MAHINDRA MANULIFE CONSUMPTION FUND

(An open ended equity scheme following Consumption theme)

|

|

|

|

|

| Data as on 28th, February 2025 |

||||

| Investment Objective | The investment objective of the Scheme is to generate long term capital appreciation by investing in a portfolio of companies that are likely to benefit from consumption led demand in India. However, there can be no assurance that the investment objective of the Scheme will be achieved |

| Fund Features | Invests in segments with strongest contribution potential to India’s growing GDP Focuses on segments largely insulated from global volatility Participating in India’s Consumption Growth Theme |

| Fund Manager and Experience | Fund Manager: Mr. Navin Matta Total Experience: 19 years Experience in managing this fund: 4 months (Managing since October 24, 2024) Fund Manager: Ms. Fatema Pacha Total Experience: 18 years Experience in managing this fund: 4 years and 2 months (Managing since December 21, 2020) |

| Date of allotment | November 13, 2018 |

| Benchmark | Nifty India Consumption TRI |

| Options | IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default |

| Minimum Application Amount | Rs. 1,000 and in multiples of Re. 1/-

thereafter |

| Minimum Additional Purchase Amount: | Rs. 1,000 and in multiples of Re. 1/- thereafter |

| Minimum Amount for Switch in: | Rs. 1,000/- and in multiples of Re. 0.01/- thereafter. |

| Minimum Amount for Redemption / Switch-outs: | Rs. 1,000/- or 100 units or account balance, whichever is lower in respect of each Option |

| SIP | Minimum Weekly & Monthly SIP Amount: Rs 500 and in

multiples of Re 1 thereafter Minimum Weekly & Monthly SIP Installments: 6 Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Re 1 thereafter Minimum Quarterly SIP installments: 4 |

| Monthly AAUM as on February 28, 2025 (Rs. in Cr.): | 433.16 |

| Monthly AUM as on February 28, 2025 (Rs. in Cr.): | 413.03 |

| Total Expense Ratio1 as on February 28, 2025: | Regular Plan: 2.38% Direct Plan: 0.65% 1Includes additional expenses charged in terms of Regulation 52(6A) (b) and 52 (6A) (c) of SEBI (Mutual Funds) Regulations, 1996 and Goods and Services Tax. |

| Load Structure: | Entry Load: N.A. Exit Load: An Exit Load of 1% is payable if Units are redeemed / switched-out upto 3 months from the date of allotment; Nil if Units are redeemed / switched-out after 3 months from the date of allotment. |

| Portfolio Turnover Ratio (Last 1 year): | 0.30 |

| Standard Deviation: | 14.79% |

| Beta: | 0.86 |

| Sharpe Ratio#: | 0.52 |

| Jenson’s Alpha : | -0.0564 |

| #Risk-free rate assumed to be 6.40% (MIBOR as on 28-02-25) -

Source:www.mmda.org Note: As per AMFI guidelines for factsheet, the ratios are calculated based on month rolling returns for last 3 years. Data as on February 28, 2025 |

