Mahindra Manulife

Dynamic Bond Fund

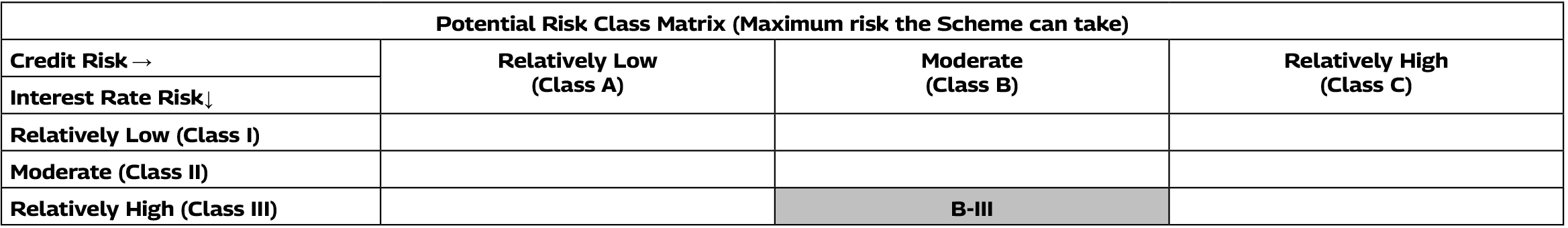

An open ended dynamic debt scheme investing across duration. A relatively high interest rate risk and moderate credit risk.

| One Pager | August 31, 2024 |

- The Annualised Portfolio YTM of the portfolio is around

7.23%.

- The Modified Duration of the portfolio (MD) increased to

around 7.09 years

- The Portfolio largely derives it duration from Gilts as we

believe that the AAA credit spreads may expand as we

move ahead

| Instruments | Indicative Allocation (% of assets) | Risk Profile | |

| Minimum | Maximum | Low/Moderate/ High | |

| Debt* & Money Market instruments | 0% | 100% | Moderate |

| Units issued by REITs & InvITs | 0% | 10% | Moderately High |

* Includes securitized debt and debt instruments having structured obligations/credit enhancements (such as corporate / promoter guarantee, conditional and contingent liabilities, covenants, pledge and / or Non Disposal Undertaking of shares etc) upto 35% of the net assets of the Scheme.

Benchmark: CRISIL Dynamic Bond A-III IndexEntry Load: N.A.

Exit Load: Nil

FUND MANAGER : MR. RAHUL PAL

Total Experience : 22 years

Experience in managing this fund: 6 years and 1 month (managing since August 20, 2018)

Note: The data/statistics given above are to explain general market trends in the securities market, it should not be construed as any research report/research recommendation.

| CURRENT MONTH August 31, 2024 |

|

| AUM (Rs. In Crore) | 54.26 |

| Monthly AAUM (Rs. In Crore) | 51.46 |

| Annualised Portfolio YTM*1 | 7.23% |

| Macaulay Duration (Years) | 7.35 |

| Modified Duration | 7.09 |

| Residual Maturity (Years) | 13.11 |

| PREVIOUS MONTH July 31, 2024 |

|

| AUM (Rs. In Crore) | 46.73 |

| Monthly AAUM (Rs. In Crore) | 45.88 |

| Annualised Portfolio YTM*1 | 7.33% |

| Macaulay Duration (Years) | 7.54 |

| Modified Duration | 7.28 |

| Residual Maturity (Years) | 14.07 |

1Yield to maturity should not be construed as minimum return offered by the Scheme

