MAHINDRA MANULIFE ASIA PACIFIC REITs FOF

An open ended fund of fund scheme investing in Manulife Global Fund – Asia Pacific REIT Fund

|

|

|

|

|

| Data as on 31st, December 2023 | ||||

| Investment Objective | The investment objective of the Scheme is to provide long term capital appreciation by investing predominantly in units of Manulife Global Fund – Asia Pacific REIT Fund, an overseas fund primarily investing in real estate investment trusts (REITs) in the Asia Pacific ex-Japan region. However, there can be no assurance that the investment objective of the Scheme will be achieved |

| Fund Features | • Aims to achieve capital appreciation • Aims to provide Inflation Hedge • Diversification in real estate with very low investment |

| Fund Manager and Experience | Fund Manager: Mr. Kush Sonigara^## Total Experience: 12 years (^Dedicated Fund Manager for Overseas Investments) Experience in managing this fund: 6 months (Managing since November 01, 2022) Fund Manager (Debt): Mr. Amit Garg Total Experience: 19 years Experience in managing this fund: 2 Years and 2 month (Managing since October 20, 2021) |

| Date of allotment: | October 20, 2021 |

| Benchmark: | FTSE EPRA Nareit Asia ex Japan REITs Index |

| Options: | IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default |

| Minimum Application Amount: | Rs. 5,000 and in multiples of Rs. 1/- thereafter |

| Minimum Additional Purchase Amount: | Rs. 1,000 and in multiples of Rs. 1/- thereafter |

| Minimum SIP Amount: | Rs. 1000 (Weekly & Monthly) and Rs. 1500 (Quarterly SIP) and in multiples of Rs. 1 thereafter |

| Monthly AAUM as on December 31, 2023 (Rs.in Cr.): | 25.93 |

| Quarterly AAUM as on December 31, 2023 (Rs.in Cr.): | 24.72 |

| Monthly AUM as on December 31, 2023 (Rs. in Cr.): | 26.84 |

| Total Expense Ratio1 as on December 31, 2023: | Regular Plan: 1.37% Direct Plan: 0.42% 1Includes additional expenses charged in terms of Regulation 52 (6A) (b) and 52 (6A) (c) of SEBI (Mutual Funds) Regulations, 1996 and Goods and Service Tax. |

| Load Structure: | Entry Load: N.A. Exit Load: 10% of the units allotted shall be redeemed without any exit load, on or before completion of 24 months from the date of allotment of Units. Any redemption in excess of the above limit shall be subject to the following exit load: • An exit load of 1% is payable if Units are redeemed / switched-out on or before completion of 12 months from the date of allotment of Units; • Nil - If Units are redeemed / switched-out after completion of 12 months from the date of allotment of Units. Note: Pursuant to change in Fund Management Responsibilities, the scheme shall be managed by Mr. Pranav Patel (Dedicated Fund Manager for Overseas Investment) and Amit Garg effective January 5, 2024. |

| Mahindra Manulife Asia Pacific REIT FoF | CAGR Returns (%) |

Value of Investment of Rs. 10,000* |

NAV / Index Value (as on December 29, 2023) |

||

| Managed by Mr. Kush Sonigara$## & Mr. Amit Garg | 1 Year

|

Since Inception |

1 Year |

Since Inception |

|

| Regular Plan - Growth Option | 0.51 |

-5.02 |

10,051 |

8,932 |

8.9318 |

| Direct Plan - Growth Option | 1.49 |

-4.06 |

10,149 |

9,132 |

9.1322 |

| FTSE EPRA Nareit Asia ex Japan REITs Index^ | 2.98 |

0.45 |

10,297 |

10,099 |

267,739.22 |

| Nifty 50 TRI^^ | 21.36 |

9.52 |

12,130 |

12,204 |

31,933.93 |

^Benchmark ^^Additional Benchmark. Inception/Allotment date: 20-Oct-21. CAGR – Compounded Annual Growth Rate. Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 10 invested at inception. The performance details provided above are of Growth Option under Regular and Direct Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. Mr. Kush Sonigara is managing this fund since July 03, 2023 For performance details of other schemes managed by the Fund Manager(s), please click here | Best Viewed in Landscape mode

Note: $Dedicated Fund Manager for Overseas Investments

Note: Pursuant to change in Fund Management Responsibilities, the scheme shall be managed by Mr. Pranav Patel (Dedicated Fund Manager for Overseas Investment) and Amit Garg effective January 5, 2024.

| Mahindra Manulife Asia Pacific REITs FOF | Regular Plan |

Direct Plan |

FTSE EPRA Nareit Asia ex Japan REITs Index^ |

Nifty 50 Index TRI^^ |

|||||

| SIP Investment Period | Total Amount Invested (  ) ) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

| 1 Year | 120,000 |

125,522 |

8.74 |

126,145 |

9.74 |

126,572 |

10.43 |

140,493 |

33.52 |

| Since Inception | 270,000 |

272,842 |

0.91 |

275,882 |

1.88 |

281,324 |

3.59 |

331,856 |

18.89 |

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 24-Aug-20.

Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Returns greater than 1 year period are compounded annualized. For SIP returns, monthly investment of equal amounts invested on the 1st business

day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return). For SIP Performance please click here | Best Viewed in Landscape mode

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| IDCW | 8.9318 |

9.1322 |

| Growth | 8.9318 |

9.1322 |

| IDCW: Income Distribution cum Capital Withdrawal | ||

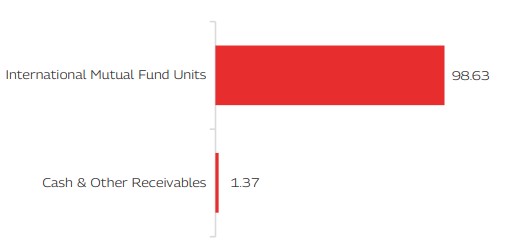

| Company / Issuer | % of Net Assets |

| International Mutual Fund Units | 98.63% |

| Manulife Global Fund SICAV-Asia Pacific REIT | 98.63% |

| Cash & Other Receivables | 1.37% |

| Grand Total | 100.00% |

| as on December 31, 2023 |

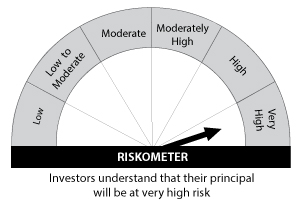

Product Suitability

|

|

| This Product is Suitable for investors who are seeking* | |

|

|

Scheme Riskometers |

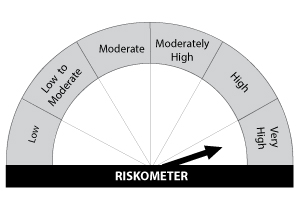

Benchmark Riskometers |

Scheme Benchmark: FTSE EPRA Nareit Asia ex Japan REITs Index |

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|