Mahindra Manulife

Small Cap Fund

(An open ended equity scheme predominantly investing in small cap stocks)

One Pager as on July 31, 2023

| Potential growth tailwinds in Indian Economy. |

| Opportunity to capitalize on Indian Entrepreneurship. |

| Opportunity to capture market / economic cycles. |

| Potential to create wealth and generate alpha over long-term. |

| Small caps are generally under-researched and under-owned and hence provides an opportunity for stock-picking at reasonable valuations. |

| Small Caps could be beneficiaries of structural reforms announced from time to time. |

| Small caps also provide exposure to companies which are potential market leaders in the industries they operate in (a few examples include textile, paper, sugar, luggage) and have potential to become midcaps of tomorrow as they achieve scale |

| Strong Financials and cashflows |

| Reasonable valuations |

| Scalable Business model |

| Emerging Business models |

| Management track record |

| Global trends |

- Portfolio construction on bottom up stock selection basis.

- Key Overweight sector/Industries includes Capital Goods , Metals & Mining and FMCG vs the Schemes’ Benchmark.

- Key Underweights sectors /Industries includes Chemicals, IT and Healthcare vs the Schemes’ Benchmark.

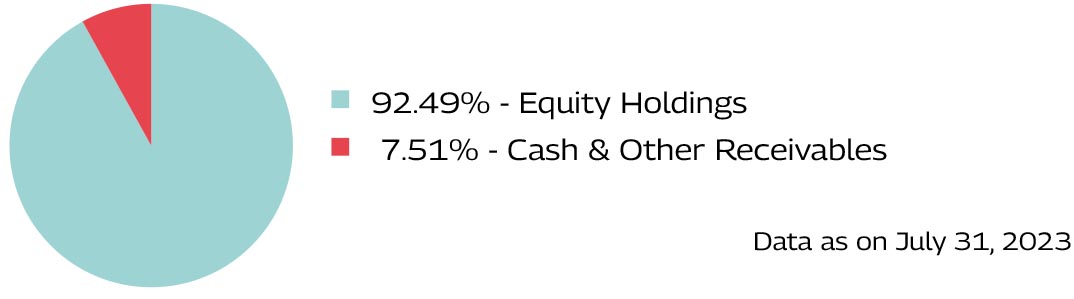

- Carrying Higher cash levels around 7.5% in the portfolio as tight monetary policy in India may continue a bit longer than expected, following higher global policy rates and upside risks to domestic inflation.

| Instruments | Indicative Allocation

(%of net assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity & Equity related instruments of Small Cap Companies# | 65% | 100% | Very High |

| Equity & Equity related instruments of other than Small Cap Companies | 0% | 35% | Very High |

| Debt and Money Market Securities (including TREPS (Tri-Party Repo), Reverse Repo) | 0% | 35% | Low to Moderate |

| Units issued by REITs & InvITs | 0% | 10% | Moderately High |

The Scheme may take exposure in equity derivative instruments to the extent of 50% of the Equity

component. Investment in derivatives shall be for hedging, portfolio balancing and such other purposes

as maybe permitted from time to time under the Regulations and subject to guidelines issued by SEBI/

RBI from time to time.

#Definition of Small Cap Companies: 251st company onwards in terms of full Market Capitalization.

| Security | % to Net Assets |

| Birlasoft Limited | 2.82% |

| REC Limited | 2.82% |

| CIE Automotive India Limited | 2.61% |

| Jindal Stainless Limited | 2.50% |

| Birla Corporation Limited | 2.37% |

| Exide Industries Limited | 2.35% |

| HDFC Bank Limited | 2.34% |

| Triveni Engineering & Industries Limited | 2.31% |

| Kirloskar Brothers Limited | 2.25% |

| Mrs. Bectors Food Specialities Limited | 2.14% |

| Total | 24.51% |

| Sector | MMSCF | S&P BSE 250 Small Cap TRI |

| Capital Goods | 20.85% | 15.35% |

| Financial Services | 17.73% | 17.66% |

| Fast Moving Consumer Goods | 7.65% | 4.54% |

| Automobile And Auto Components | 7.35% | 4.25% |

| Metals & Mining | 6.19% | 2.44% |

Data as on July 31, 2023

The investment objective of the Scheme is to generate long term capital appreciation by investing in a diversified portfolio of equity & equity related securities of small cap companies, However, there can be no assurance that the investment objective of the Scheme will be achieved.

