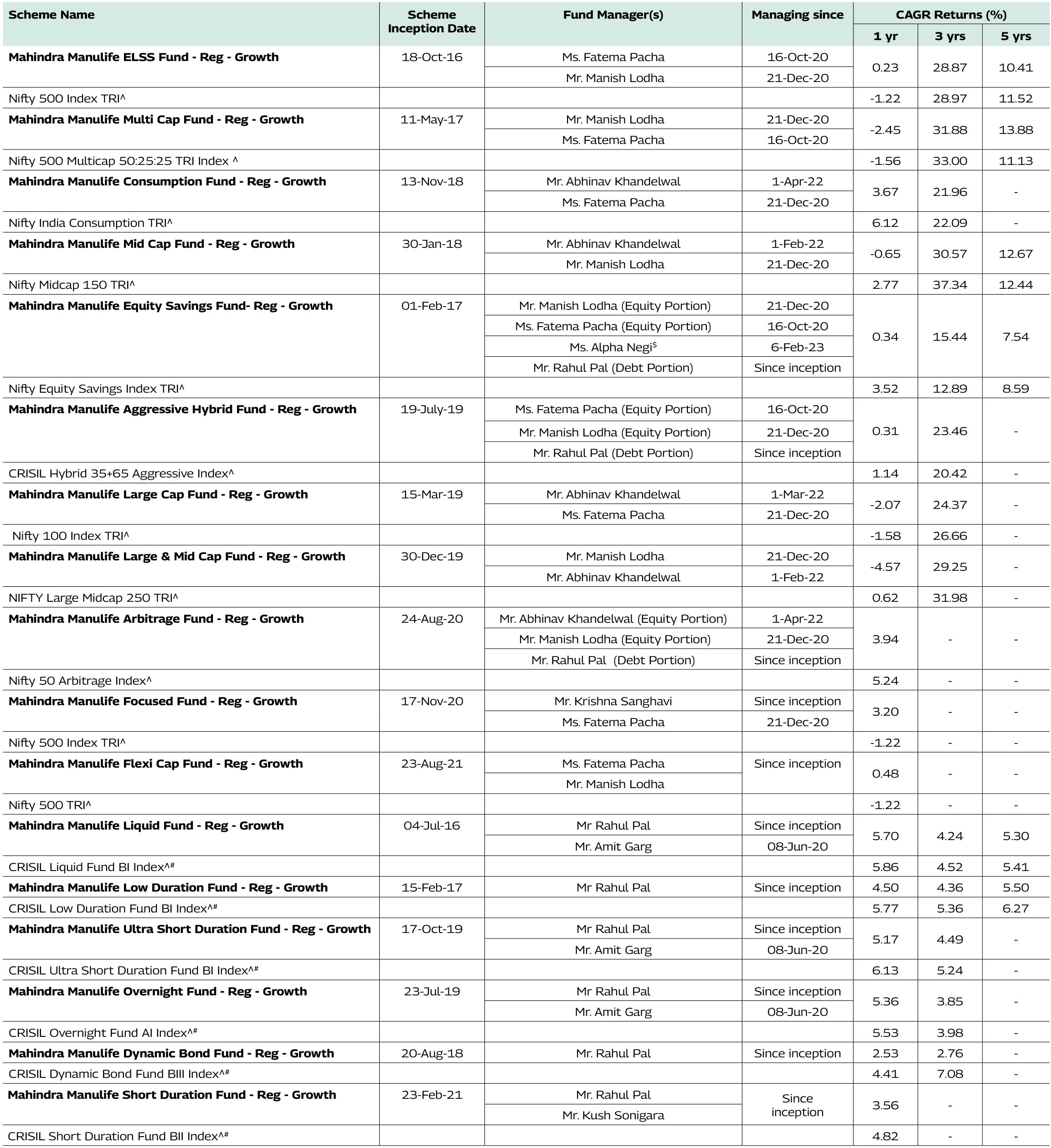

^Benchmark CAGR – Compounded Annual Growth Rate. $Dedicated Fund Manager for Overseas Investments.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. The performance details provided above are of Growth Option under Regular Plan Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Mr. Rahul Pal manages 10 schemes, Mr. Manish Lodha manages 10 schemes and Ms. Fatema Pacha manages 9 schemes each of Mahindra Manulife Mutual Fund. The performance data for the schemes which have not completed one year has not been provided.

Note: #With effect from April 3, 2023 the benchmark of Mahindra Manulife Liquid Fund has been changed to CRISIL Liquid Debt B-I Index. #With effect from April 3, 2023 the

benchmark of Mahindra Manulife Low Duration Fund has been changed to CRISIL Low Duration Debt B-I. #With effect from April 3, 2023 the benchmark of Mahindra Manulife Dynamic

Bond Fund has been changed to CRISIL Dynamic Bond B-III Index. #With effect from April 3, 2023 the benchmark of Mahindra Manulife Overnight Fund has been changed to CRISIL

Liquid Overnight Index. #With effect from April 3, 2023 the benchmark of Mahindra Manulife Ultra Short Duration Fund has been changed to CRISIL Ultra Short Duration Debt B-I

Index. #With effect from April 3, 2023 the benchmark of Mahindra Manulife Short Duration Fund has been changed to CRISIL Short Duration Debt B-II Index.

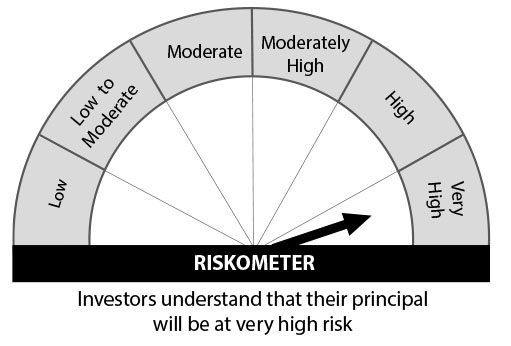

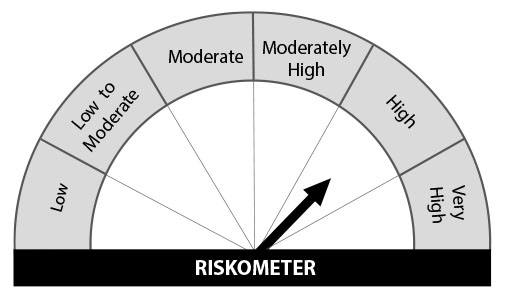

Mahindra Manulife Balanced Advantage Fund

This product is suitable for investors who are seeking*:

• Capital Appreciation while generating

income over medium to long term;

• Investments in a dynamically

managed portfolio of equity and

equity related instruments and debt

and money market instruments.

Nifty 50 Hybrid Composite Debt 50: 50 Index TRI

Benchmark Riskometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Get in Touch: Sadhana House, 1st Floor, 570,

P.B. Marg, Worli, Mumbai - 400 018, India.

Phone: +91-22-66327900, Fax: +91-22-66327932

Toll Free No.: 1800 419 6244

Website: www.mahindramanulife.com