MAHINDRA MANULIFE MANUFACTURING FUND

(An open ended equity scheme following manufacturing theme)

|

|

|

|

|

| Data as on 31st, August 2024 |

||||

| Investment Objective | The Scheme shall seek to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in manufacturing theme. However, there is no assurance that the objective of the Scheme will be achieved |

| Fund Features | Portfolio Allocation:80-100% of the Portfolio will be invested in companies engaged in the manufacturing theme. Market Cap: Flexible to invest across market capitalisation. Diversified Universe: Portfolio shall comprise of diversified stock universe mapped to the basic Industry list published by Asia Index Private Limited for S&P BSE India Manufacturing Index which includes sectors like Capital goods, Metals & Mining, Consumer Durables, Construction etc. |

| Fund Manager and Experience | Fund Manager (Equity): Mr. Renjith Sivaram Total Experience: 13 years Experience in managing this fund: 3 month (Managing since June 24, 2024) Fund Manager (Equity): Mr. Manish Lodha Total Experience: 23 years Experience in managing this fund: 3 month (Managing since June 24, 2024) Fund Manager: Mr. Pranav Patel$ Total Experience: 9 years Experience in managing this fund: 3 month (Managing since June 24, 2024) $Dedicated Fund Manager for Overseas Investments |

| Date of allotment | June 24, 2024 |

| Benchmark | BSE India Manufacturing TRI |

| Options | IDCW (IDCW Option will have IDCW Reinvestment (D) & IDCW Payout facility) and Growth (D) D-Default |

| Minimum Application Amount | Rs. 1,000 and in multiples of Re. 1/-

thereafter |

| Minimum Additional Purchase Amount: | Rs. 1,000 and in multiples of Re. 1/- thereafter |

| Minimum Amount for Switch in: | Rs. 1,000/- and in multiples of Re. 0.01/- thereafter. |

| Minimum Amount for Redemption / Switch-outs: | Rs. 1,000/- or 100 units or account balance, whichever is lower in respect of each Option |

| SIP | Minimum Weekly & Monthly SIP Amount: Rs 500 and in

multiples of Re 1 thereafter Minimum Weekly & Monthly SIP Installments: 6 Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Re 1 thereafter Minimum Quarterly SIP installments: 4 |

| Monthly AAUM as on August 31, 2024 (Rs. in Cr.): | 890.33 |

| Monthly AUM as on August 31, 2024 (Rs. in Cr.): | 911.61 |

| Total Expense Ratio1 as on August 31, 2024: | Regular Plan: 2.21% Direct Plan: 0.59% 1Includes additional expenses charged in terms of Regulation 52(6A) (b) and 52 (6A) (c) of SEBI (Mutual Funds) Regulations, 1996 and Goods and Services Tax. |

| Load Structure: | Entry Load: N.A. Exit Load: 0.5% is payable if Units are redeemed / switched-out on or before completion of 3 months from the date of allotment.; Nil - If Units are redeemed / switched-out after completion of 3 months from the date of allotment. Redemption /Switch-Out of Units would be done on First in First Out Basis (FIFO). Note: The performance data of Mahindra Manulife Manufacturing Fund has not been provided as the scheme has not completed 6 months since inception. The said Scheme is co-managed by Mr. Renjith Sivaram, Mr. Manish Lodha & Mr. Pranav Patel (Dedicated Fund Manager for Overseas Investments) |

NAV as on August 30, 2024

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| IDCW | 10.2404 |

10.2732 |

| Growth | 10.2404 |

10.2732 |

| IDCW: Income Distribution cum Capital Withdrawal Note: As August 31, 2024 was a non business days, the NAV disclosed above is as on August 30, 2024. |