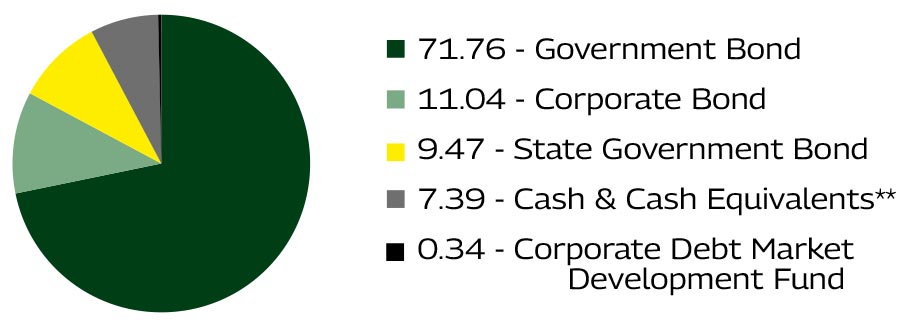

**Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS.

Data as on August 31, 2024

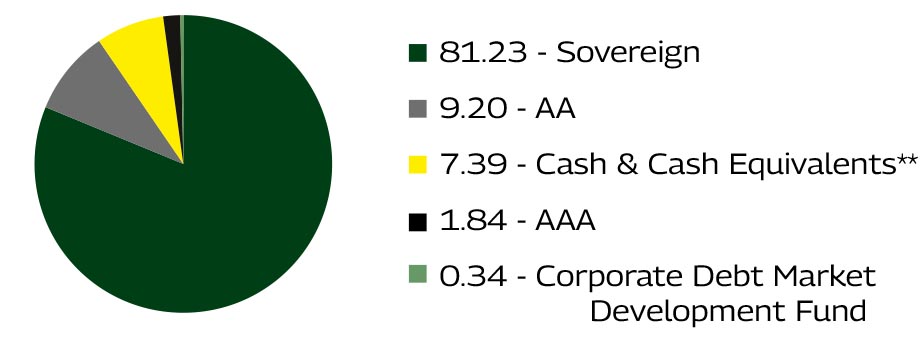

**Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS.

Data as on August 31, 2024

| CURRENT MONTH August 31, 2024 | |

| Security | % to N.A. |

| 7.1% GOI (MD 08/04/2034) (SOV) | 27.16% |

| 7.18% GOI (MD 24/07/2037) (SOV) | 19.79% |

| 7.3% GOI (MD 19/06/2053) (SOV) | 17.20% |

| 7.64% Maharashtra SDL (MD 25/01/2033) (SOV) | 9.47% |

| TVS Credit Services Limited (CRISIL AA rated CB) | 4.61% |

| 360 One Prime Limited (CRISIL AA rated CB) | 4.60% |

| 7.34% GOI (MD 22/04/2064) (SOV) | 3.84% |

| 7.32% GOI (MD 13/11/2030) (SOV) | 3.78% |

| Embassy Office Parks REIT (CRISIL AAA rated CB) | 1.84% |

| Corporate Debt Market Development Fund Class A2 (CDMDF) | 0.34% |

| TOTAL | 92.61% |

| PREVIOUS MONTH July 31, 2024 | |

| Security | % to N.A. |

| 7.18% GOI (MD 24/07/2037) (SOV) | 22.85% |

| 7.3% GOI (MD 19/06/2053) (SOV) | 22.04% |

| 7.1% GOI (MD 08/04/2034) (SOV) | 14.08% |

| 7.64% Maharashtra SDL (MD 25/01/2033) (SOV) | 10.93% |

| 360 One Prime Limited (CRISIL AA rated CB) | 5.34% |

| TVS Credit Services Limited (CRISIL AA rated CB) | 5.34% |

| 7.34% GOI (MD 22/04/2064) (SOV) | 4.42% |

| 7.32% GOI (MD 13/11/2030) (SOV) | 4.37% |

| Embassy Office Parks REIT (CRISIL AAA rated CB) | 2.14% |

| Corporate Debt Market Development Fund Class A2 (CDMDF) | 0.39% |

| TOTAL | 91.90% |

| FRESH ADDITIONS | COMPLETE EXITS |

| Security | Security |

| - | - |

Note: The companies/stock(s) referred above are only for the purpose of disclosure of significant portfolio changes during the month and should not be construed as recommendation to buy/sell/ hold. The fund manager may or may not choose to hold these companies/stocks, from time to time. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

| SYSTEMATIC INVESTMENT PLAN |

| WITH THIS YOU CAN • Build corpus in the long term • Take advantage of rupee cost averaging • Experience the power of compounding even on small investments |