Fund Manager:

Mr. Abhinav Khandelwal

Total Experience : 14 years

Experience in managing this fund: 7 Months (Managing since December 12, 2022)

Mr. Manish Lodha

Total Experience : 23 years,

Experience in managing this fund: 7 Months (Managing since December 12, 2022)

Date of allotment: December 12, 2022

Benchmark: S&P BSE 250 Small Cap TRI

Option: IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default

Minimum Application Amount: Rs. 1,000 and in multiples of Re. 1/- thereafter

Minimum Weekly & Monthly SIP Amount: Rs 500 and in multiples of Rs 1/- thereafter

Minimum Weekly & Monthly SIP Installments: 6

Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Rs 1/- thereafter

Minimum Quarterly SIP installments: 4

Monthly AAUM as on July 31, 2023 (Rs. in Cr.): 971.84

Monthly AUM as on July 31, 2023 (Rs. In Cr.): 1,077.68

Entry Load: Not applicable

Exit Load: • An Exit Load of 1% is payable if Units are redeemed / switched-out upto 3 months from the date of allotment;

• Nil if Units are redeemed / switched-out after 3 months from the date of allotment.

Note: The Exit Load structure of the scheme has been modified with effect from July 3, 2023

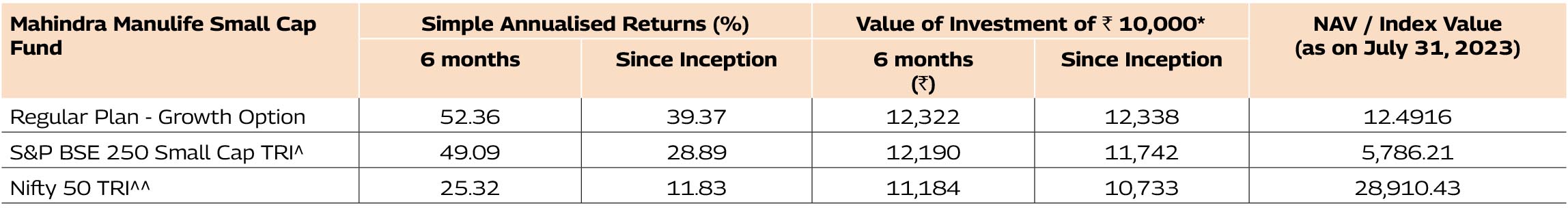

^Benchmark ^^Additional Benchmark. Inception/Allotment date: 12-Dec-22.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period.