|

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| IDCW | 15.7585 |

17.8453 |

| Growth | 19.5968 |

21.8208 |

| IDCW: Income Distribution cum Capital Withdrawal. |

||

Issuer |

% of Net Assets

|

|

|---|---|---|

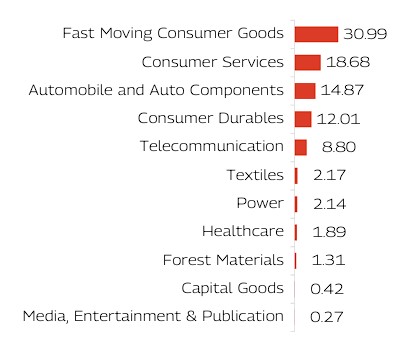

| Automobile and Auto Components | 14.87% |

|

| Mahindra & Mahindra Limited | 4.67% |

|

| Maruti Suzuki India Limited | 3.30% |

|

| Hero MotoCorp Limited | 1.83% |

|

| TVS Motor Company Limited | 1.58% |

|

| CEAT Limited | 1.34% |

|

| Tata Motors Limited | 1.20% |

|

| Amara Raja Energy & Mobility Ltd | 0.95% |

|

| Capital Goods | 0.42% |

|

| Polycab India Limited | 0.42% |

|

| Consumer Durables | 12.01% |

|

| Blue Star Limited | 2.26% |

|

| Havells India Limited | 2.07% |

|

| Metro Brands Limited | 1.44% |

|

| Safari Industries (India) Limited | 1.34% |

|

| Bata India Limited | 1.15% |

|

| Asian Paints Limited | 1.07% |

|

| Senco Gold Limited | 1.00% |

|

| Greenply Industries Limited | 0.99% |

|

| Whirlpool of India Limited | 0.70% |

|

| Consumer Services | 18.68% |

|

| Zomato Limited | 3.63% |

|

| Trent Limited | 3.46% |

|

| Aditya Vision Ltd | 1.75% |

|

| Devyani International Limited | 1.68% |

|

| Chalet Hotels Limited | 1.32% |

|

| Info Edge (India) Limited | 1.25% |

|

| FSN E-Commerce Ventures Limited | 1.19% |

|

| Avenue Supermarts Limited | 1.10% |

|

| Vishal Mega Mart Limited | 0.98% |

|

| Aditya Birla Fashion and Retail Limited | 0.88% |

|

| Restaurant Brands Asia Limited | 0.70% |

|

| Swiggy Limited | 0.50% |

|

| ITC Hotels Limited | 0.24% |

|

| Fast Moving Consumer Goods | 30.99% |

|

| ITC Limited | 5.85% |

|

| Hindustan Unilever Limited | 4.97% |

|

| Doms Industries Limited | 2.24% |

|

| United Spirits Limited | 1.90% |

|

| Godrej Consumer Products Limited | 1.89% |

|

| Britannia Industries Limited | 1.84% |

|

| Varun Beverages Limited | 1.71% |

|

| Mrs. Bectors Food Specialities Limited | 1.30% |

|

| Balrampur Chini Mills Limited | 1.24% |

|

| Dabur India Limited | 1.18% |

|

| Radico Khaitan Limited | 1.00% |

|

| Tata Consumer Products Limited | 0.96% |

|

| Emami Limited | 0.92% |

|

| Jyothy Labs Limited | 0.87% |

|

| Adani Wilmar Limited | 0.86% |

|

| Hindustan Foods Limited | 0.83% |

|

| Gillette India Limited | 0.79% |

|

| Nestle India Limited | 0.64% |

|

| Forest Materials | 1.31% |

|

| Aditya Birla Real Estate Limited | 1.31% |

|

| Healthcare | 1.89% |

|

| Max Healthcare Institute Limited | 1.89% |

|

| Media, Entertainment & Publication | 0.27% |

|

| D.B.Corp Limited | 0.27% |

|

| Power | 2.14% |

|

| Tata Power Company Limited | 2.14% |

|

| Telecommunication | 8.80% |

|

| Bharti Airtel Limited | 5.36% |

|

| Indus Towers Limited | 1.82% |

|

| Bharti Hexacom Limited | 1.62% |

|

| Textiles | 2.17% |

|

| Page Industries Limited | 1.56% |

|

| Kewal Kiran Clothing Limited | 0.61% |

|

| Equity and Equity Related Total | 93.55% |

|

| Cash & Other Receivables | 6.45% |

|

| Grand Total | 100.00% |

( |

| Mahindra Manulife Consumption Fund | CAGR Returns (%) |

Value of Investment of Rs. 10,000* |

NAV / Index Value (as on February 28, 2025) |

||||||

| Managed by Mr. Navin Matta & Ms. Fatema Pacha | 1 Year |

3 Years |

5 Years | Since Inception |

1 Year |

3 Years |

5 Years |

Since Inception |

|

| Regular Plan - Growth Option | -0.04 |

13.78 |

13.90 |

11.27 |

9,996 |

14,735 |

19,180 |

19,597 |

19.5968 |

| Direct Plan - Growth Option | 1.70 |

15.68 |

15.78 |

13.19 |

10,170 |

15,487 |

20,819 |

21,821 |

21.8208 |

| Nifty India Consumption TRI^ | 4.63 |

15.58 |

17.13 |

14.23 |

10,463 |

15,445 |

22,065 |

23,117 |

12,749.08 |

| Nifty 50 TRI^^ | 1.89 |

10.92 |

15.94 |

13.74 |

10,189 |

13,652 |

20,966 |

22,504 |

32,973.36 |

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 13-Nov-18.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth

Option under Regular and Direct Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. Mr. Navin Matta is managing this scheme since October 24, 2024. Ms. Fatema Pacha is managing this scheme since December 21, 2020.

*Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. For performance details of other schemes managed by the Fund Manager(s), please click here | Best Viewed in Landscape mode

| Mahindra Manulife Consumption Fund |

Regular Plan |

Direct Plan |

Nifty India Consumption TRI^ |

Nifty 50 TRI^^ |

|||||

| SIP Investment Period | Total Amount Invested (  ) ) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

| 1 Year | 1,20,000 |

1,05,569 |

-21.72 |

1,06,570 |

-20.27 |

1,09,586 |

-15.84 |

1,12,215 |

-11.93 |

| 3 Years | 3,60,000 |

4,14,023 |

9.32 |

4,26,022 |

11.28 |

4,29,754 |

11.88 |

4,10,246 |

8.69 |

| 5 Years | 6,00,000 |

8,46,389 |

13.75 |

8,88,803 |

15.74 |

8,82,756 |

15.46 |

8,34,832 |

13.19 |

| Since Inception | 7,50,000 |

11,40,210 |

13.26 |

12,11,798 |

15.20 |

12,16,696 |

15.33 |

11,44,420 |

13.38 |

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 13-Nov-2018.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Returns greater than 1 year period are compounded annualized. For SIP returns, monthly investment of equal amounts invested on the 1st business

day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return). For SIP Performance please click here |

Best Viewed in Landscape mode

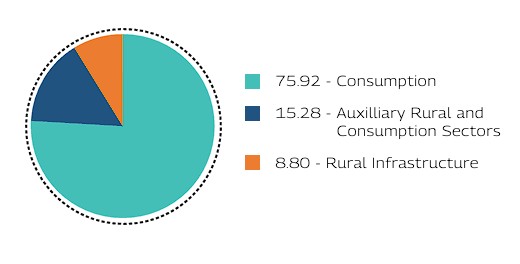

*Investible sector as per SID

Record Date |

Plan(s) / Option(s) |

IDCW |

Face Value |

Cum-IDCW NAV |

(Rs. per unit) |

(Rs. per unit) |

(Rs. per unit) |

||

17-Mar-22 |

Regular IDCW |

1.00 |

10 |

13.1211 |

17-Mar-22 |

Direct IDCW |

1.00 |

10 |

13.9060 |

27-Feb-23 |

Regular IDCW |

1.00 |

10 |

13.3749 |

27-Feb-23 |

Direct IDCW |

1.00 |

10 |

14.4631 |

14-Mar-24 |

Regular IDCW |

1.00 |

10 |

16.9634 |

14-Mar-24 |

Direct IDCW |

1.00 |

10 |

18.7727 |

Pursuant to payment of IDCW, the NAV of the IDCW Option(s) of the Scheme/Plan(s) falls to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. For complete list of IDCWs, visit www.mahindramanulife.com.

