MAHINDRA MANULIFE MULTI ASSET ALLOCATION FUND

(An open ended scheme investing in Equity, Debt, Gold/Silver

Exchange Traded Funds (ETFs) and Exchange Traded

Commodity Derivatives)

|

|

|

|

|

| Data as on 31st, March 2024 | ||||

| Investment Objective | The investment objective of the Scheme is to seek to generate long-term capital appreciation and income by investing in equity and equity related securities, debt & money market instruments, Gold/Silver ETFs and Exchange Traded Commodity Derivatives (ETCDs) as permitted by SEBI from time to time. However, there can be no assurance that the investment objective of the Scheme will be achieved |

| Fund Features |

Professional Asset: Allocation Asset Allocation shall be rebalanced regularly by fund managers based on evolving market dynamics Diversified Portfolio: Portfolio that aims to combine stability of fixed income, growth potential of equity and tactical exposure to gold/silver Tax Efficient Provides investors with an opportunity for long term capital gains taxation with the benefit of indexation$ $As per prevailing tax laws. Please refer Scheme Information Document of the Scheme for more details on taxation. In view of individual nature of tax consequences, each unit holder is advised to consult his/her own professional tax advisors |

| Fund Manager and Experience | Fund Manager (Equity): Mr. Renjith Sivaram Total Experience: 13 years Experience in managing this fund (managing since March 13, 2024) Fund Manager (Equity): Mr. Rahul Pal Total Experience: 22 years Experience in managing this fund (managing since March 13, 2024) Fund Manager (Debt): Mr. Pranav Patel$ Total Experience: 9 years Experience in managing this fund (managing since March 13, 2024) |

| Date of allotment | March 13, 2024 |

| Benchmark | 45% NIFTY 500 TRI + 40% CRISIL Composite Bond Index + 10% Domestic Price of Physical Gold + 5% Domestic Price of Silver (First Tier Benchmark) |

| Options | IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default |

| Minimum Application Amount | Rs. 1,000/- and in multiples of Re. 1/- thereafter |

| Minimum Additional Purchase Amount: | Rs. 1,000/- and in multiples of Re. 1/- thereafter |

| Minimum amount for redemption/switch out: | Rs. 1,000/- or 100 units or account balance, whichever is lower |

| SIP | Minimum Weekly & Monthly SIP Amount: Rs 500 and in multiples of Re 1 thereafter Minimum Weekly & Monthly SIP Installments: 6 Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Re 1 thereafter Minimum Quarterly SIP installments: 4 |

| Monthly AAUM as on March 31, 2024 (Rs. in Cr.): | 154.03 |

| Quarterly AAUM as on March 31, 2024 (Rs. in Cr.): | 52.47 |

| Monthly AUM as on March 31, 2024 (Rs. in Cr.): | 225.19 |

| Total Expense Ratio1 as on March 31, 2024: | Regular Plan: 2.05% Direct Plan: 0.40% 1Includes additional expenses charged in terms of Regulation 52(6A)(b) and 52(6A)(c) of SEBI (Mutual Funds) Regulations, 1996 and Goods and Services Tax. |

| Load Structure: | Entry Load: N.A. Exit Load: An Exit Load of 0.5% is payable if Units are redeemed / switched-out up to 3 months from the date of allotment; Nil if Units are redeemed / switched-out after 3 months from the date of allotment. Redemption /Switch-Out of Units would be done on First in First out Basis (FIFO). Note: The performance data of Mahindra Manulife Multi Asset Allocation Fund has not been provided as the scheme has not completed 6 months since inception. The said Scheme is co-managed by Mr. Renjith Sivaram, Mr. Rahul Pal & Mr. Pranav Patel. $(Dedicated Fund Manager for Overseas Investments) |

| Annualised Portfolio YTM*2^: | 7.23%3 |

| Macaulay Duration^: | 1.79 years3 |

| Modified Duration^: | 1.70 |

| Residual Maturity^: | 2.35 years3 |

| As on (Date) | March 31, 2024 |

| ^For debt component *In case of semi annual YTM, it will be annualised 2Yield to maturity should not be construed as minimum return offered by the scheme; 3Calculated on amount invested in debt securities (including accrued interest), deployment of funds in TREPS and Reverse Repo and net receivable / payable. |

