Mahindra Manulife

Small Cap Fund

(Small Cap Fund - An open ended equity scheme predominantly

investing in small cap stocks)

|

|

|

|

|

| Data as on 31st, May 2024 |

||||

| Investment Objective | The investment objective of the Scheme is to generate long term capital appreciation by investing in a diversified portfolio of equity & equity related securities of small cap companies. However, there can be no assurance that the investment objective of the Scheme will be achieved. |

| Fund Features | Potential growth tailwinds in Indian Economy. Opportunity to capitalize on Indian Entrepreneurship. Opportunity to capture market / economic cycles. Potential to create wealth and generate alpha over long-term. Small caps are generally under-researched and under-owned and hence provides an opportunity for stock-picking at reasonable valuations. Small Caps could be beneficiaries of structural reforms announced from time to time. Small caps also provide exposure to companies which are potential market leaders in the industries they operate in (a few examples include textile, paper, sugar, luggage) and have potential to become midcaps of tomorrow as they achieve scale. |

| Fund Manager and Experience | Fund Manager: Mr. Abhinav Khandelwal Total Experience: 14 years Experience in managing this fund: 1 year and 5 months (Managing since December 12, 2022) Fund Manager: Mr. Manish Lodha Total Experience: 23 years Experience in managing this fund: 1 year and 5 months (Managing since December 12, 2022) |

| Date of allotment | December 12, 2022 |

| Benchmark | BSE 250 Small Cap TRI$ |

| Options | IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default |

| Minimum Application Amount | Rs. 1,000 and in multiples of Rs. 1/-

thereafter |

| Minimum Additional Purchase Amount: | Rs. 1,000/- and in multiples of Re. 1/- thereafter |

| Minimum Weekly & Monthly SIP Amount | Rs 500 and in multiples of Rs 1/- thereafter |

| Minimum Weekly & Monthly SIP installments: | 6 |

| Minimum Quarterly SIP Amount: | Rs 1,500 and in multiples of Rs 1/- thereafter |

| Minimum Quarterly SIP installments: | 4 |

| Monthly AAUM as on May 31, 2024 (Rs. in Cr.): | 4,061.13 |

| Monthly AUM as on May 31, 2024 (Rs. in Cr.): | 4,131.27 |

| Total Expense Ratio1 as on May 31, 2024: |

Regular Plan: 1.82% Direct Plan: 0.27% 11Includes additional expenses charged in terms of Regulation 52(6A)(b) and 52 (6A)(c)of SEBI (Mutual Funds) Regulations, 1996 and Goods and Services Tax. |

| Load Structure: | Entry Load: N.A. Exit Load: An Exit Load of 1% is payable if Units are redeemed / switched-out upto 3 months from the date of allotment; Nil if Units are redeemed / switched-out after 3 months from the date of allotment. Note: $With effect from June 1, 2024, the name of the benchmark of the said scheme has been revised from S&P BSE 250 Small Cap Index TRI to BSE 250 Small Cap Index TRI |

