MAHINDRA MANULIFE BALANCED ADVANTAGE FUND

An open ended dynamic asset allocation fund

|

|

|

|

|

| Data as on 31st, May 2024 | ||||

| Investment Objective | The investment objective of the Scheme is to provide capital appreciation and generate income through a dynamic mix of equity, debt and money market instruments. The Scheme seeks to reduce the volatility by diversifying the assets across equity, debt and money market instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved. |

| Fund Features |

Optimal asset allocation at regular intervals. Aims to capture the optimum mix between Equity and Debt across market cycles. With flexibility to invest upto 100% in equity & debt, the Scheme may be suitable for volatile market conditions. Endeavours to provide tax efficiency* *Though the scheme is a dynamic asset allocation scheme, the endeavour will be to invest a minimum of 65% of its net assets in equity and equity related instruments which may help in attracting equity taxation as per prevailing tax laws. |

| Fund Manager and Experience | Fund Manager (Equity): Mr. Manish Lodha Total Experience: 23 years Experience in managing this fund: 2 Years and 5 months (Managing since December 30, 2021) Fund Manager (Equity): Ms. Fatema Pacha Total Experience: 18 years Experience in managing this fund: 2 Years and 5 months (managing since December 30, 2021) Fund Manager (Debt): Mr. Rahul Pal Total Experience: 22 years Experience in managing this fund: 2 Years and 5 months (Managing since December 30, 2021) |

| Date of allotment | December 30, 2021 |

| Benchmark | Nifty 50 Hybrid Composite Debt 50: 50 Index TRI |

| Options | Option: IDCW and Growth (D) D - Default |

| IDCW Sub-options: | IDCW Reinvestment (D) & IDCW Payout |

| Minimum Application Amount | Rs. 1,000/- and in multiples of Re.1/- thereafter |

| Minimum Additional Purchase Amount: | Rs. 1,000/- and in multiples of Re. 1/- thereafter |

| Minimum Redemption/Switch-Out Amount: | Rs. 1,000/- or 100 units or account balance, whichever is lower |

| SIP | Minimum Weekly & Monthly SIP Amount: Rs 500 and in multiples of Re 1 thereafter Minimum Weekly & Monthly SIP Installments: 6 |

| Monthly AAUM as on May 31, 2024 (Rs. in Cr.): | 731.43 |

| Monthly AUM as on May 31, 2024 (Rs. in Cr.): | 738.59 |

| Total Expense Ratio1 as on May 31, 2024: | Regular Plan: 2.29% Direct Plan: 0.58% 1Includes additional expenses charged in terms of Regulation 52(6A)(b) and 52(6A)(c) of SEBI (Mutual Funds) Regulations, 1996 and Goods and Services Tax. |

| Load Structure: | Entry Load: N.A. Exit Load: 10% of the units allotted shall be redeemed without any exit load, on or before completion of 3 months from the date of allotment of Units. Any redemption in excess of the above limit shall be subject to the following exit load: -An Exit Load of 1% is payable if Units are redeemed / switched-out on or before completion of 3 months from the date of allotment of Units; - Nil - If Units are redeemed / switched-out after completion of 3 months from the date of allotment of Units. |

| Annualised Portfolio YTM*2^: | 7.25%3 |

| Macaulay Duration^: | 3.19 years3 |

| Modified Duration^: | 3.193 |

| Residual Maturity^: | 4.47 years3 |

| Portfolio Turnover Ratio (Last 1 year): | 2.84 |

| As on (Date) | May 31, 2024 |

| ^For debt component *In case of semi annual YTM, it will be annualised 2Yield to maturity should not be construed as minimum return offered by the scheme; 3Calculated on amount invested in debt securities (including accrued interest), deployment of funds in TREPS and Reverse Repo and net receivable / payable. |