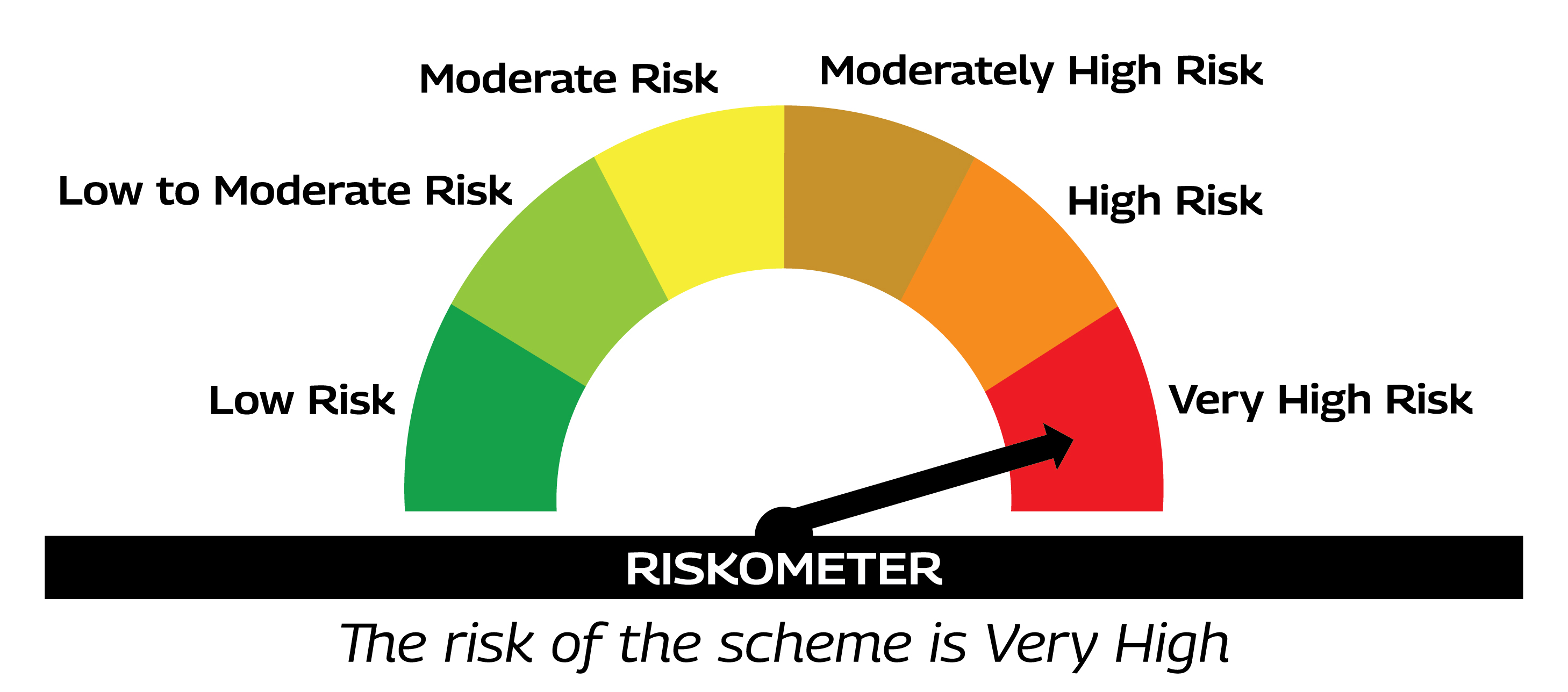

Product Suitability

|

|

| This Product is Suitable for investors who are seeking* | |

|

|

Scheme Riskometers |

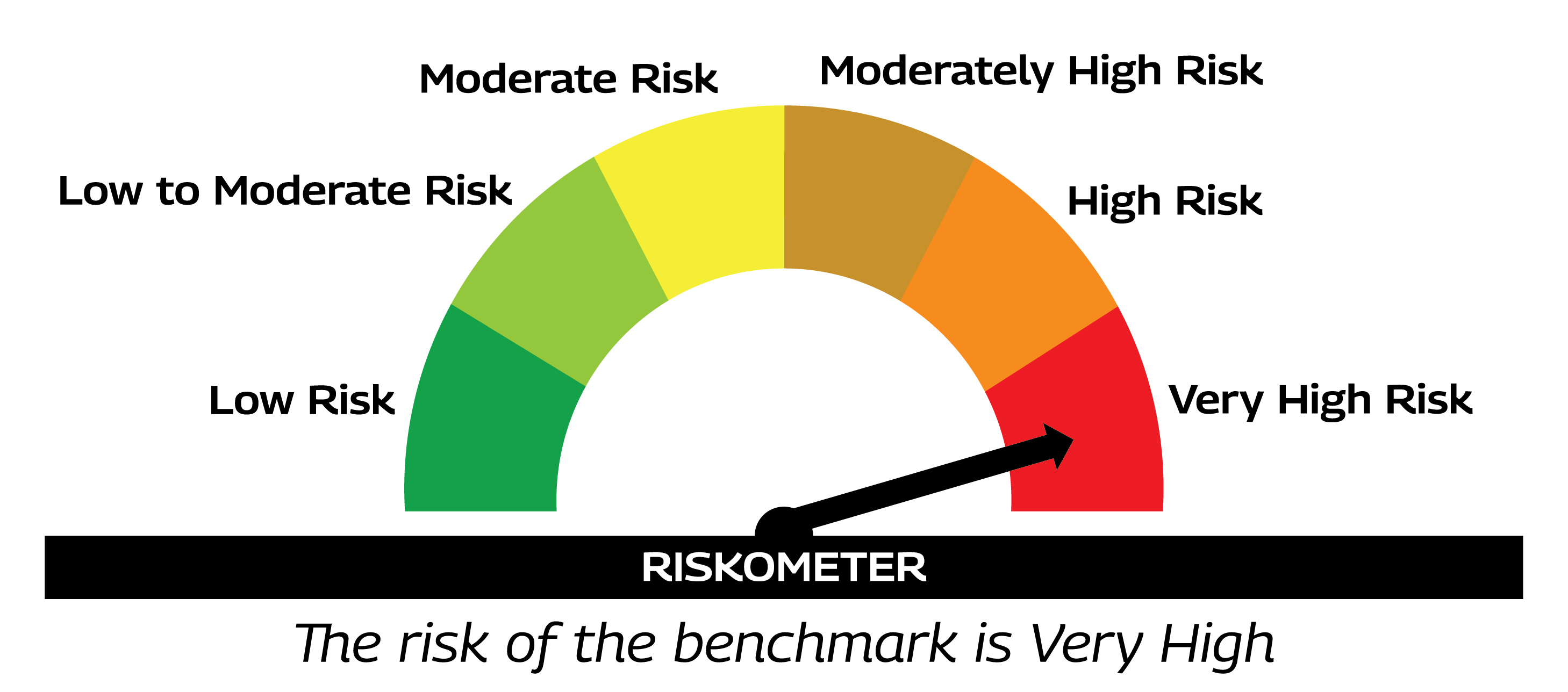

Benchmark Riskometers |

As per AMFI Tier I Benchmark i.e. Nifty India Consumption TRI |

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|