| CHOICE OF FREQUENCIES • Weekly • Monthly • Quarterly |

| CHOICE OF DATES Any date of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 6 instalments of ₹ 500 each under weekly frequency • 6 instalments of ₹ 500 each under monthly frequency • 4 instalments of ₹ 1500 each under quarterly frequency |

| SYSTEMATIC TRANSFER PLAN |

| WITH THIS YOU CAN • Take measured exposure into a new asset class • Rebalance your portfolio |

| CHOICE OF FREQUENCIES • Daily • Weekly • Monthly • Quarterly |

| CHOICE OF DATES Any date^ of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 6 instalments of ₹500 each under daily, weekly and monthly frequency • 4 instalments of ₹1500 each under quarterly frequency |

| SYSTEMATIC WITHDRAWAL PLAN |

| WITH THIS YOU CAN • Meet regular expenses |

| CHOICE OF FREQUENCIES • Monthly • Quarterly • Half-Yearly & Annual |

| CHOICE OF DATES Any date of your choice |

| MINIMUM AMOUNTS / INSTALMENTS • 2 instalments of ₹ 500 each under monthly / quarterly / Half-Yearly & Annual frequency |

^STP can be registered for any date under the monthly and quarterly frequencies and for any business day under the weekly frequency.

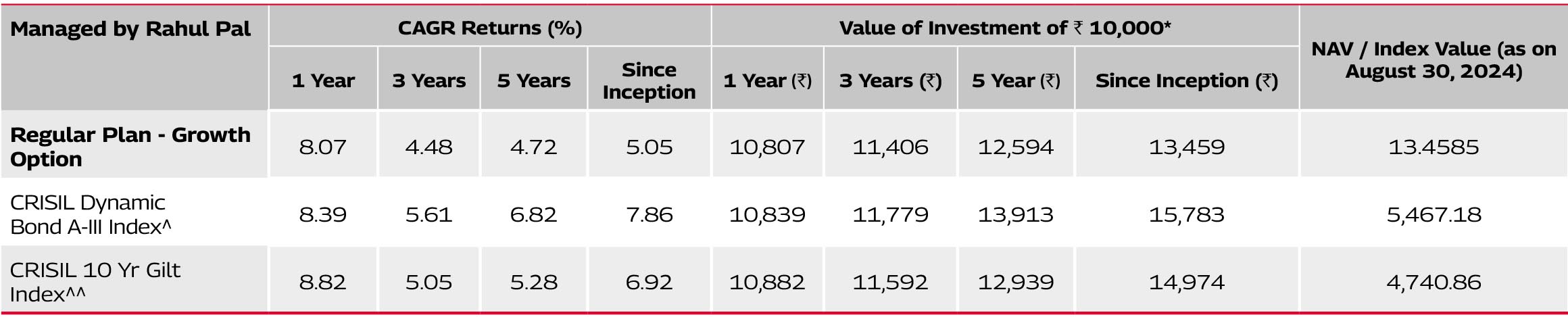

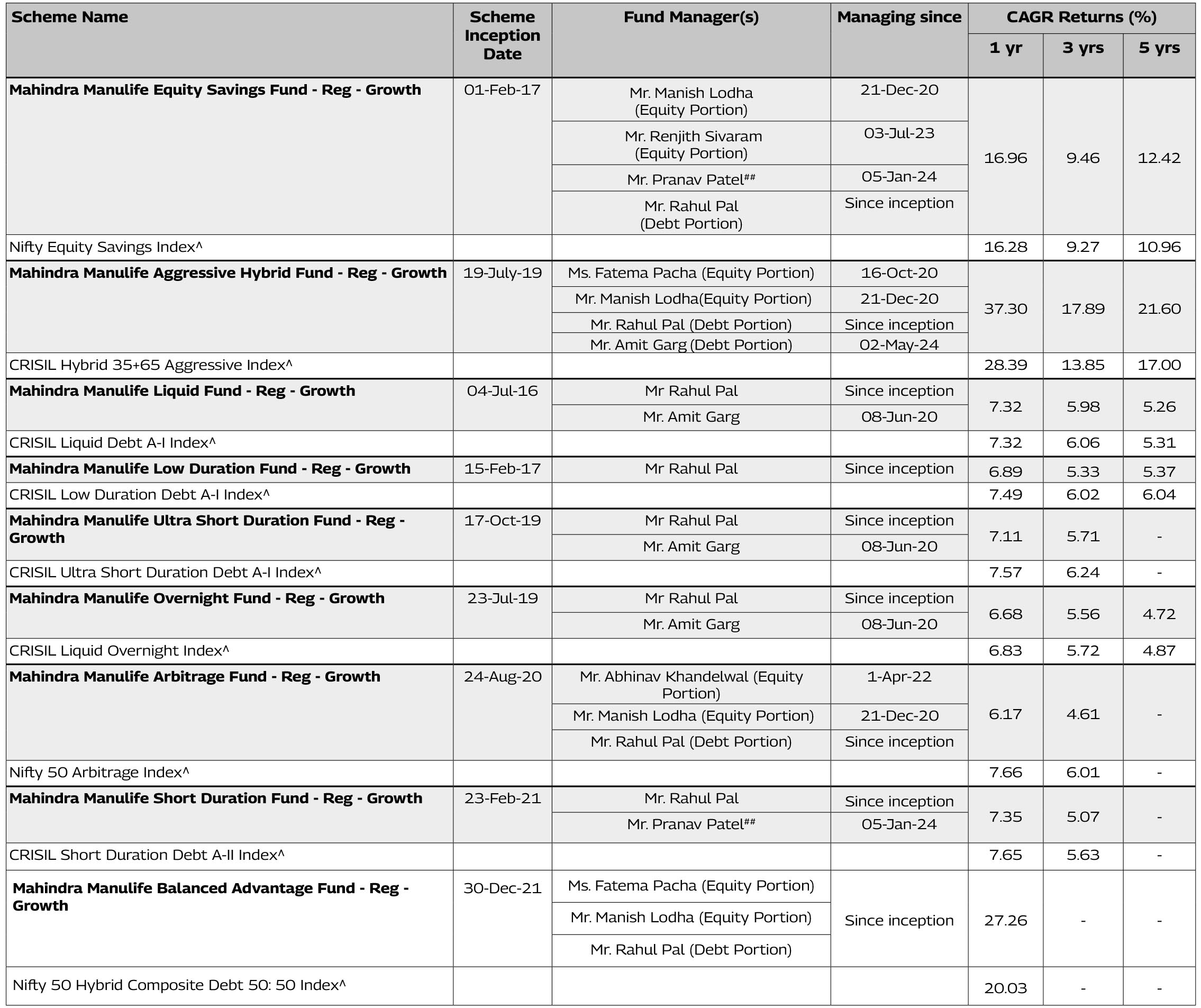

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 20-Aug-18.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments.

Since inception returns of the scheme is

calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular Plan. Different Plans i.e Regular Plan and Direct

Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period.

^Benchmark CAGR – Compounded Annual Growth Rate.##Dedicated Fund Manager for Overseas Investments

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments.

The performance details provided above are of Growth

Option under Regular Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Mr. Rahul Pal manages 11 schemes of Mahindra Manulife Mutual Fund.

The performance data for the schemes which have not completed one year has not been provided.

Mahindra Manulife Dynamic Bond Fund

This product is suitable for investors who are seeking*:

• To generate regular returns and

capital appreciation through active

management of portfolio.

• Investments in debt & money market instruments across duration.

CRISIL Dynamic Bond A-III Index

Benchmark Riskometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Get in Touch: Unit No. 204, 2nd Floor, Amiti Building, Piramal Agastya Corporate Park, LBS Road, Kamani Junction, Kurla (W), Mumbai – 400 070.

Phone: +91-22-66327900, Fax: +91-22-66327932 Toll Free No.: 1800 419 6244

Website: www.mahindramanulife.com