|

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| IDCW | 12.2109 |

12.8078 |

| Growth | 13.2472 |

13.8478 |

| IDCW: Income Distribution cum Capital Withdrawal | ||

Company / Issuer |

Rating |

% of Net Assets$ | % to NAV Derivatives |

|

|---|---|---|---|---|

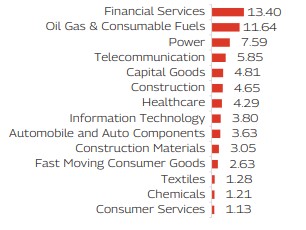

| Automobile and Auto Components | 3.63% |

|||

| Tata Motors Limited | 1.42% |

|||

| Eicher Motors Limited | 1.28% |

|||

| LG Balakrishnan & Bros Limited | 0.92% |

|||

| Capital Goods | 4.81% |

|||

| Garden Reach Shipbuilders & Engineers Limited | 1.21% |

|||

| Inox India Limited | 1.06% |

|||

| Titagarh Rail Systems Limited | 0.90% |

|||

| Bharat Electronics Limited | 0.80% |

|||

| Jyoti CNC Automation Ltd | 0.46% |

|||

| Apar Industries Limited | 0.40% |

|||

| Chemicals | 1.21% |

|||

| SRF Limited | 0.75% |

|||

| Gujarat State Fertilizers & Chemicals Limited | 0.46% |

|||

| Construction | 4.65% |

-1.01% |

||

| Larsen & Toubro Limited | 2.73% |

-1.01% |

||

| IRCON International Limited | 1.10% |

|||

| Power Mech Projects Limited | 0.82% |

|||

| Construction Materials | 3.05% |

|||

| Grasim Industries Limited | 1.72% |

|||

| ACC Limited | 1.33% |

|||

| Consumer Services | 1.13% |

|||

| Aditya Vision Ltd | 0.75% |

|||

| The Indian Hotels Company Limited | 0.38% |

|||

| Fast Moving Consumer Goods | 2.63% |

|||

| United Spirits Limited | 2.12% |

|||

| Balrampur Chini Mills Limited | 0.51% |

|||

| Financial Services | 13.40% |

|||

| Canara Bank | 3.39% |

|||

| State Bank of India | 2.72% |

|||

| ICICI Bank Limited | 1.50% |

|||

| Union Bank of India | 1.08% |

|||

| Shriram Finance Limited | 0.86% |

|||

| HDFC Asset Management Company Limited | 0.84% |

|||

| The Jammu & Kashmir Bank Limited | 0.78% |

|||

| Central Depository Services (India) Limited | 0.76% |

|||

| Punjab National Bank | 0.70% |

|||

| The South Indian Bank Limited | 0.68% |

|||

| Aadhar Housing Finance Limited | 0.07% |

|||

| Healthcare | 4.29% |

|||

| Cipla Limited | 1.47% |

|||

| Dr. Reddy's Laboratories Limited | 1.25% |

|||

| Biocon Limited | 1.05% |

|||

| Max Healthcare Institute Limited | 0.51% |

|||

| Divi's Laboratories Limited | 0.01% |

|||

| Information Technology | 3.80% |

-0.70% |

||

| Tata Consultancy Services Limited | 2.50% |

-0.70% |

||

| Wipro Limited | 1.31% |

|||

| Oil Gas & Consumable Fuels | 11.64% |

-3.08% |

||

| Reliance Industries Limited | 4.61% |

|||

| Coal India Limited | 2.63% |

-1.55% |

||

| Hindustan Petroleum Corporation Limited | 2.44% |

|||

| Indian Oil Corporation Limited | 1.54% |

-1.54% |

||

| GAIL (India) Limited | 0.43% |

|||

| Power | 7.59% |

-3.91% |

||

| NTPC Limited | 3.82% |

-2.50% |

||

| Tata Power Company Limited | 2.37% |

|||

| Power Grid Corporation of India Limited | 1.41% |

-1.41% |

||

| Telecommunication | 5.85% |

|||

| Bharti Airtel Limited | 2.69% |

|||

| Indus Towers Limited | 1.89% |

|||

| Bharti Hexacom Limited | 1.27% |

|||

| Textiles | 1.28% |

|||

| K.P.R. Mill Limited | 0.73% |

|||

| Vardhman Textiles Limited | 0.55% |

|||

| Equity and Equity Related Total | 68.96% |

-8.70% |

||

| Certificate of Deposit | 3.68% |

|||

| HDFC Bank Limited | CRISIL A1+/ CARE A1+ |

3.68% |

||

| Corporate Bond | 7.52% |

|||

| National Bank For Agriculture and Rural Development | CRISIL AAA |

3.60% |

||

| Power Finance Corporation Limited | CRISIL AAA |