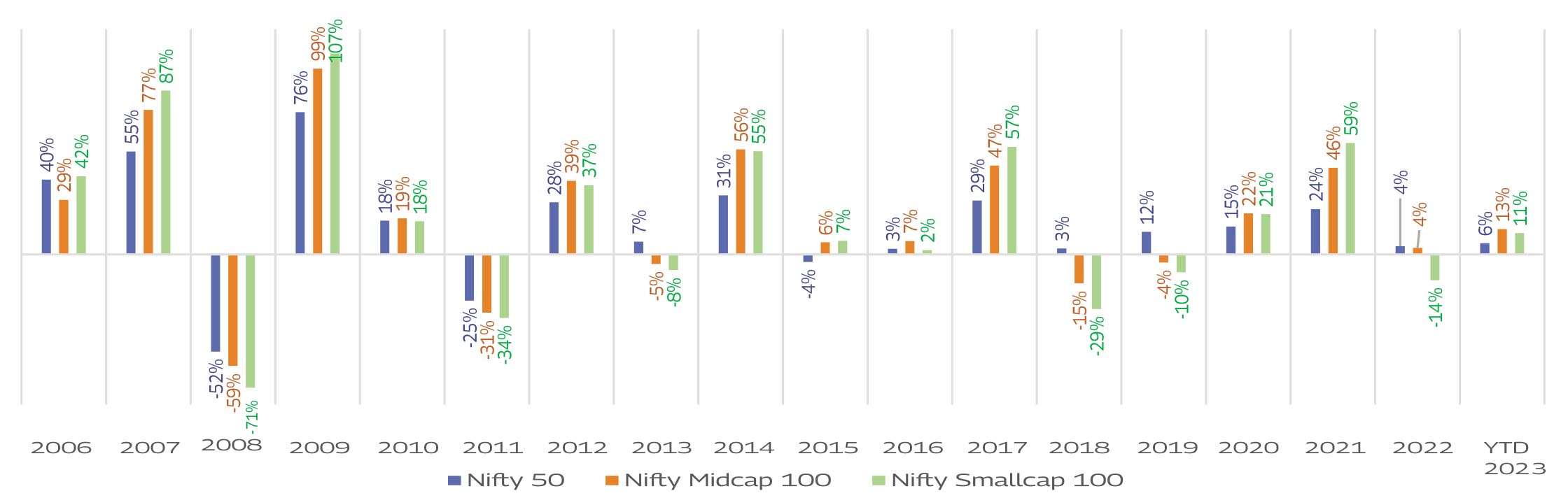

Data Source: ICRA. Data period: 1st January, 2006 till July 31, 2023 Returns are absolute returns (1 year) calculated as of the last business day of every calender year end (For the CY 2023, the data for the period 1st January, 2023 to 31st July, 2023 has been given). The data provided above is for illustrative purpose only and should not be construed as a promise on minimum returns and safeguard of capital. Mahindra Manulife Investment Management Private Limited/Mahindra Manulife Mutual Fund is not guaranteeing or forecasting any returns. Past performance may or may not be sustained in future.