|

NAV as on March 28, 2024

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| IDCW | 10.1165 |

10.1238 |

| Growth | 10.1165 |

10.1238 |

| IDCW: Income Distribution cum Capital Withdrawal | ||

Company / Issuer |

Rating |

% of Net Assets$ | ||

|---|---|---|---|---|

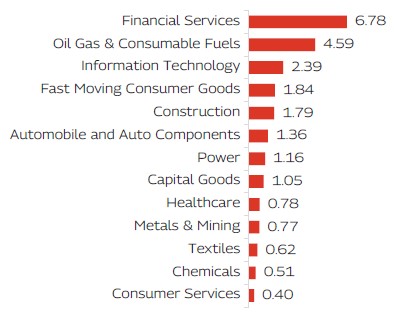

| Automobile and Auto Components | 1.36% |

|||

| Maruti Suzuki India Limited | 0.90% |

|||

| Hero MotoCorp Limited | 0.45% |

|||

| Capital Goods | 1.05% |

|||

| Carborundum Universal Limited | 0.52% |

|||

| TD Power Systems Limited | 0.40% |

|||

| Ratnamani Metals & Tubes Limited | 0.14% |

|||

| Chemicals | 0.51% |

|||

| Archean Chemical Industries Limited | 0.51% |

|||

| Construction | 1.79% |

|||

| Larsen & Toubro Limited | 0.89% |

|||

| ISGEC Heavy Engineering Limited | 0.50% |

|||

| PNC Infratech Limited | 0.39% |

|||

| Consumer Services | 0.40% |

|||

| Aditya Vision Ltd | 0.40% |

|||

| Fast Moving Consumer Goods | 1.84% |

|||

| ITC Limited | 1.15% |

|||

| Tata Consumer Products Limited | 0.69% |

|||

| Financial Services | 6.78% |

|||

| ICICI Bank Limited | 1.67% |

|||

| State Bank of India | 1.42% |

|||

| IndusInd Bank Limited | 1.17% |

|||

| Canara Bank | 0.96% |

|||

| Kotak Mahindra Bank Limited | 0.79% |

|||

| HDFC Bank Limited | 0.77% |

|||

| Healthcare | 0.78% |

|||

| Divi's Laboratories Limited | 0.78% |

|||

| Information Technology | 2.39% |

|||

| Infosys Limited | 1.20% |

|||

| Tech Mahindra Limited | 0.83% |

|||

| Wipro Limited | 0.37% |

|||

| Metals & Mining | 0.77% |

|||

| Hindalco Industries Limited | 0.77% |

|||

| Oil Gas & Consumable Fuels | 4.59% |

|||

| Hindustan Petroleum Corporation Limited | 0.97% |

|||

| Oil India Limited | 0.85% |

|||

| Reliance Industries Limited | 0.81% |

|||

| Coal India Limited | 0.57% |

|||

| Petronet LNG Limited | 0.50% |

|||

| Indraprastha Gas Limited | 0.50% |

|||

| Gujarat State Petronet Limited | 0.39% |

|||

| Power | 1.16% |

|||

| NTPC Limited | 1.16% |

|||

| Textiles | 0.62% |

|||

| S. P. Apparels Limited | 0.37% |

|||

| Nitin Spinners Limited | 0.25% |

|||

| Equity and Equity Related Total | 24.04% |

|||

| Real Estate Investment Trusts (REIT) | 1.87% |

|||

| Brookfield India Real Estate Trust | Realty |

1.87% |

||

| Exchange Traded Funds (ETF) | 13.72% |

|||

| ICICI Prudential Gold ETF | Others |

8.58% |

||

| Nippon India Silver ETF | Others |

5.13% |

||

| Corporate Bond | 13.41% |

|||

| National Bank For Agriculture and Rural Development | CRISIL AAA |

3.84% |

||

| Kotak Mahindra Investments Limited | CRISIL AAA |

3.84% |

||

| Cholamandalam Investment and Finance Company Ltd | ICRA AA+ |

3.81% |

||

| Bharti Telecom Limited | CRISIL AA+ |

1.91% |

||

| Government Bond | 9.68% |

|||

| 7.32% GOI (MD 13/11/2030) | SOV |

3.88% |

||

| 7.18% GOI (MD 24/07/2037) | SOV |

3.86% |

||

| 7.18% GOI (MD 14/08/2033) | SOV |

1.93% |

||

| Cash & Net Receivables/(Payables) | 37.28% |

|||

| Grand Total | 100.00% |

|||

| $Hedged and Unhedged positions | ||||

| ( |

||||

As per the latest Market Capitalisation data provided by AMFI (In line with the applicable SEBI guidelines)

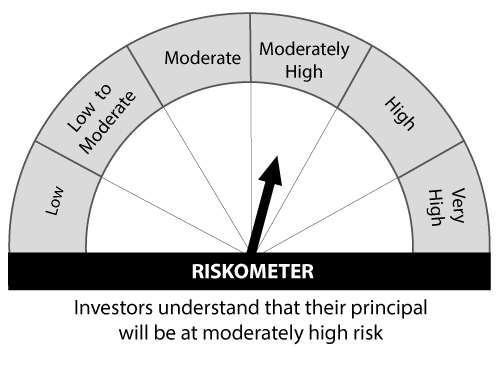

Product Suitability |

|

| This Product is Suitable for investors who are seeking* | |

|

|

Scheme Riskometers |

Benchmark Riskometers |

|

Scheme Benchmark: 45% NIFTY 500 TRI + 40% CRISIL Composite Bond Index + 10% Domestic Price of Physical Gold + 5% Domestic Price of Silver |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|