| Portfolio Turnover Ratio (Last 1 year): | 0.66 |

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| IDCW | 17.8729 |

18.3410 |

| Growth | 17.8729 |

18.3410 |

| IDCW: Income Distribution cum Capital Withdrawal | ||

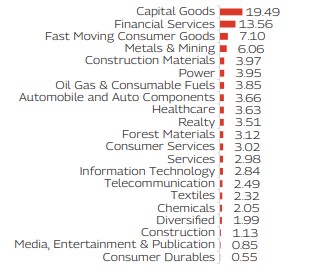

Issuer |

% of Net Assets |

||

|---|---|---|---|

| Automobile and Auto Components | 3.66% |

||

| Minda Corporation Limited | 1.94% |

||

| Varroc Engineering Limited | 1.16% |

||

| Asahi India Glass Limited | 0.56% |

||

| Capital Goods | 19.49% |

||

| Kirloskar Oil Engines Limited | 1.99% |

||

| Apar Industries Limited | 1.92% |

||

| Bharat Bijlee Limited | 1.91% |

||

| Inox India Limited | 1.52% |

||

| BEML Limited | 1.50% |

||

| Sanghvi Movers Limited | 1.46% |

||

| KEI Industries Limited | 1.19% |

||

| Voltamp Transformers Limited | 1.14% |

||

| Tega Industries Limited | 1.07% |

||

| Kaynes Technology India Limited | 0.92% |

||

| Texmaco Rail & Engineering Limited | 0.91% |

||

| Lakshmi Machine Works Limited | 0.91% |

||

| Kirloskar Brothers Limited | 0.84% |

||

| Titagarh Rail Systems Limited | 0.79% |

||

| Finolex Industries Limited | 0.53% |

||

| Ratnamani Metals & Tubes Limited | 0.49% |

||

| RHI Magnesita India Limited | 0.39% |

||

| Chemicals | 2.05% |

||

| PCBL Limited | 1.25% |

||

| Gujarat State Fertilizers & Chemicals Limited | 0.80% |

||

| Construction | 1.13% |

||

| Engineers India Limited | 1.13% |

||

| Construction Materials | 3.97% |

||

| Grasim Industries Limited | 2.25% |

||

| Birla Corporation Limited | 1.14% |

||

| Orient Cement Limited | 0.58% |

||

| Consumer Durables | 0.55% |

||

| Safari Industries (India) Limited | 0.55% |

||

| Consumer Services | 3.02% |

||

| Thomas Cook (India) Limited | 1.76% |

||

| Electronics Mart India Limited | 1.26% |

||

| Diversified | 1.99% |

||

| Godrej Industries Limited | 1.99% |

||

| Fast Moving Consumer Goods | 7.10% |

||

| United Spirits Limited | 1.68% |

||

| Emami Limited | 1.67% |

||

| Mrs. Bectors Food Specialities Limited | 1.24% |

||

| Jyothy Labs Limited | 0.92% |

||

| Triveni Engineering & Industries Limited | 0.89% |

||

| Sula Vineyards Ltd | 0.70% |

||

| Financial Services | 13.56% |

||

| REC Limited | 2.66% |

||

| Cholamandalam Financial Holdings Limited | 2.10% |

||

| ICICI Securities Limited | 1.51% |

||

| Central Depository Services (India) Limited | 1.46% |

||

| Union Bank of India | 1.43% |

||

| Ujjivan Small Finance Bank Limited | 1.26% |

||

| ICRA Limited | 1.21% |

||

| Aadhar Housing Finance Limited | 1.04% |

||

| The Karnataka Bank Limited | 0.52% |

||

| The South Indian Bank Limited | 0.37% |

||

| Forest Materials | 3.12% |

||

| Century Textiles & Industries Limited | 3.12% |

||

| Healthcare | 3.63% |

||

| Piramal Pharma Limited | 1.40% |

||

| Glenmark Pharmaceuticals Limited | 0.94% |

||

| Natco Pharma Limited | 0.84% |

||

| Alembic Pharmaceuticals Limited | 0.45% |

||

| Information Technology | 2.84% |

||

| Birlasoft Limited | 1.46% |

||

| Cyient Limited | 1.37% |

||

| Media, Entertainment & Publication | 0.85% |

||

| D.B.Corp Limited | 0.85% |

||

| Metals & Mining | 6.06% |

||

| MOIL Limited | 1.58% |

||

| National Aluminium Company Limited | 1.58% |

||

| Steel Authority of India Limited | 1.48% |

||

| Kirloskar Ferrous Industries Limited | 0.75% |

||

| Jindal Stainless Limited | 0.67% |

||

| Oil Gas & Consumable Fuels | 3.85% |

||

| Reliance Industries Limited | 2.42% |