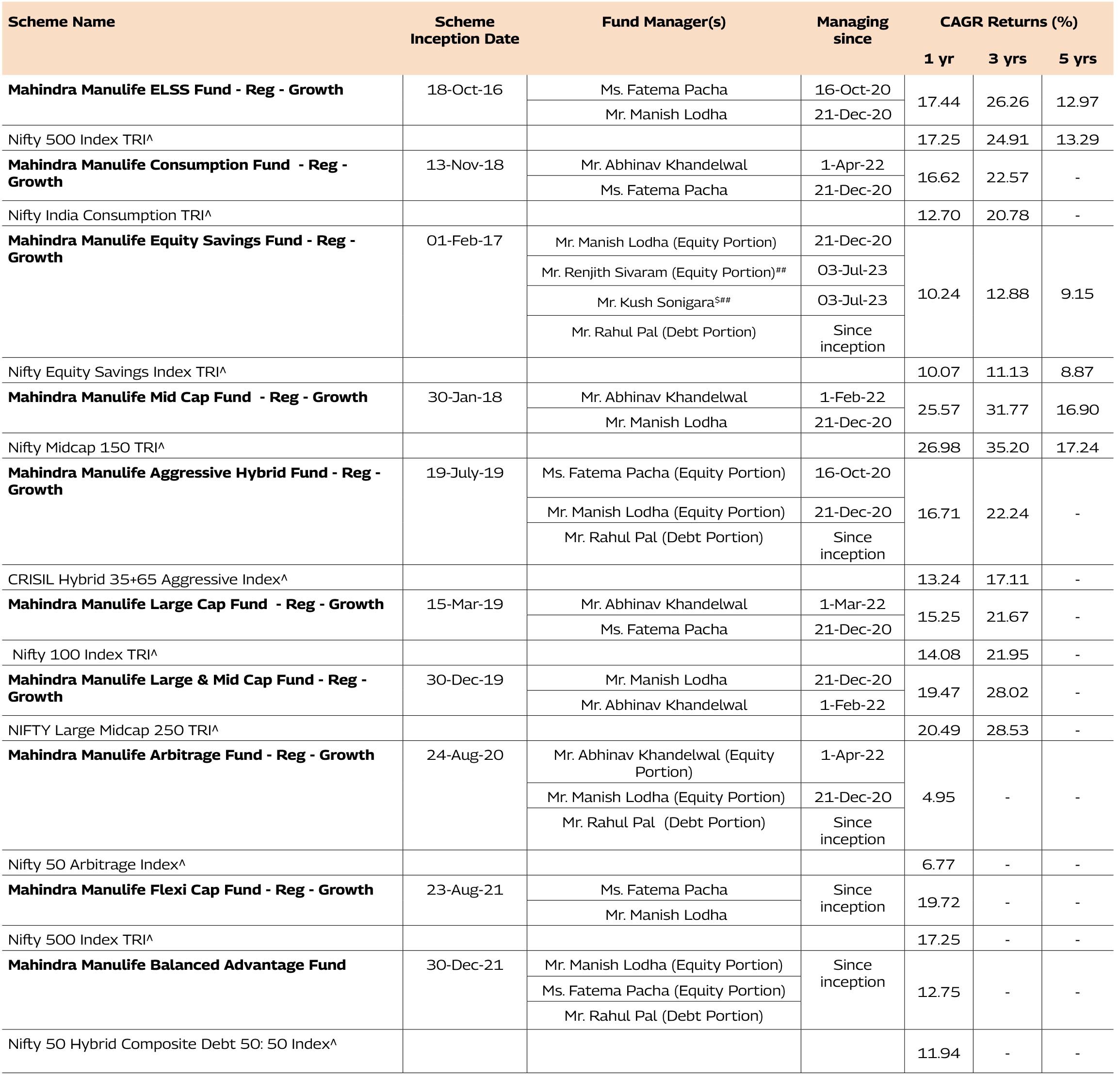

^Benchmark CAGR – Compounded Annual Growth Rate. $Dedicated Fund Manager for Overseas Investments.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments.

The performance details provided above are of Growth Option under Regular Plan Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Mr. Abhinav Khandelwal manages 6 schemes and Mr. Manish Lodha manages 10 schemes each of Mahindra Manulife Mutual Fund. The performance data for the schemes which have not completed one year has not been provided.

Performance as on July 31, 2023

Note: ##Pursuant to change in Fund Management Responsibilities, the scheme shall be co-managed by Mr. Manish Lodha, Mr. Renjith Sivaram, Mr. Rahul Pal and Mr. Kush Sonigara (Dedicated Fund Manager for Overseas Investments)effective July 3, 2023.

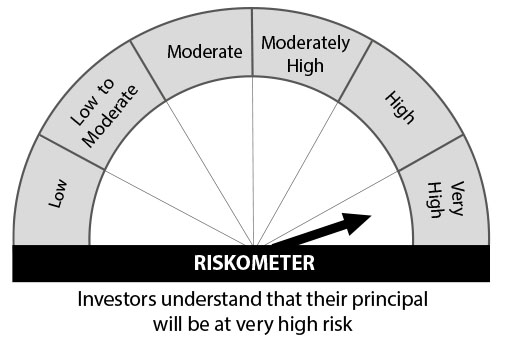

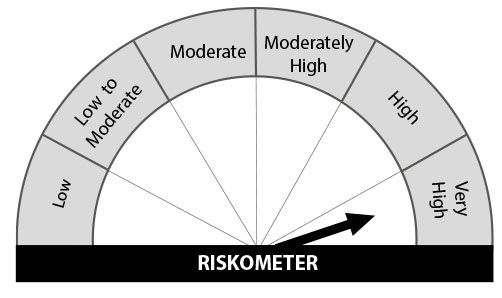

Mahindra Manulife Small Cap Fund

This product is suitable for investors who are seeking*:

• Long term capital appreciation;

• Investment predominantly in equity and equity related securities of small cap companies.

S&P BSE 250 Small Cap TRI

Benchmark Riskometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Get in Touch: Sadhana House, 1st Floor, 570,

P.B. Marg, Worli, Mumbai - 400 018, India.

Phone: +91-22-66327900, Fax: +91-22-66327932

Toll Free No.: 1800 419 6244

Website: www.mahindramanulife.com