||

Issuer |

% of Net Assets

|

|

|---|---|---|

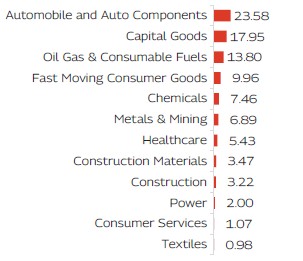

| Automobile and Auto Components | 23.58% |

|

| Mahindra & Mahindra Limited | 3.26% |

|

| Maruti Suzuki India Limited | 2.91% |

|

| Samvardhana Motherson International Limited | 2.77% |

|

| Hero MotoCorp Limited | 2.39% |

|

| Schaeffler India Limited | 2.03% |

|

| Tata Motors Limited | 2.02% |

|

| CIE Automotive India Limited | 1.85% |

|

| Bosch Limited | 1.72% |

|

| CEAT Limited | 1.44% |

|

| TVS Motor Company Limited | 1.15% |

|

| LG Balakrishnan & Bros Limited | 1.09% |

|

| Asahi India Glass Limited | 0.94% |

|

| Capital Goods | 17.95% |

|

| Technocraft Industries (India) Limited | 2.19% |

|

| Kirloskar Brothers Limited | 2.03% |

|

| Bharat Electronics Limited | 2.03% |

|

| Vesuvius India Limited | 1.87% |

|

| Siemens Limited | 1.69% |

|

| Triveni Turbine Limited | 1.29% |

|

| Carborundum Universal Limited | 1.27% |

|

| Thejo Engineering Limited | 1.25% |

|

| Tega Industries Limited | 1.09% |

|

| PTC Industries Limited | 1.08% |

|

| Inox India Limited | 0.96% |

|

| Lakshmi Machine Works Limited | 0.89% |

|

| Disa India Limited | 0.30% |

|

| Chemicals | 7.46% |

|

| Deepak Fertilizers and Petrochemicals Corporation Limited | 2.32% |

|

| Archean Chemical Industries Limited | 1.99% |

|

| NOCIL Limited | 1.09% |

|

| Jubilant Ingrevia Limited | 1.08% |

|

| Fine Organic Industries Limited | 0.98% |

|

| Construction | 3.22% |

|

| Larsen & Toubro Limited | 1.89% |

|

| ISGEC Heavy Engineering Limited | 1.33% |

|

| Construction Materials | 3.47% |

|

| Grasim Industries Limited | 1.78% |

|

| Shree Cement Limited | 1.70% |

|

| Consumer Services | 1.07% |

|

| Aditya Vision Ltd | 1.07% |

|

| Fast Moving Consumer Goods | 9.96% |

|

| ITC Limited | 4.40% |

|

| Hindustan Unilever Limited | 2.74% |

|

| Marico Limited | 1.42% |

|

| Dabur India Limited | 1.40% |

|

| Healthcare | 5.43% |

|

| Divi's Laboratories Limited | 2.11% |

|

| Sun Pharmaceutical Industries Limited | 2.00% |

|

| Emcure Pharmaceuticals Limited | 1.32% |

|

| Metals & Mining | 6.89% |

|

| Hindalco Industries Limited | 2.75% |

|

| Tata Steel Limited | 1.54% |

|

| Steel Authority of India Limited | 1.38% |

|

| Kirloskar Ferrous Industries Limited | 1.23% |

|

| Oil Gas & Consumable Fuels | 13.80% |

|

| Reliance Industries Limited | 3.08% |

|

| Oil & Natural Gas Corporation Limited | 2.79% |

|

| Bharat Petroleum Corporation Limited | 2.76% |

|

| Coal India Limited | 2.07% |

|

| Petronet LNG Limited | 1.75% |

|

| Hindustan Petroleum Corporation Limited | 1.33% |

|

| Power | 2.00% |

|

| NTPC Limited | 2.00% |

|

| Textiles | 0.98% |

|

| S. P. Apparels Limited | 0.98% |

|

| Equity and Equity Related Total | 95.83% |

|

| Cash & Other Receivables | 4.17% |

|

| Grand Total | 100.00% |

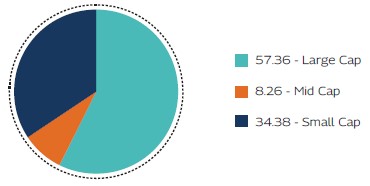

( |

As per the latest Market Capitalisation data provided by AMFI

(In line with the applicable SEBI guidelines)

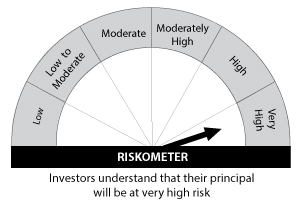

Product Suitability

|

|

| This Product is Suitable for investors who are seeking* | |

|

|

Scheme Riskometers |

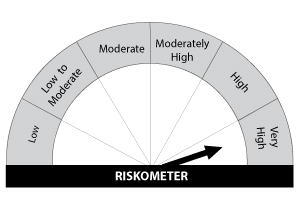

Benchmark Riskometers |

Scheme Benchmark: BSE India Manufacturing TRI |

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|