||

| Coal India Limited | 1.43% |

||

| Power | 3.95% |

||

| CESC Limited | 2.66% |

||

| NLC India Limited | 1.29% |

||

| Realty | 3.51% |

||

| Anant Raj Limited | 1.96% |

||

| Sobha Limited | 0.80% |

||

| Kolte - Patil Developers Limited | 0.75% |

||

| Services | 2.98% |

||

| Firstsource Solutions Limited | 1.15% |

||

| Gateway Distriparks Limited | 0.80% |

||

| eClerx Services Limited | 0.54% |

||

| The Great Eastern Shipping Company Limited | 0.49% |

||

| Telecommunication | 2.49% |

||

| Indus Towers Limited | 2.49% |

||

| Textiles | 2.32% |

||

| Arvind Limited | 1.55% |

||

| Nitin Spinners Limited | 0.77% |

||

| Equity and Equity Related Total | 92.13% |

||

| Cash & Other Receivables | 7.87% |

||

| Grand Total | 100.00% |

||

| ( | |||

| Mahindra Manulife Small Cap Fund | CAGR Returns (%) |

Value of Investment of Rs. 10,000* |

NAV / Index Value (as on May 31, 2024) |

||

| Managed by Mr. Abhinav Khandelwal & Mr. Manish Lodha | 1 Years |

Since Inception |

1 Year |

Since Inception |

|

| Regular Plan - Growth Option | 62.88 |

48.50 |

16,309 |

17,873 |

17.8729 |

| Direct Plan - Growth Option | 65.65 |

51.14 |

16,588 |

18,341 |

18.3410 |

| BSE 250 Small Cap TRI^$ | 52.97 |

36.56 |

15,315 |

15,803 |

7,730.78 |

| Nifty 50 TRI^^ | 22.95 |

15.62 |

12,302 |

12,376 |

33,285.90 |

^Benchmark ^^Additional Benchmark. Inception/Allotment date: 12-Dec-22. Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular and Direct Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. Note: $With effect from June 1, 2024, the name of the benchmark of the said scheme has been revised from S&P BSE 250 Small Cap Index TRI to BSE 250 Small Cap Index TRI

| Mahindra Manulife Small Cap Fund | Regular Plan |

Direct Plan |

BSE 250 Small Cap TRI^ |

Nifty 50 Index TRI^^ |

|||||

| SIP Investment Period | Total Amount Invested (  ) ) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

| 1 Year | 120,000 |

151,243 |

51.61 |

152,712 |

54.18 |

144,493 |

39.94 |

133,075 |

20.83 |

| 3 Years | NA |

NA |

NA |

NA |

NA |

NA |

NA |

NA |

NA |

| 5 Years | NA |

NA |

NA |

NA |

NA |

NA |

NA |

NA |

NA |

| Since Inception | 180,000 |

258,589 |

54.93 |

262,466 |

57.61 |

243,263 |

44.32 |

209,871 |

21.02 |

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 12-Dec-22. Past performance may or may not be sustained in future and should not be used as a basis of comparison with other

investments. Returns greater than 1 year period are compounded annualized. For SIP returns, monthly investment of equal amounts invested on the 1st business day of every month has been considered. CAGR Returns (%) are computed

after accounting for the cash flow by using the XIRR method (investment internal rate of return). Note: $With effect from June 1, 2024, the name of the benchmark of the said scheme has been revised from S&P BSE 250 Small Cap Index

TRI to BSE 250 Small Cap Index TRI. For SIP Performance please click here | Best Viewed in Landscape mode

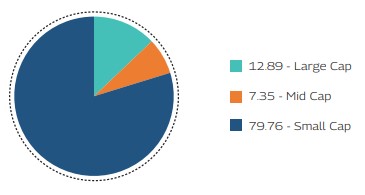

As per the latest Market Capitalisation data provided by AMFI (In line with the applicable SEBI guidelines)

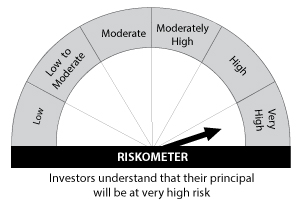

Product Suitability

|

|

| This Product is Suitable for investors who are seeking* | |

|

|

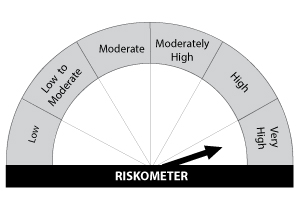

Scheme Riskometers |

Benchmark Riskometers |

Scheme Benchmark: BSE 250 Small Cap TRI |

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|