1.35% |

||

| REC Limited | CRISIL AAA |

1.35% |

||

| Bharti Telecom Limited | CRISIL AA+ |

1.22% |

||

| Government Bond | 12.09% |

|||

| 7.18% GOI (MD 24/07/2037) | SOV |

5.67% |

||

| 7.18% GOI (MD 14/08/2033) | SOV |

2.19% |

||

| 7.1% GOI (MD 08/04/2034) | SOV |

2.18% |

||

| 7.38% GOI (MD 20/06/2027) | SOV |

2.05% |

||

| Treasury Bill | 3.00% |

|||

| 364 Days Tbill (MD 02/01/2025) | SOV |

1.69% |

||

| 364 Days Tbill (MD 21/11/2024) | SOV |

1.31% |

||

| Cash & Other Receivables | 4.75% |

|||

| Grand Total | 100.00% |

|||

| $Hedged and Unhedged positions | ||||

| ( |

||||

| Mahindra Manulife Balanced Advantage Fund | CAGR Returns (%)

|

Value of Investment of Rs. 10,000* |

NAV / Index Value (as on May 31, 2024) |

||

| Managed by Mr. Manish Lodha (equity), Ms. Fatema Pacha (equity) & Mr. Rahul Pal (Debt) | 1 Year |

Since Inception |

1 Year |

Since Inception |

|

| Regular Plan - Growth Option | 27.54 |

12.33 |

12,763 |

13,247 |

13.2472 |

| Direct Plan - Growth Option | 29.74 |

14.40 |

12,983 |

13,848 |

13.8478 |

| Nifty 50 Hybrid Composite Debt 50: 50 Index^ | 14.77 |

9.56 |

11,482 |

12,473 |

14,545.97 |

| Nifty 50 TRI^^ | 22.95 |

13.14 |

12,302 |

13,480 |

33,285.90 |

^Benchmark ^^Additional Benchmark. Inception/Allotment date: 30-Dec-21. CAGR - Compounded Annual Growth Rate. Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular and Direct Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. For performance details of other schemes managed by the Fund Manager(s), please click here | Best Viewed in Landscape mode

| Mahindra Manulife Balanced Advantage Fund |

Regular Plan |

Direct Plan |

Nifty 50 Hybrid Composite Debt 50:50 Index TRI^ |

Nifty 50 Index TRI^^ |

|||||

| SIP Investment Period | Total Amount Invested (  ) ) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

| 1 Year | 120,000 |

134,858 |

23.76 |

136,157 |

25.90 |

129,119 |

14.40 |

133,075 |

20.83 |

| Since Inception | 300,000 |

373,577 |

17.95 |

382,619 |

20.02 |

349,619 |

12.33 |

370,859 |

17.32 |

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 30-December-21. Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Returns greater than 1 year period are compounded annualized. For SIP returns, monthly investment of equal amounts invested on the 1st business day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return). For SIP Performance please click here | Best Viewed in Landscape mode

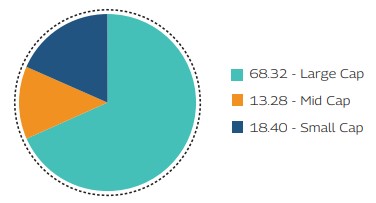

As per the latest Market Capitalisation data provided by AMFI (In line with the applicable SEBI guidelines)

Record Date |

Plan(s) / Option(s) |

IDCW |

Face Value |

Cum-IDCW NAV |

(Rs. per unit) |

(Rs. per unit) |

(Rs. per unit) |

||

14-Mar-24 |

Regular IDCW |

1.00 |

10 |

13.1323 |

14-Mar-24 |

Direct IDCW |

1.00 |

10 |

13.6732 |

Pursuant to payment of IDCW, the NAV of the IDCW Option(s) of the Scheme/Plan(s) falls to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. For complete list of IDCWs, visit www.mahindramanulife.com. |

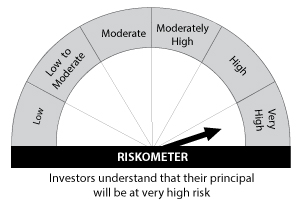

Product Suitability |

|

| This Product is Suitable for investors who are seeking* | |

|

|

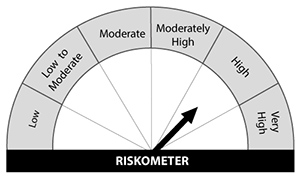

Scheme Riskometers |

Benchmark Riskometers |

|

Scheme Benchmark: Nifty 50 Hybrid Composite Debt 50: 50 Index TRI |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|